views

Business administrators have to integrate technology within their operations to function properly, to beat competition, attract new customers and increase revenue. Many are wondering what are mobile merchant services and getting to know the concept brings you one-step closer to integrate the right solutions. Many terms and features sound confusing until you learn more about them. For instance, large corporations and institutions that manage credit card processing need to know about level 3 processing and how it helps save money and optimizes interchange rates.

What is Mobile Merchant?

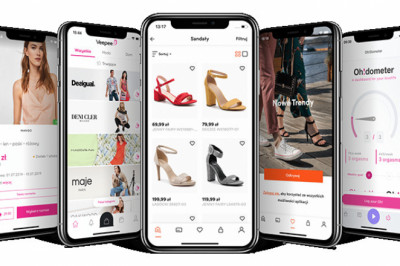

Keeping up with technology is essential nowadays and it is important for every business to remain competitive and embrace changes. Throughout the years, payment methods have changed. People used to pay using cash and checks, but these days they can do it using credit and debit cards. Mobile platforms are heavily used, because consumers prefer to browse and shop from their tablets and mobile phones, not sit at the computer and order products and services. This means that every business should be accommodated with change and finding a reliable mobile merchant is vital for this.

Businesses that have established an online presence and serve customers in this sector have to integrate mobile payment, meaning accepting payments done through mobile phones and other devices. It is more convenient for everyone. Customers pay for orders directly and then wait for the delivery and companies will have the money in their account. No one has to handle cash anymore, give change, keep a registry, and such. More and more companies are adopting the integration and it is time to do the same.

What is Level 3 Processing?

There are several types of companies, based on their activity field, how they operate and the clients served. Business to consumer companies (B2C) use Level 1 credit card processing. They serve individuals who have MasterCard, Visa or American Express cards. However, businesses that offer their products/services to other businesses, also known as B2B, need to look into Level 2 processing, especially if they are small or medium-sized. However, larger corporations and government institutions require Level 3 processing , to be able to operate interchange rates.

It is best to understand the Level 3 payment processing and how it benefits your company. Initially, it was developed to prevent excess spending and if item detail information is transmitted, then credit cards have special interchange rates. Some of the common line items include tax amounts, commodity and product codes, item descriptions, contact information for merchants, quantities, freight. All this data is required for various reasons and it benefits not only the buyer, but the business as well.

In the business world, there are a lot of changes and aspects to be aware of, because the primary goal is to sell and increase earnings. However, everything has to be done in a controlled and safe manner, to secure all transactions. This brings us to the mobile merchant and how important it is to integrate this feature on your website. This payment acceptance is required to fulfil the needs of this new generation of consumers. They have to enjoy an easy to use method, convenient and flexible. Many manage payments on the go and mobile phones are transforming how businesses operate nowadays.

All companies operate cash and the ones available on mobile devices have to integrate mobile payment. Working with cash is not always convenient, because it has to be stored and it is more exposed to theft and loss. Accepting electronic payments through a mobile merchant is safer and easier to manage. Solutions integrate security measures, so that all procedures are done safely, without any risks. Consumers are aware their data is protected and businesses enjoy the added functionalities.

More to it, company staff will not have to handle cash anymore and make several trips to the bank. They will have more free time to focus on improving customer satisfaction. The mobile merchant takes care of the transaction, from the moment the customer pays and until the money ends up in the company’s bank account. Choosing the right provider is the key to improve security and make sure that everyone trusts the business and wants to pay on their mobile devices. Evaluating all offers is recommended and discussing directly with providers about your needs to find the perfect solution.

The most important aspect is that companies have various solutions at their disposal, offered by reliable providers that do not hesitate to amaze. There are so many facilities and so many aspects that have to be known by every business. Take for instance the B2B domain and how important is Level 3 processing. It brings many benefits into discussion, especially for customers. Control is one of them and by requesting the extra details, they can restrict aspects like the organization allowed to buy, how often the card can be used and the amount of every purchase.

Control is necessary when you think about the volume of governmental and corporate spending and Level 3 processing allows better tracking and knowing where the money is going. Merchants also take advantage of various features. For example, the type of clients attracted differs and is of another level, such as large ones that would not do business with you otherwise. Some government agencies only use Level 3 credit cards and they need to purchase from businesses accepting them.

Due to Level 3 processing, merchants pay lower interchange fees and this is because of the extra data requested. Fraud is less likely to occur and in the same time, the risk of credit card abuse lowers. Understanding and processing such payments is essential to avoid unpleasant situations and finding additional support in the matter is always a good idea. There are several providers out there that help businesses in all fields cope with the latest technologies and requirements. They have the purpose to help companies grow and access a larger market area and high-end consumers. The good news is that online you can find such providers and count on their level of expertise and support.