views

According to an article published by the International Society of Nephrology 2020, countries such as China and Italy reported AKI rates as high as 29%. The early initiation of continuous renal replacement therapy (CRRT) is an important step to curbing the rising incidence of AKI due to the COVID-19 infection. However, owing to the rapid rise in the demand by healthcare systems, HD and PD exist as an alternative dialysis treatment in ICUs, which can have a negative impact on the growth of the CRRT market during this period.

The COVID-19 pandemic has significantly affected the CRRT market. The surge in the number of COVID cases, along with the rise in its severity rate, is likely to create a potential increase in the incidence of kidney damage. This makes AKI the next emerging healthcare concern after respiratory tract infections among patients with COVID-19.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=246917088

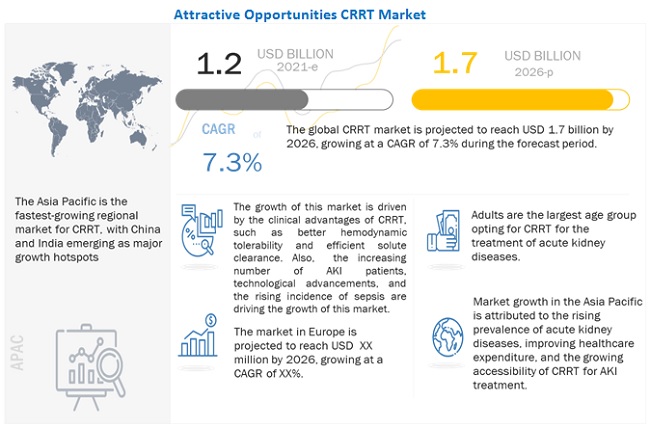

The growing worldwide incidence of AKI/AKF is, therefore, expected to increase the demand for CRRT. According to the International Society of Nephrology (INR), an estimated 13.3 million cases of AKI are registered annually worldwide. This is anticipated to boost the adoption of continuous renal replacement therapy at a rapid rate.

With the rapid growth in the geriatric population globally, the prevalence of kidney-related diseases is expected to increase significantly. This, in turn, is expected to propel the growth of the CRRT market at a significant rate during the forecast period.

As the population in emerging nations is price-sensitive, they prefer lower-priced products. Although the cost of CRRT in developing countries is high which makes these procedures are still unaffordable for a large portion of the population due to the low purchasing power. This limits the demand and uptake of CRRT in developing as well as developed countries.

To leverage the significant growth opportunities in emerging countries, players are increasingly focusing on undertaking strategic developments to increase their presence in these markets and tap a large number of customers. Additionally, regulatory policies in the Asia Pacific region are more adaptive and business friendly due to the less-stringent data requirements. This, along with the increasing competition in the mature markets (Europe, Japan, and Australia), will further encourage CRRT product manufacturers to focus on the emerging markets.

The largest market share of this segment is attributed to factors such growing demand for dialysates to remove undesired solutes and restoring the electrolytes and acid-base balance in the blood along with presence of well established players with strong offerings in dialysates & replacement fluid

continuous venovenous hemodiafiltration (CVVHDF) is to have highest growth rate of the CRRT market, by modality during the forecast period.

The high growth rate of the CVVHDF segment can be attributed to its flexibility as compared to other CRRT modalities. The CVVHDF modality also combines the benefits of convection and diffusion for the removal of solutes, which is another major factor supporting its growth.

The prominent players operating in the global Continuous Renal Replacement Therapy (CRRT) Market include Baxter International Inc. (US), Fresenius Medical Care AG & Co. KGaA (Germany), NIKKISO CO., LTD. (Japan), B. Braun Melsungen AG (Germany), Asahi Kasei Corporation (Japan), Toray Medical Co., Ltd. (Japan), Infomed SA (Switzerland), Medtronic plc (Ireland), Medica S.p.A. (Italy), Medical Components, Inc. (US), Medites Pharma spol. s.r.o. (Czech Republic), SWS Hemodialysis Care Co., Ltd. (China), Ningbo Tianyi Medical Devices Co., Ltd. (China), Nipro Corporation (Japan), and Anjue Medical Equipment Co., Ltd. (China), among others.