views

Requirements for Overdraft Facility

Requirements for Overdraft Facility

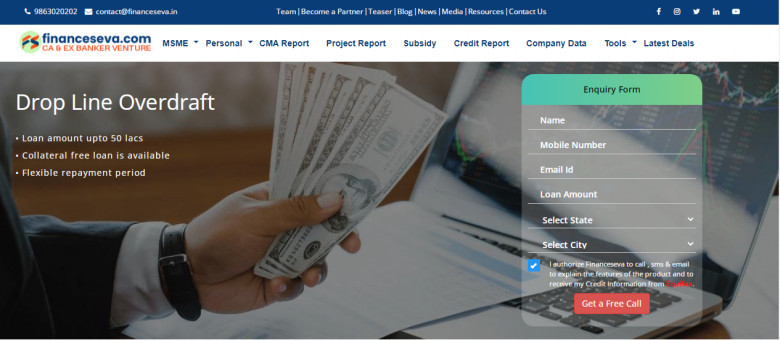

Overdraft facility is a short-term credit facility that is to be repaid in defined tenure. This is a type of financial instrument in which you can withdraw money from your savings or current account, even if your account balance reaches zero or below.

This feature is provided by almost every financial institution, including banks and NBFCs.

Lending institutions shall levy the interest rates that the applicant needs to repay, as per the bank’s terms and conditions. In the case of requirements for overdraft facility, the type of interest rates offered by the lenders are both fixed and not floating.

Getting an Overdraft Facility

Borrowing through a quick overdraft is just like borrowing a loan from a bank or NBFCs. Some customers are pre-entitled to avail an overdraft facility by the lender while some have to get approval.

In case, if the pre-entitled customers withdraw additional capital from their account, their account balance becomes negative, and the overdraft facility is activated automatically.

An overdraft facility can be availed in the form of unsecured overdraft taken against a bank account is considered as an unsecured overdraft in which borrowers are not required to pledge collateral.

While on the other hand, secured overdraft facilities is obtained in collateral- backed by security or an asset.