Report Coverage

By Design type: D-type, O-type, A-type

By type: Water-tube Package boilers, Fire-tube Package boilers, Electric boilers, others.

By Fuel: Oil, Gas, Biomass, Coal, others.

By End User Application: Food & Beverages, Oil & Gas, Chemical, Paper, Manufacturing and Others

By Geography: North America (U.S, Canada, Mexico), Europe(Germany, UK, France, Italy, Spain, Russia and Others), APAC(China, Japan India, South Korea, Australia and Others), South America (Brazil, Argentina and Others) and ROW (Middle East and Africa)

Key Takeaways

- The expansion of large scale projects in the developing economies is driving the market. Benefits associated with this boilers is comparatively high than other industrial boilers such as low maintenance cost, easy installation.

- Increased industrialization in the APAC is driving the opportunity to grow in the forecast period.

- The food and beverage industry which is a major market for the Package boiler industry will contribute more to the package boiler market.

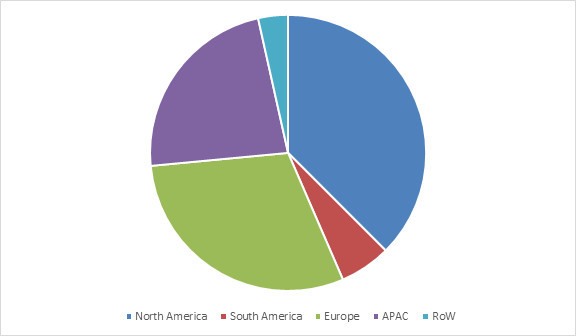

Package Boilers Market, By Region, 2020

Package Boiler Market Segment Analysis – By Design type

Market is segmented into D-type, O-type, and A-type. D-type package boilers are more effective and thus accounted for 51.2% share in 2020 because of reduced cycle time and low cost equipment for steam generating. These package boilers are utilized in many industries. D type has water drum, steam drum and generating tubes. Water flows through steam drum into water drum. These products are majorly used in Food & Beverages and Oil & Gas industry and also used in plants with greater clearance.

A-type package boilers are smaller than D-type therefore will fit smaller plants, but does not have the same power output as D-type package boilers. Thus, the need for compact and modular designs will drive the market for A-Type package boilers despite their lower power output. The O-type boilers are a little simpler compared to D-type and A-type. O-type boilers are mainly used for their fast steam production and reduced maintenance cost. Comparatively A type are projected to grow at the fastest rate during the forecast period.

Package Boiler Market Segment Analysis – By End User Application

The food and beverage end user application segment will drive the industry with a CAGR of 5.9% over 2021-2026. The segment is advancing with technicalities and rise in production capacities. The Package boilers are used in many internal process rather than being used only in generating the steam. The oil and gas segment are also projected to grow in the package boiler market as access to the natural gases has increased.

Package Boiler Market Segment Analysis – By Geography

North America and Europe both dominate the market during the forecast period with North America accounting for 36.1% share in 2020. US government has imposed the regulation which has increased the demand for the product. Increased demand for electricity and various other industrial heating processes is key factor driving the growth of the industry. APAC has the fastest growing market and drives opportunities during the period. The presence of well-established players and manufacturing units will drive the market. Countries like India, Japan, South Korea and other Asian countries expected to grow significantly due to rising industrialization.

Package Boiler Market Drivers

Industrialization in the developing economies

The development of large scale projects in the developing countries have expanded the use of package boiler in industries. The increasing demand for the clean energy coupled with the expansion of non renewable power resources is the major factor driving the growth of market. Expanding the bundle boilers to increase the productivity of biomass using many new sources, materials and wastes is a key factor driving the growth of the market. The increasing ultra-power projects and growing demand in many industries will also propel the market growth. Installation of the product is easy and that is the reason why it is in high demand. Fire-tube boiler and oil-tube boiler are also increasing in popularity over the forecast period.

Rise in Demand for Energy Efficient Boilers

Steam Boiler manufacturers are increasingly producing energy-efficient products to reduce carbon footprint and enable energy savings for the consumers. The rise of energy-efficient appliances can be attributed to the stringent government regulations on electric home appliances and advances in technology. Newly emerging low NOx regulations are designed to thwart or reduce the harmful effects of Nitrogen Oxide (NOx) gases on the environment. This highly toxic family of reactive gases is produced when fuel is combusted at high temperatures, such as with water heaters, boilers, furnaces and even from the engines of vehicles. Because of the apparent harmful effects of NOx on the environment, a growing number of boiler manufacturers are looking to get ahead of the inevitable regulations.

Package Boiler Market Challenges

Regulatory Stringency

The regulations held by the government in the market such as the formulation of strict emission standards acts as a key brake in the expansion of package boiler market. Impact of domestic tariffs and trade routes are the major points which affect the market. The cost associated with manufacturing means that only few well-known and well established companies lead the industry and thus the industry showcases low threat from the new entrants.

Package Boiler Market Landscape

The market for Package Boilers Market is comprised of Cleaver-Brooks Inc, Themax Global, Mitsubishi Hitachi Power Systems, Ltd., Babcock & Wilcox Enterprises Inc. and Johnston Boiler Company. These companies have adopted the growth strategies such as product launches and developments, partnerships, agreements, contracts, and mergers & acquisitions to strengthen their position in the market.

Acquisitions/Technology Launches/Partnerships

- In June, 2019, Cleaver-Brooks launched configured watertube boilers known as CBCW, for faster quotes and technical documentation.

Related Reports

Report Code: CMR 0856

Report Code: EPR 33804

For more Automation and Instrumentation related reports, please click here