views

Many mid-income groups think they can’t get treatment at the best hospital because of heavy medical expenses. But the fact is otherwise. In this day and age when health insurance is available, availing of treatment in a hospital of your choice is possible without having to worry about medical costs. Having a health insurance policy in place protects you against any financial liabilities that can arise due to sudden medical emergencies.

However, when buying a healthcare policy, make sure to consider if there is no copayment or copay clause in the policy. The copayment clause will put a financial burden at the time of raising claims.

Wondering what a copayment clause is in health insurance? If so, keep reading to understand it.

What is Copayment in Health Insurance?

Copayment or co-pay in health insurance is the percentage of the claim amount the policyholder bears under his or her health policy. Few insurance plans are designed to have a mandatory copay clause, whereas others can keep it optional for voluntary co-pay which allows them to reduce the premium. In a policy with a co-pay clause, insurers do not have to pay 100% of the total claim amount.

In general, there are two types of claims in health insurance policies: Cashless claim and Reimbursement claim. In the first case, the insurance company settles all your treatment costs directly with the hospital where you are getting treatment. In the reimbursement option, your insurance company reimburses for the expenses incurred while you or an insured person was undergoing treatment. The copayment clause is applied in both types of claims.

Copayment Situations

There are two cases when it comes to copay in health insurance.

- When you choose higher copayment, it will reduce your total premium payment. But, you will have to pay a greater amount during a claim.

- If you go for a lower copay, it will reduce the amount that you will have to pay during the claim. But, you will have to pay a higher premium against your policy.

Let’s understand with an example.

Assume that you have chosen a 20% copayment in your health insurance plan. In this case, your health insurance provider will pay only 80% of the total hospital bill and the rest 20% will be paid by you.

Types of Copayment Clauses in Health Insurance

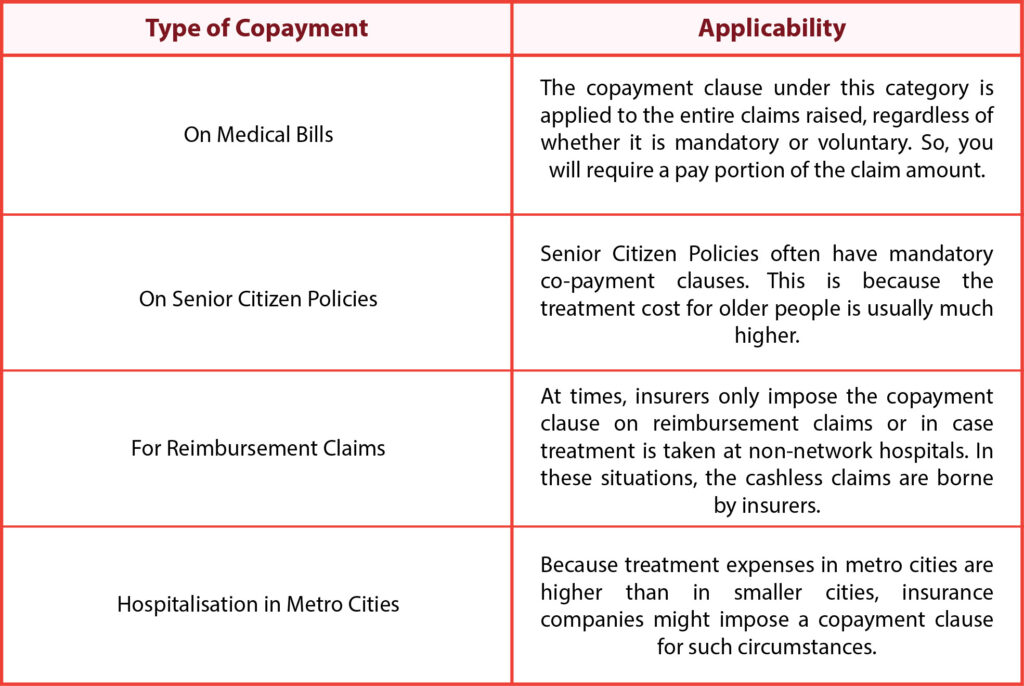

If your health insurance comes with a copay clause, it can be applied in the bellow ways:

Why Insurers Levy Copayment Clauses on Policyholder

The most common reason to levy a copayment clause is that insurance companies can save a portion of their costs on claims filed. Besides, there are many other reasons for insurance providers to impose this clause on policyholders.

To prevent policy misuse

This is among the common reasons. With this, insurance companies are able to prevent misuse of policy by stopping unnecessary claims raised by the policyholders. For example, an individual may want to file claims against the treatment of diseases that actually do not require high treatment costs. Having a copay clause puts a stop to the misuse of insurance policies in this case.

To promote the correct use of the policy

Because copay requires you to pay some fraction of medical costs, it increases your stakes in the matter. Thus, it promotes sensible and correct use of the policy on the part of the policyholder.

To let you think twice before seeking expensive treatment

If you know that you will have to pay some percentage from your own pocket, you will avoid opting for additional expensive treatment. Even when medical costs are rising continually, people often opt for treatment from an expensive hospital.

To take an example, if you have purchased a policy with a 10% copayment on the treatment costs, then you will have to pay Rs 1,000 on the treatment cost of Rs 10,000. Similarly, if the treatment cost is 1 lakh, then you will have to pay Rs 10,000.

Things to Consider When Choosing a Plan with Copayment Clause

Even though you have found health insurance with a copay clause that is much more affordable, it is vital for you to decide your coverage requirements before you choose it. Further, you should make sure that you have proper finances to cover your share of hospitalisation bills before you opt for a plan with copay options.

In a nutshell, even if your health insurance comes with a copay option, it may sound ideal. Actually, copayment is not a good idea. It hardly does anything in lowering your financial liabilities in case of medical emergencies. It is therefore advisable to choose health insurance without any copayment clause.