views

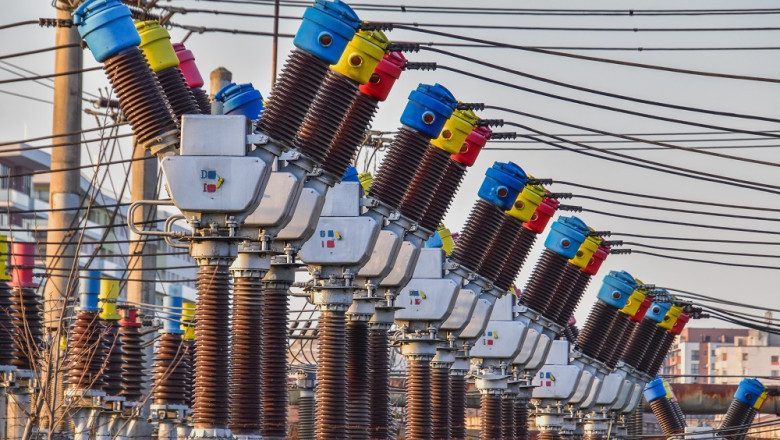

The solid-state transformer market is in the research and development phase. Solid-state transformers are expected to be the replacement for conventional transformers in the coming years.

The global solid-state transformer market is expected to value $207.3 million in 2025 and is projected to reach $467.0 million in 2031, following a CAGR of 14.34% during the forecast period 2026-2031. The growth in the global solid-state transformer market is expected to be driven by an increase in investment toward the building and construction of power transmission and distribution networks, renewable power generation, and EV charging station infrastructure across the globe.

Read Report Overview: Solid-State Transformer Market

Impact

- Solid-state transformers are the primary building blocks of the smart grid infrastructure. Such a transformer can transfer power bidirectionally and scale down and scale up voltages as per the application. The companies that manufacture conventional transformers are taking an interest in the R&D of solid-state transformers to fulfill the future demand from smart grid infrastructure.

- Solid-state transformers, with the inclusion of communication capability among components used in the power system infrastructure, can be referred to as the smart transformer in the coming years. It will help power utilities in the measurement of demand and supply of electricity use. A solid-state transformer has various advantages over conventional transformers, including power factor correction, fault isolation, harmonic reduction, voltage sag and swell compensation, bidirectional power transfer, and others.

Impact of COVID-19

Due to the COVID-19 pandemic, research and development slowed down across many industries owing to the lack of funding, halted manufacturing activities, and components or raw material supply chain disruptions. In addition, a halt in the building and construction of renewable power infrastructure and smart grid projects has also been induced by COVID-19, which is resulted in a decrease in demand for transformer products and further affected R&D projects worldwide.

Demand - Drivers and Limitations

The following are the demand drivers for the solid-state transformer market:

- Increase in Renewable Power Generation

- Rise in Number of Electric Vehicle Charging Stations

- Electrification of Rail Locomotives across the Globe

- High Voltage DC (HVDC) Integration

The market is expected to face the following challenges:

- High Initial Cost of Solid-State Transformer

- Technical Challenges

- Lack of Basic Power Infrastructure in Underdeveloped Countries

Recent Developments in the Global Solid-State Transformer Market

- In January 2022, Eaton Corporation acquired Royal Power Solutions (EV component producer) for $600 million. Under the agreement between the Department of Energy (DOE) and Eaton Corporation, Eaton would develop and demonstrate electric vehicle charging infrastructure (EVCI). To support this charging infrastructure, Eaton would develop a solid-state transformer. This acquisition strengthened the position of eMobility company in the EV sector.

- In March 2021, Hitachi Energy (formerly Hitachi ABB Power Grids) collaborated with Nanyang Technological University (NTU) Singapore. This collaboration aimed at advancing developments in solid-state transformer (SST) technology. This project is supported by the National Research Foundation, Singapore (NRF). This would enhance the product portfolio of the company and its presence in the solid-state transformer market.

- In December 2019, ERMCO, Inc partnered with SP Energy Networks (a U.K. electricity network operator). Through this partnership, ERMCO would provide smart transformer solutions to LV Engine project. This project would monitor or demonstrate how smart transformers can efficiently manage energy, and then they would deliver smarter grids with lower carbon emissions.

- In December 2021, Eaton Corporation signed an agreement with the Department of Energy (DOE). This agreement or award was aimed at developing low-cost fast-charging infrastructure, solid-state transformers, and modular chargers in a three-year timeframe (2022-2025). This would strengthen the position of the company in the solid-state transformer market globally.

Request for Sample: https://bisresearch.com/requestsample?id=1387&type=download

Analyst View

According to Rakhi Tanwar, Principal Analyst, BIS Research, “The solid-state transformer market is expected to provide a great replacement to the conventional transformers used for bidirectional power transfer, isolation, and high-frequency applications. Through R&D and adoption of the solid-state transformer products in the future, the power transformer losses can be mitigated along with an increase in reliable and continuous electricity supply for end users."

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing the company's coverage, product portfolio, its market penetration.

The top segment players leading the market include key power, distribution, and traction transformer manufacturers in the market and the ones engaged in the research and development of solid-state transformers across the globe.