views

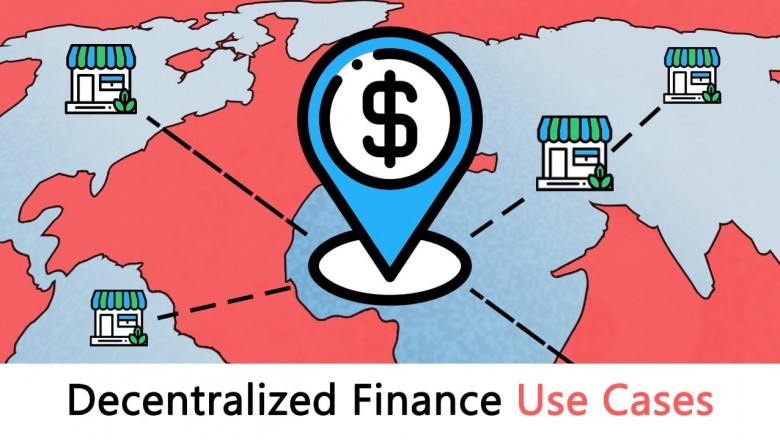

Decentralized Exchange

Decentralized exchanges can give newer meaning to the trading activities in the Defi ecosystem, being one of the more impactful Defi use cases. Some might think that decentralized exchanges are only meant for trading cryptocurrencies Services. This is far from the truth — these exchanges encompass anything from asset trading to derivatives trading.

As there is no central authority on the commanding position, there is no risk of asset manipulation or market manipulation. Plus, decentralized exchanges offer lower exchange fees, faster settlement, and complete control over their digital assets through blockchain digital transformation.

Gaming and eSports

Long gone are the days, when video games were nothing but a form of entertainment. Most of the new video games have in-app purchases and loot box features in them. These features enable users to use real-life currency to buy new skins for their characters and tools.

With the use of DeFi, game developers can implement the newer incentive or reward models with DeFi coins. In fact, gaming and eSports will likely become one of the major markets as the users are more tech-savvy and open to newer technologies.

Margin Trading

Margin trading is a common feature of the traditional trading system. In simpler terms, it refers to the act of borrowing money from the brokers to invest and gain short-term gain.

Prediction Platforms

Despite the stigma around the concept, prediction platforms and the market are very large and attract many users. The rise and use of DeFi, has created an opportunity to develop DeFi-based prediction platforms where users could trade value by forecasting or predicting the outcome of future events. These prediction platforms are peer-to-peer, decentralized, and offer global access.

Augur is one of the leaders in the DeFi ecosystem that specialize in the prediction market. This platform allows the users to place bets on events like — sports, world events, economics, election results, and more.

Savings

Due to the high inflation rate of fiat currencies and the low-interest rates, saving money has become a challenge in the current economy. In fact, the risk-averse middle-class citizens around the world are desperately seeking alternate investment/savings solutions.

Different decentralized finance (DeFi) projects have taken the opportunity to introduce new solutions.

Stablecoins

Cryptocurrencies are highly volatile assets that gain or lose value within seconds. This is one of the major reasons why cryptocurrencies are yet to achieve mass adoption.

Stablecoins, on the contrary, offer a better proposal. A stablecoin is a special type of cryptocurrency development that is asset-backed.

Thus, stablecoins can reduce the overall volatility of the cryptocurrency ecosystem and become a viable global payment solution.

Tokenization

Tokenization is the process of — creating, issuing and managing digital assets on a blockchain network. As any kind of asset could be tokenized and stored on a blockchain, it is essentially creating a new form of economy.

For example, the NFTs are tokenizing unique digital assets that hold value based on the rarity and the demand for any particular digital asset. A plethora of decentralized finance projects are working on tokenizing digital assets for creating, storing, or trading value.

Trading platforms and tools

However, the introduction of the DeFi ecosystem has opened up doors to many new forms of trading. This newer form of trading includes — crypto trading, margin trading, derivative trading, NFT trading, and many more.

Moreover, these DeFi projects or decentralized finance applications offer lower commission rates, liquidity pools, faster and secure transitions, settlement options, transparency, and decentralization.