views

Wealth Management Platform Market is estimated to be US$ 7.58 billion by 2030 with a CAGR of 38.3% during the forecast period

Wealth Management Platform Market accounted for US$ 2.34 billion in 2020 and is estimated to be US$ 7.58 billion by 2030 and is anticipated to register a CAGR of 13.2%. This is attributed to increasing digitalization and process automation optimizes wealth management practice, coupled with rising ratio of the HNWIs (High-net-worth individual) across the globe.

Rising innovations in the financial technology and adoption of blockchain and AI in the wealth management platform market is expected to create lucrative growth opportunities for new as well as existing players to gain competitive edge.

The report "Global Wealth Management Platform Market, by Advisory Model (Human Advisory, Robo Advisory, and Hybrid), by Business Function (Financial Advice Management, Portfolio, Accounting, and Trading Management, Performance Management, Risk and Compliance Management, Reporting, and Others (Billing and Benchmarking)), by Deployment Model (Cloud and On-Premises), by End-User Industry (Banks, Investment Management Firms, Trading and Exchange Firms, Brokerage Firms, and Others (Asset Management Firms and Custody and Compliance Providers)), and Region - Global Forecast to 2030"

Key Highlights:

· In October 2018, SS&C Technologies, Inc. completed the acquisition of Eze Software Group LLC, a global provider of investment management solutions.

· In February 2017, Fiserv, Inc. brought innovative, new digital investment advice solutions to its wealth management network in partnership with Marstone.

Key Market Insights from the report:

The global Wealth Management Platform market accounted for US$ 2.34 billion in 2020 and is estimated to be US$ 7.58 billion by 2030 and is anticipated to register a CAGR of 13.2%. The market report has been segmented on the basis of advisory model, business function, deployment model, end-user industry, and region.

· By advisory model, the robo advisory segment accounted for major revenue share in 2019, owing to increasing competition, evolving client’s requirements, and cost efficiency.

· By business function, the portfolio, accounting, and trading management holds for major revenue share in 2019. This is due to increasing demand for portfolio management, decision support, and trading across globe.

· By deployment model, the cloud holds for major revenue share in 2019. This is attributed to increasing adoption of cloud solution due to its advantages such as agility, reduced operational costs, scalability, easy access to data, flexible payment options, and self-service capabilities.

· By end-user, the asset management firms is segment accounted for major revenue share in 2019, attributed to asset management firms manage funds for individuals and companies as well as asset management firms make actual time investment decisions on behalf of their clients to grow their finances and portfolio.

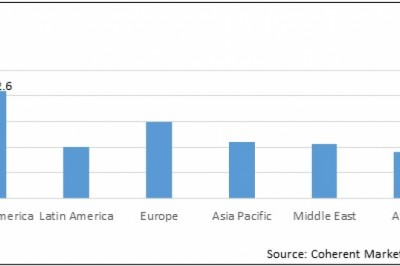

· By region, North America wealth management platform market accounted for major revenue share of the global wealth management platform market and is further anticipated to maintain its dominance over the forecast period, owing to increasing adoption of new and emerging technologies, coupled with expanding data. Asia Pacific wealth management platform market accounted for significant market share, in 2019.

Before purchasing this report, request a sample or make an inquiry by clicking the following link:

https://www.prophecymarketinsights.com/market_insight/Insight/request-sample/350

The prominent player operating in the global wealth management platform market includes SS&C Technologies, Inc., Fiserv, Inc., Fidelity National Information Services, Inc., Profile Software Ltd, Broadridge Financial Solutions, Inc., InvestEdge, Inc, Temenos Group AG, SEI Investments Co., Comarch Inc., ObjectWay S.p.A., and Dorsum Ltd.

OTHER RELATED REPORTS:-

https://chaitanya21blogs.blogspot.com/2022/08/electrochromic-glass-market-is.html

https://sites.google.com/view/electrochromicglassmarket/home