views

Unified Monitoring Market is expected to reach $10.5 billion by 2025 at a CAGR of 19.2% during the forecast period 2020-2025. With the increasing penetration of Internet of Things (IoT) and related technologies, such as big data, and serverless architecture, the demand for unified monitoring is expected to gain huge traction. Growing demand for Digital Age Networking that enables enterprises to move toward digital transformation and generate new business outcomes by leveraging new digital age technologies such as the Internet of Things (IoT), cloud, and Artificial Intelligence (AI) is expected to drive the market. For instance, according to the report, 70% of companies either have a digital transformation strategy in place or are working on it, and 21% of companies perceive that they have already completed the digital transformation. Around 40% of all technology spending in 2019 is expected to go towards digital transformation. Moreover, the necessity to efficiently manage the security and performance is another factor boosting the market growth.

Unified Monitoring Market Segment Analysis - By Industry Vertical

Telecommunications and IT is growing at a highest CAGR of 23.5% in the forecast period. Unified infrastructure monitoring gives data center operations teams the centralized management view they need to focus on service quality and agility. When the networking team, the server team, the storage team, and the applications team are all working within the same management console with the same end-to-end data set, they are able to work more cooperatively and efficiently. Many enterprises are striving to unify IT operations. According to the report given by EMA, 57% of enterprises now have cross-functional processes to orchestrate provisioning and management of storage, network, and server resources. Uninterrupted service is absolutely crucial for telecommunication companies to maintain their reputation and retain loyal customers. Unified monitoring with network mapping, special equipment monitoring, and flexible detection of redundant data paths can help telecom service providers quickly identify and resolve their unique issues before problems reach their customer's attention. Hence these advancements are analysed to drive the market in the forecast period.

Request for Sample Report @ https://www.industryarc.com/pdfdownload.php?id=500723

Report Price: $ 4500 (Single User License)

Unified Monitoring Market Segment Analysis - By Deployment Type

Cloud deployment is growing at a highest CAGR of 22.2% in the forecast period owing to its operational flexibility and real-time deployment ease to companies than on-premises deployment. It also offers numerous benefits, including reduced operational costs, simple deployment process, and higher scalability in terms of connected resources. Additionally, the cost-effective cloud-based solutions ease installation when compared to the on-premises solutions. The highest level of data security and reliability offered by the cloud deployment are increasing the share of this deployment in the forecast period. Several companies are providing solutions related to this deployment. For instance, Sematext Cloud uses automated and manual tools for accomplishing, monitoring, and assessing the cloud computing plan, structure, and service station. Hence these benefits are analyzed to drive the market growth in the forecast period 2020-2025.

Unified Monitoring Market Segment Analysis - By Geography

North America dominated the market by a market share of more than 34.5% in 2019, owing to increased investment in IT infrastructure and shifts towards new and upgraded technologies with the increasing adoption of digital business strategies is analysed to drive the market growth. Several companies in this region have been investing heavily for the advancements in this technology. In 2019, Sysdig has raised $68.5 Million in Series D Funding to Enable Enterprises to Secure and Monitor Containers and Cloud-Native Applications. In addition Sysdig also expands Unified Monitoring across IBM Cloud Services. Similarly AppDynamics has invested over $200 million for continued expansion of its Application Intelligence Platform into the IT Operations. Hence these developments are analyzed to drive the market in the forecast period 2020-2025.

Unified Monitoring Market Drivers

Increase in the adoption rate of Internet of Things (IoT) and big data among enterprises.

The Internet of Things (IoT) and Big Data are growing rapidly in the commercial arena. Enterprises are adopting IoT into their businesses at a high rate and most of them have positive responses in terms of business outcomes. Microsoft’s new state of IoT research shows that 85% of enterprises are having at least one IoT project in either the learning, proof of concept, purchase, or use phase. Many enterprises reported that they had more than one projects in the use phase. 88% of the enterprises who have already adopted IoT said that this technology is critical to their overall success. In addition, UM also gained additional monitoring visibility into Big Data operations with Hadoop and Cassandra monitoring probes. Hence these benefits are analyzed to drive the market in the forecast period.

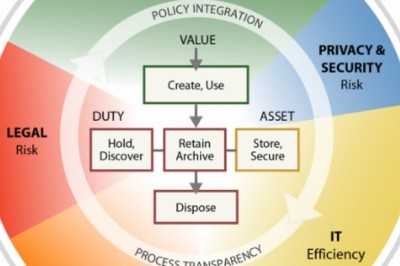

Increasing Cyber Safety and Security Concerns among Organizations

Rising security issues among organization is analyzed to drive the market. Organizations such as IT and telecommunication, Healthcare, BFSI and so on are facing Cyber-attacks. According to the report, financial firms are 300 times more likely than other institutions to experience cyber-attacks and thus require a security system and its continuous monitoring. For instance, in 2019, Mastercard reported over 460,000 intrusion attempts each day, which has increased by 70% compared to the year prior. Further, during the Covid-19 coronavirus pandemic, most of the users are relying on digital banking, and there is a sudden increase in cyber-attacks targeting the financial services sector. According to the VMware Carbon Black Threat Analysis Unit, cyber-attacks spiked by 38% between February and March in 2020. Moreover, IT and Telecommunication are also witnessing increasing cyber-attacks during the forecast period. Hence, there is a tremendous pressure on such organizations to monitor all the components with real-time data simultaneously maintaining security will drive the market in the forecast period 2020-2025.

Download Sample Report @ https://www.industryarc.com/pdfdownload.php?id=500723

Unified Monitoring Market Challenges

High maintenance costs.

Despite of so many benefits of Unified Monitoring cost is biggest obstacle to adopting new technology. High operational costs and poor organizational productivity are forcing companies to streamline their contact center and unified communication support and maintenance operations. Several organizations rely on multiple vendors to manage their contact center and unified communication (CC & UC) systems, requiring greater integration effort. This greater integration requires high deployment cost. Further, limited in-house capabilities and manual processes lead to higher resolution time in case of technical glitches. Hence these high maintaince cost hamper the market growth in the forecast period 2020-2025.

Market Landscape

Technology launches, acquisitions, Partnerships and R&D activities are key strategies adopted by players in the Unified Monitoring market. In 2019, the market of Unified Monitoring industry outlook has been fragmented by several companies. Unified Monitoring top 10 companies include Dynatrace LLC, Zoho Corporation, AppDynamics Inc., Broadcom Inc., Zenoss Inc., GroundWork Open Source, Inc., Acronis International GmbH, Paessler AG, Opsview Limited, Juniper Networks Inc. among others.

Acquisitions/Technology Launches

In 2019, Zenoss Inc., partnered with Health Partners Plans (HPP), to monitor its large and complex IT infrastructure. It’s a patented technology that builds real-time topology models of hybrid IT infrastructures, provides actionable, prescriptive insights, and predicting service disruptions before they impact business would be implemented.

Key Takeaways

North America dominated the market by a market share of more than 34.5% in 2019, owing to increased investment in IT infrastructure and shifts towards new and upgraded technologies is analyzed to drive the market growth.

Cloud deployment is growing at a highest CAGR of 22.2% in the forecast period. As these solutions help in protecting data from thefts and loss, along with reducing attacks that can hamper network performance.

Unified infrastructure monitoring gives data centre operations teams the centralized management view they need to focus on service quality and agility.

Unified Monitoring top 10 companies include Dynatrace LLC, Zoho Corporation, AppDynamics Inc., Broadcom Inc., Zenoss Inc., GroundWork Open Source, Inc., Acronis International GmbH, Paessler AG, Opsview Limited and Juniper Networks Inc. among others.

Related Reports :

A. User Activity Monitoring Market

https://www.industryarc.com/Research/User-Activity-Monitoring-Market-Research-500726

B. Internet Of Things Market

https://www.industryarc.com/Research/Internet-Of-Things-Market-Research-510100

For more Information and Communications Technology related reports, please click here

About IndustryARC: IndustryARC primarily focuses on Cutting Edge Technologies and Newer Applications market research. Our Custom Research Services are designed to provide insights on the constant flux in the global supply-demand gap of markets. Our strong team of analysts enables us to meet the client research needs at a rapid speed, with a variety of options for your business. Any other custom requirements can be discussed with our team, drop an e-mail to sales@industryarc.com to discuss more about our consulting services.