222

views

views

Embifi is one of the best B2B payment platforms in India, providing solutions in B2B checkout, financing, lending and payments. Avail their expert services and enable your business to benefit from FinTech-driven payments. For more details, visit the Embifi website now.

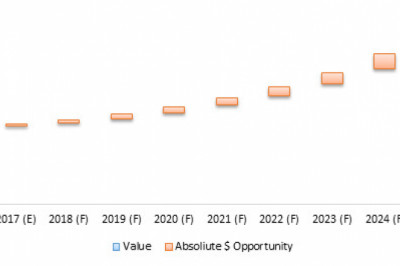

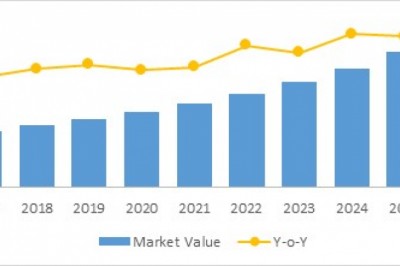

The rapid digitalisation of businesses in the wake of the Covid-19 pandemic compelled people across the globe to turn to cashless transactions- a trend further confirmed by the fact that the FinTech industry peaked at a whopping $91.5 billion in the year 2021.

The FinTech sector has also been quick in adapting to meet the evolving investor and customer needs. Many such companies are now working on the effect of blockchain technology on generating revenue, and competing to deliver process efficiency, enhance end user experience and reduce business risks.

The market is steadily filling with B2B payment platforms, and each one has a unique penchant for technologically revolutionary solutions in B2B finance and much more. But what advantage can businesses have from availing the services of such FinTech payments providers? Read on to discover the top 5 benefits of FinTech-driven payments to businesses of all scales and sectors.

- Funding becomes Easier

The process of obtaining a bank loan can be long and tedious as it involves a thorough assessment of the applicant’s credit history. In fact, this criterion is the most common reason why middle-class people fail to get business loans for a startup, as they lack sufficient security to provide against the same. FinTech, with their range of NBFCs and B2B payment platforms, are credited for meeting the B2B finance needs of such ventures without much hassle.

- Increased Scope of Business Activity

FinTech companies create systems for businesses to accept payment for trades and services with greater convenience. Associating with a FinTech initiative is particularly beneficial for SMEs as they have access to the former’s vast array of financial resources, distribution channels, investments and payments platforms. Say you need an electronic payment platform for your small business, a FinTech company can help you with their expertise on it.

FinTechs also operate multilingual services on their B2B payment platforms, providing a scope for global transactions without any language barriers. It is for this reason that businesses relying on agent networks are starting to resort to FinTech to make transaction processes more seamless for themselves and their clients alike.

- Increased Speed and Security in Transactions

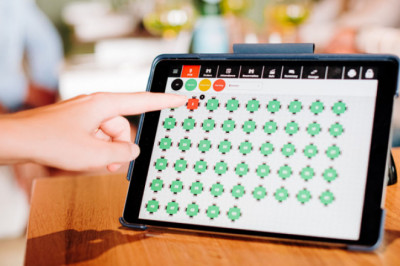

Well, this one’s a given. Advancements in FinTech have drastically improved and increased payment options for businesses in a variety of industries. Most B2B payment platforms can connect directly with a business owner’s bank account, making real-time instant payments possible with the help of an open banking API. On the security front, most FinTech services are equipped to provide protective measures like biometrics and two-factor authentication to ensure safe transactions.

- Reduced Costs

FinTech-driven payments can save businesses from additional expenses like modification fees, cancellation fees and other hidden charges. They also enable businesses to make transactions across multiple currencies without the compulsion of conversion fees. FinTech further provides the scope for consolidating multiple bank accounts and cards using a single interface, thus reducing overall costs for businesses by simplifying their transaction methods.

- Increased Transparency

FinTech solutions have also paved the way for more transparency in B2B finance. FinTech platforms are often kept in a tight loop regarding their individual transactions, there is usually the facility of 24*7 customer support as well as real-time updates on all big and small transactions. FinTech-driven payments have thus promoted trust and reliability in business.

Embifi is one of the best B2B payment platforms in India, providing solutions in B2B checkout, financing, lending and payments. Avail their expert services and enable your business to benefit from FinTech-driven payments. For more details, visit the Embifi website now.