384

views

views

The demand for trauma treatment centres has now been strongly impacted by strategic collaborations between urgent care providers such as neurosurgeons, anesthesiology, radiology and hospitals.

Sub-Saharan Africa Polycarbonate Resin market size is forecast to reach US$260.4 million by 2026, after growing at a CAGR of 4.4% during 2021-2026. Polycarbonate is a transparent, lightweight, high-performance thermoplastic polymer. The product has varied properties such as excellent electrical resistance, toughness, optical clarity, dimensional stability, and high heat resistance among others. Due to these properties, the product finds its usage among various industries such as automotive, packaging, construction, electronics, and others. The product is also known as engineered plastic. Polycarbonate injection molding is a naturally transparent amorphous thermoplastic used for manufacturing automotive components, and medical tubing. The growing consumption of plastic among different industries is boosting the market growth for polycarbonate resin during the forecast period. The growing product demand among the automotive and construction sectors is supporting the market growth during the forecast period. The growing demand for Blu-Ray discs in the Sub-Saharan Africa region is propelling the market growth. However, the availability of alternative products such as polypropylene, copolyesters, and polystyrene is likely to hamper the market growth between 2021-2026.

COVID-19 Impact

The COVID-19 pandemic is impacting different industries; one of the few industries that were largely hit to some extent was the plastic industry. Due to the Covid-19, the construction and automotive industry is impacted very badly which further effected the polycarbonate resin market. Lack of supply chain, low demand, and lack of workforce are the major factors that negatively impacted the market during a covid-19 pandemic. The covid-19 has resulted in a slowdown in economic activities in the African region.

Report Coverage

The report: “Sub-Saharan Africa Polycarbonate Resin Market – Forecast (2021-2026)”, by IndustryARC, covers an in-depth analysis of the following segments of the Sub-Saharan Africa Polycarbonate Resin industry.

By Viscosity: Low, Medium, and High

By Type: Sheets [Solid, Corrugated, Multiwall, and Others], Films [Optical PC Films, Flame Retardant PC Films, and Others], Fibers, Blends, Tubes, and Others

By Process Type: Casting Resin Process, and Molding Resin Process [Injection molding, Compression molding, Blow molding or film extrusion, Reaction injection molding (RIM), and Resin transfer molding (RTM)

By Application: Machine parts, Electronic components, Smartphones, Game consoles, Paints and Coatings, Bond Panels, Seal Windows, Coil or transformer manufacturing, and Others

By End-Use Industry: Automotive [Passenger vehicles, Light Weight Commercial Vehicles and Heavy Commercial vehicles], Electronics, Medical equipment, Building & construction [Commercial Buildings, and Residential Buildings], Optical media, IT and Communication, Packaging Industry, Sports Goods, and Others

By Geography: South Africa, Nigeria, Kenya, Ethiopia, Ghana, and Rest of Sub-Saharan Africa

Key Takeaways

- Polycarbonates belong to a group of thermoplastic polymers whose chemical structures contain carbonate groups.

- Polycarbonate resins can be used over a broad range of temperatures ranging from -30°C (-22°F) to 200°C (392°F). The product also offers excellent transparency and good flow properties at very high temperatures.

- The South Africa country is expected to grow at a CAGR of 4.5% in Sub-Saharan Africa Polycarbonate Resin market during 2021-2026, due to the growing construction activities.

Figure: South Africa Polycarbonate Resin Market Revenue, 2020-2026 (US$ Million)

For more details on this report - Request for Sample

Sub-Saharan Africa Polycarbonate Resin Market Segment Analysis - By Process Type

The molding resin process segment accounted for the largest market share in the Sub-Saharan Africa Polycarbonate Resin market. The injection molding process accounted for approximately 25% of the molding resin process segment in 2020 and is also estimated to grow at a significant CAGR during the forecast period. The polycarbonate injection molding process utilizes rapid heating and cooling technologies to produce different parts and components. The products manufactured through the injection molding process have superior impact strength, excellent rigidity, and crystal-clear transparency. The compress molding segment is expected to grow at a high CAGR during the forecast period, owing to its good dielectric properties and low moisture absorption property.

Sub-Saharan Africa Polycarbonate Resin Market Segment Analysis – By Application

The machine parts and electronics parts segment accounted for more than 15% of the market share in 2020 and is estimated to grow significantly during the forecast period. Polycarbonate products are stronger than glass and are also known as one of the most durable transparent plastics available in the market. Polycarbonate resin is used for manufacturing medical equipment, auto parts, and others. Polycarbonate blend is used by OEMs to manufacture laptops, copiers, printers, mobile chargers for smartphones, electrical connectors, insulators, and others.

Sub-Saharan Africa Polycarbonate Resin Market Segment Analysis – By End-Use Industry

The automotive segment accounted for more than 18% of the market share in 2020 and is estimated to grow significantly during the forecast period. The market for cars and commercial vehicles is growing rapidly in the Sub-Saharan African region. The presence of automotive companies in Africa such as Birkin Cars, Innoson Motors, Kiira Motors Corporation, Mobius Motors, and Kantanka Cars among others are supporting the market growth during the forecast period. Rapid utilization of polycarbonate resins in the manufacturing of automotive parts and components is supporting automotive growth. Polycarbonate resin is used for producing automotive windows, headlamps, exterior automotive components, farming equipment, and others.

Sub-Saharan Africa Polycarbonate Resin Market Segment Analysis - By Geography

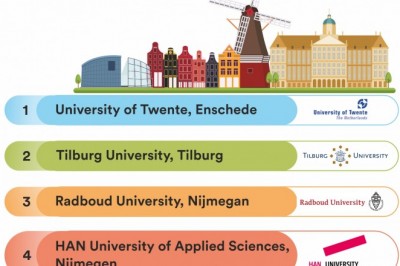

The presence of developing nations including South Africa, Mauritius, Nigeria, and others supporting the market growth for polycarbonate resin in the region. South Africa is one of the highly developed economies in the Africa region with advanced infrastructure. The country also has well-established financial, transport, legal, communications, and energy sectors. The African continent is undergoing a phase of mass development. There are many construction projects underway across Africa includes Modderfontein Mega City, Square Kilometer Array Telescope, and BRICS cable project among others.

Sub-Saharan Africa Polycarbonate Resin Market Drivers:

Growing demand from end-use industries

Polycarbonate (PC) is a lightweight, high-performance resin that has a unique balance of toughness, dimensional stability, and optical clarity. Polycarbonate is the best and safer alternative to glass in optical applications, such as corrective lenses. The product is used in a wide variety of products including digital media, sports safety equipment, electronic equipment, exterior lighting fixtures, vehicles, greenhouses, construction, medical devices, and others. According to the data published by OICA, South Africa manufactured approximately 447,218 units of vehicles in 2020. The country manufactured 238,216 cars and 209,002 commercial vehicles in 2020. Over the past few years’ construction industries is growing moderately in the African region. The economic growth, investments in infrastructure projects, and technology advancements are boosting the industry. According to a research paper, the Africa construction industry is expected to grow at a CAGR of 6.4% between 2020-2024. Tunisia 2020 national five-year development plan, the government has decided to develop various infrastructure projects. The government allocated approximately US$25billion to the five-year development plan.

High Applicability in the Electronic industry

Polycarbonate resin is widely used for manufacturing electronic components. The product is a good electrical insulator and having heat-resistant, flame-retardant properties. Due to its advanced properties, the resin is used in electrical and telecommunications hardware products. The product finds its usage in TVs, computers, smartphones, consumer electronics, and other electronic products. Electronic components such as switching relays, connectors, and sensor parts are also manufactured from polycarbonate resin. According to Invest Cape Town, South Africa is home to the largest consumer electronics industry involved in the design, engineering, manufacturing, testing, implementation, and maintenance in the African market. South Africa spends approximately US$10.5 billion annually.

Sub-Saharan Africa Polycarbonate Resin Market Challenges:

Availability of alternative products in the market

Polycarbonate resins find their application in many industries for manufacturing different types of components and parts. Due to high demand in the market, the manufacturers are looking for alternatives to polycarbonates. Acrylic, polypropylene, co-polyesters, and polystyrene are some of the major alternatives available in the market for polycarbonates. Polypropylene is widely used in the manufacturing of water bottles and food containers as an alternative to polycarbonate. The usage of polycarbonates in packaging materials and medical applications is decreased due to the detection of bisphenol-A (BPA) in packaging materials. These are some of the major challenges restraining the market growth during the forecast period.

Sub-Saharan Africa Polycarbonate Resin Market Landscape

Technology launches, acquisitions, and R&D activities are key strategies adopted by players in the Sub-Saharan Africa Polycarbonate Resin market. Major players in the Sub-Saharan Africa Polycarbonate Resin market are SABIC Innovative Plastics, Bayer MaterialScience AG, Teijin Ltd., Mitsubishi Engineering-Plastics Corporation, Chi Mei Corporation, Formosa Chemicals & Fiber Corporation, LG Chem Ltd., Samsung Sdi Co., Ltd., Samyang Corporation, Thai Polycarbonate Co. Ltd., Trinseo LLC, and others