views

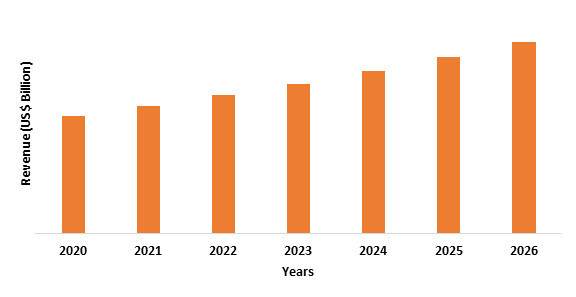

Self-adhered Roofing Membranes Market size is forecasted to grow at a CAGR of 4.6% during 2021-2026. It is widely used in residential applications such as roof covering and underlayment. Self-adhered roofing system is one of the most cost-effective and environment-friendly roofing systems. Self-adhering roofs are green for a few reasons such as they do not contain volatile organic compounds and fully recyclable. In addition, self-adhered roofing would not retain extreme heat or cold, which gives a break to heating system and air conditioning systems. Self-adhered roofing is completed with no fumes, which makes them relatively safe to use at residential and commercial buildings. Hence, increasing demand for self-adhered roofing materials such as thermoplastic polyolefin, modified bitumen, polyvinyl chloride, ethylene propylene diene monomer, and others due to their chemical resistance and excellent weather ability from the construction sector is expected to grow the demand for self-adhered roofing.

Impact of COVID-19:

The COVID 19 pandemic has put all construction projects on hold along with residential and non-residential construction projects. Due to lockdown, the demand for self-adhered roofing systems has decreased. According to the U.S. Census Bureau, in January 2021, private construction declined 0.5 percent, residential (-0.2 percent), health care (-4.4 percent), and office (-0.5 percent) in the United States. In 2021, all the residential and non-residential have been stopped due to which roofing membranes demand decreased.

Report Coverage

The report: “Self-adhered Roofing Membranes Market – Forecast (2021-2026)”, by IndustryARC, covers an in-depth analysis of the following segments of the self-adhered roofing industry.

By Material: Thermoplastic Polyolefin (TPO), Modified Bitumen, Poly Vinyl Chloride (PVC), Ethylene Propylene Diene Monomer (EPDM), and others.

By Application: Residential Buildings (Independent Homes, Row Houses, Large Apartment Buildings, Others), Commercial Building (Airports, Hospitals, Retail, Educational Institutes, Shopping Malls, Supermarkets, Hotels, School, Others), Industrial Buildings, and others.

By Geography: North America (USA, Canada, and Mexico), Europe (UK, Germany, Italy, France, Spain, Netherlands, Russia, Belgium, and Rest of Europe), APAC (China, Japan, India, South Korea, Australia, Taiwan, Indonesia, Malaysia, and Rest of Asia Pacific), South America (Brazil, Argentina, Colombia, Chile, and Rest of South America), and RoW (Middle East and Africa).

Key Takeaways

- North America dominates the self-adhered roofing membranes market owing to increasing infrastructural development such as residential construction, affordable housing, and new institutes in United States, Mexico, and Canada.

- Increasing adoption of modified bitumen as it can be recycled and reused for road construction.

- Increasing demand for self-adhered roofing due to their specialties such as cost-effectiveness and excellent weather resistance will increase demand for the self-adhered roofing membranes market.

Figure: North America Self-adhered Roofing Membranes Market Revenue, 2021-2026 (US$ Billion)

For More Details on This Report - Request for Sample

Self-adhered Roofing Membranes Market Segment Analysis – By Material

<span times="" new="" roman";mso-bidi-font-family:="" calibri;mso-bidi-theme-font:minor-latin;color:black;mso-themecolor:text1"="" style="box-sizing: border-box;">Thermoplastic polyolefin (TPO) material type segment held the largest share in the self-adhered roofing membranes market in 2020, due to its various superior properties such as high chemical resistance and excellent weather durability, which makes them suitable for construction applications. Thermoplastic polyolefin is made up of blends of ethylene polypropylene rubber and talc carbon filler or fiberglass. It is generally more durable than other low-slope roof systems and has a strong resistance to tears and easy to install. TPO is used in residential and commercial roofing systems due to its versatility. Apart from this, modified bitumen is UV resistant and helps to reduce energy costs. Modified bitumen is most commonly used in conjunction with other roofing materials such as asphalt shingles because it can be recycled and used to construct new roads. Thus, due to all these factors, the demand for self-adhered roofing membranes is growing.

Self-adhered Roofing Membranes Market Segment Analysis – By Application

Residential sector dominated the global self-adhered roofing membranes in 2020 and is expected to grow at a CAGR 4.8% during 2021-2026 due to the increasing use of self-adhered roofing membranes in residential buildings owing to their environment-friendly installation that also avoid surface cracking from ultra-violet radiation. It is used in buildings with modern designs that integrate flat roofs. According to the National Development and Reform Commission (NDRC), 14 construction investment projects were approved worth CNY177.8 billion (US$25.2 billion), following approvals of CNY68.9 billion (US$10.1 billion) in August 2020. Additionally, self-adhered roofing systems are typically installed in two or three layers, which reduces leak risk as compared to a single-layer installation. Hence, self-adhered roofing membranes are protecting from the sun’s UV rays and offering a level of fire resistance, which is increasing the demand for self-adhered roofing membranes.<span times="" new="" roman";mso-bidi-font-family:="" calibri;mso-bidi-theme-font:minor-latin;color:black;mso-themecolor:text1;="" mso-bidi-language:hi"="" style="box-sizing: border-box;">

Self-adhered Roofing Membranes Market Segment Analysis – By Geography

North America dominated the self-adhered roofing membranes market with more than 30% in 2020 due to the growing construction activities in the countries such as the United States and Canada. The housing market plays an important role in the U.S. economy. According to the US Census Bureau, building permits in the United States increased 0.3 percent to an adjusted annual rate of 1.76 million in April 2021 from 1.75 million in March 2021. Furthermore, according to the Canadian Mortgage and Housing Corporation (CMHC), Canadian housing starts rose 21.6% in March as compared with February 2021. Thus, residential and commercial construction in the region is projected to drive self-adhered roofing membranes market.

Self-adhered Roofing Membranes Market Drivers

Robust Growth in Building & Construction Sector

According to the India Brand Equity Foundation (IBEF), the government launched the 'Housing for All by 2022' scheme under Pradhan Mantri Awasa Yojana (PMAY) in India, which is expected to drive the residential construction at a low cost of the country over the coming years. Additionally, according to Central Sanctioning and Monitoring Committee (CSMC), 1,68,606 new homes were approved to construct in urban areas under Pradhan Mantri Awasa Yojana in 2021. Furthermore, according to the Ministry of Rural Development and Ministry of Housing and Urban Affairs indicate a housing shortage of about 3 crore units in rural areas and 1.2 crore units in urban areas. On the other hand, according to the National Bureau of Statistics, China's real estate market investment jumped from 15.7% in 2019 to 38.3% in January-February 2021. Hence, all factors are growing demand for self-adhered roofing membranes.

Self-adhered Roofing Membranes Market Challenges

High Cost of Thermoplastic Polyolefin Compared to other Roofing Membranes

Thermoplastic Polyolefin (TPO) is widely used in low slope roofing systems as it <span times="" new="" roman";mso-bidi-font-family:="" calibri;mso-bidi-theme-font:minor-latin;color:black;mso-themecolor:text1;="" mso-bidi-language:hi"="" style="box-sizing: border-box;">provides outstanding resistance to ozone, ultraviolet rays, and some chemical exposure. But thermoplastic polyolefin (TPO) is more expensive than ethylene propylene diene monomer (EPDM) rubber membrane roofs, thus it requires quality installation. Thermoplastic polyolefins produce less toxic agents and can help to lower carbon emissions. Hence TPO self-adhered roofing membranes are expensive than others. Which may limit the market growth.

Self-adhered Roofing Membranes Market Landscape

Technology launches, acquisitions, and R&D activities are key strategies adopted by players in the self-adhered roofing membranes market. Major players in the Self-adhered Roofing Membranes Market are:

- <span times="" new="" roman";mso-bidi-font-family:calibri;mso-bidi-theme-font:minor-latin;="" color:black;mso-themecolor:text1;letter-spacing:.1pt;mso-bidi-language:hi"="" style="box-sizing: border-box;">APOC

- <span times="" new="" roman";mso-bidi-font-family:calibri;mso-bidi-theme-font:minor-latin;="" color:black;mso-themecolor:text1;letter-spacing:.1pt;mso-bidi-language:hi"="" style="box-sizing: border-box;">Carlisle SynTec Systems

- <span times="" new="" roman";mso-bidi-font-family:calibri;mso-bidi-theme-font:minor-latin;="" color:black;mso-themecolor:text1;letter-spacing:.1pt;mso-bidi-language:hi"="" style="box-sizing: border-box;">Firestone Building Products Company LLC

- <span times="" new="" roman";mso-bidi-font-family:calibri;mso-bidi-theme-font:minor-latin;="" color:black;mso-themecolor:text1;letter-spacing:.1pt;mso-bidi-language:hi"="" style="box-sizing: border-box;">GAF

- <span times="" new="" roman";mso-bidi-font-family:calibri;mso-bidi-theme-font:minor-latin;="" color:black;mso-themecolor:text1;letter-spacing:.1pt;mso-bidi-language:hi"="" style="box-sizing: border-box;">Henry Company

- <span times="" new="" roman";mso-bidi-font-family:calibri;mso-bidi-theme-font:minor-latin;="" color:black;mso-themecolor:text1;letter-spacing:.1pt;mso-bidi-language:hi"="" style="box-sizing: border-box;">Icopal Ltd (BMI Group)

- <span times="" new="" roman";mso-bidi-font-family:calibri;mso-bidi-theme-font:minor-latin;="" color:black;mso-themecolor:text1;letter-spacing:.1pt;mso-bidi-language:hi"="" style="box-sizing: border-box;">Johns Manville

- <span times="" new="" roman";mso-bidi-font-family:calibri;mso-bidi-theme-font:minor-latin;="" color:black;mso-themecolor:text1;letter-spacing:.1pt;mso-bidi-language:hi"="" style="box-sizing: border-box;">Owens Corning

- <span times="" new="" roman";mso-bidi-font-family:calibri;mso-bidi-theme-font:minor-latin;="" color:black;mso-themecolor:text1;letter-spacing:.1pt;mso-bidi-language:hi"="" style="box-sizing: border-box;">Sika AG

- <span times="" new="" roman";mso-bidi-font-family:calibri;mso-bidi-theme-font:minor-latin;="" color:black;mso-themecolor:text1;letter-spacing:.1pt;mso-bidi-language:hi"="" style="box-sizing: border-box;">Soprema Inc. and among others.