views

Lenders as such do not favour small businesses for granting loans other than unsecured loans which carry a high rate of interest. Under such circumstances, most small businesses depend on credit cards for funding or financing their businesses. Using a personal credit card is risky if the small business does not work out. One should therefore consider a business credit card.

Let us then understand the pros and cons of using a credit card to fund a small business.

Which credit card is best for a small business? Personal or Business?

If you are using your personal credit card to fund your business finance needs, then it is not a good idea as debt keeps accumulating on a monthly basis. If the business does not work out, then it would be more difficult for the small business owner to repay the debt. Therefore, a small business should opt for a business credit card.

Business credit cards have a higher credit limit sanctioned which would help a small business to manage their day-to-day business expenses and keep track of the business purchases, recording every transaction in a systematic manner.

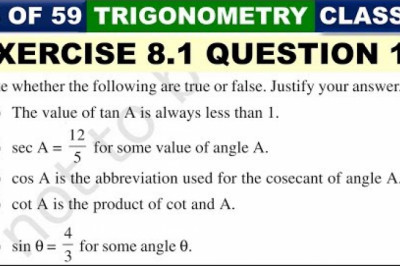

Pros and Cons of Using Credit Cards to Fund Small Business

Pros

-

Easily Available

If you already possess a personal credit card, then your chances of getting a business credit card increases, as you have a credit score and credit report. Also, if your business has a good credit history and you have been in operation for a few years, then it’s easy to get a business credit card.

A good credit score increases your chances of getting your business credit card easily approved by the bank. You can check your latest business credit score right on our site. Just provide a few basic details and get your credit score and report within a few minutes.

Smart Credit Card Tip: It’s always better to keep your personal and business finances separately. So, instead of using your personal credit cards for business, apply for and use a separate business credit card.

-

Revolving Credit

A business credit card gives you the benefit of revolving credit. It means you can purchase for your business till the credit limit is reached and pay for it later. After your bill has been paid, fresh purchases can be made. However, you need to ensure that you pay your credit card bills on time, as this will give you the benefit of a continuous credit limit and a good credit score.

-

Full Ownership

Financing your business with your business credit card entails having complete ownership of your business. This is beneficial for maintaining control over your company and helpful while searching for investors.

-

Competitive Interest Rates

Have a business credit card provides you with the option of getting competitive interest rates as compared to other business loans. Also, business credit cards entail easy financing of your business needs ensuring a steady cash flow.

-

Collateral not required

The bank does not ask for collateral for a business credit card, unlike a secured business loan.

-

Build Business Credit

Having a business credit card will help a small business to build business credit which otherwise would have been difficult to build for a small business. A business credit card also helps to improve credit over time depending on your timely payments. This will also help you to get potential business loans easily.

-

Tracking Expenses

Having a business credit card also helps in keeping track of your business expenses and related purchases. This would help in managing your business accounts and for tax purpose.

-

Higher Rewards

Business credit cards are premium credit cards that come with a higher credit limit, better offers and rewards than a personal credit card.

To know more about Pros And Cons Of Using A Credit Card To Fund Your Small Business