134

views

views

the need for varied kind of off-road vehicles including off road motorcycles, all-terrain vehicles and others is getting impacted significantly. Moreover, growing investments on mining projects along with rise in development of electric powered off-road vehicles is also set to fuel the market growth in the long run.

The Global Off the Road market size is forecast to reach $18.4 billion by 2026, growing at a CAGR of 6.9% from 2021 to 2026. Off-road vehicles can be categorized as those vehicles characterized with large tires and flexible suspension capable of travelling with low ground pressure across off paved or gravel surfaces. The market growth towards these vehicles is attributed by various factors including growing popularity of extreme sport activities, rise of construction activities, increasing agricultural activities and others. Owing to this, the need for varied kind of off-road vehicles including off road motorcycles, all-terrain vehicles and others is getting impacted significantly. Moreover, growing investments on mining projects along with rise in development of electric powered off-road vehicles is also set to fuel the market growth in the long run.

Report Coverage

The report: “Off the Road Industry Outlook – Forecast (2021-2026)”, by IndustryARC covers an in-depth analysis of the following segments of the industry.

By Vehicle Type: All-Terrain Vehicles (ATV), Off Road Motorcycles, Snowmobiles, Side by Side Vehicles (SSV)/Utility Task Vehicle

By Engine Type: Diesel, Electric, Gasoline

By Drive train: All-wheel drive (AWD), Four-wheel drive (4WD)

By Application: Sports vehicles, Recreation, Military vehicles, Commercial

By End Users: Mining, Agriculture, Construction, Forestry, Others

By Geography: North America (U.S, Canada, Mexico), Europe (U.K, Germany, France, Italy, Spain, Others), APAC (China, Japan, South Korea, India, Australia, Others), South America (Brazil, Argentina, Others) and RoW (Middle East, Africa)

Key Takeaways

- All-Terrain Off-road vehicles are analysed to witness the fastest market growth during 2021-2026, owing to its availability in different model variants as well as versatile operation.

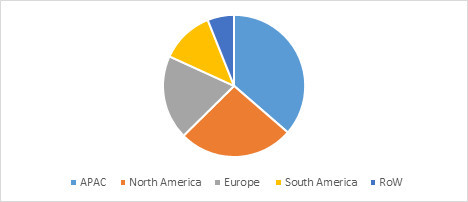

- APAC Off the Road market held the largest share in 2020, owing to factors including rapid industrialization as well as rising construction of residential and commercial sectors.

- Growing investments for mining projects as well as rising development of electric powered off-road vehicles is analysed to significantly drive the Off The Road market during the forecast period 2021-2026.

Global Off the Road Market Value Share, By Region, 2020 (%)

For More Details on This Report - Request for Sample

Off the Road Market Segment Analysis - By Vehicle Type

Based on vehicle type, All-Terrain Vehicles (ATV) segment is analysed to grow with the highest CAGR of around 5.3% in the global off the road market during the forecast period 2021-2026. All-Terrain vehicles (ATV) can be referred to those vehicles with low pressure tires and handlebars for steering control, alongside availability in different variants such as quad bikes, three wheelers, four wheelers and others. Due to its versatility, these vehicles combine compact size with excellent turning radius in order to serve applications such as sports events, land management, and others. Growing shift towards sports activities, recreational purpose along with high preference towards travelling in hilly areas have been driving the market growth for these vehicles. Moreover, rising advancements towards development of electric powered ATV models as a part of expand up the eco-friendly automotive range is set to boost the market growth forward. In April 2021, Artic Cat announced about the launch of an ATV model, named Altera 600 EPS as a part of its 2022 line up to be available for dealerships by July. This model has been incorporated with an all-new engine, chassis and drive train capable of providing benefits such as better handling coupled with increased power and ease of servicing. Such factors are further meant to propel the need for ATVs in the coming time.

Off the Road Market Segment Analysis - By End Users

Construction sector is analyzed to account with the highest CAGR of around 6.5% in the global Off the Road market during 2021-2026. Rising number of infrastructural projects for both residential and commercial sector drives the need for rugged heavy-duty vehicles capable of working under steep, uneven and sloppy ground environments. Adoption of off the road vehicles help the construction site operators to finish diverse applications such as loading, unloading and many others with higher efficiency compared to traditional vehicles. In addition, features like compact sized vehicles coupled with innovation towards electric off-road vehicles have been also aiding its market demand in the construction industry. Rapid industrialization, rise of new infrastructural facilities or expansion projects of various industrial sectors be it power generation, chemicals, food & beverage and others, will further drive the need for robust construction machinery tools like off the road vehicles in the long run. In October 2020, Equipmake announced about the launch of APM electric motors for off-highway vehicles as well as construction equipment applications, in order to meet growing demands towards minimizing emissions and noise from construction sites. Such advancements towards off the road vehicle components is set to further raise its market demands serving construction activities in the long run.

Off the Road Market Segment Analysis - By Geography

APAC region had dominated the global off the road market with a share of around 36% in 2020 and is also analysed to have a significant growth during the forecast period 2021-2026. Rapid industrialization along with rise in construction activities for residential and commercial sectors have been attributing towards the market growth. High investments towards R&D activities from some of the major market players such as Yamaha Motor, Kawasaki and others as well as rising penetration of sport and recreational events can also help in boosting the market growth for off the road vehicles within the region. In addition, governmental initiatives to support various industrial infrastructural projects along with growth of mining activities will further drive the market in the long run. In March 2021, a Chinese automobile manufacturer, Great Wall Motor had revealed about its plans of launching a new standalone brand, named Tank for its off-road vehicles, as a part of growing sales for this segment. Such factors are further meant to propel the demand for off-road vehicles in the coming time.

Off the Road Market Drivers

Rising development towards electric powered off-road vehicles:

Rising development towards electric powered off-road vehicles can be considered as a major factor boosting the growth of off the road market. With technological advances along with growing shift towards environmentally friendly automotive alternatives, various automakers have started focusing on developing electric driven vehicles. The development of electric powered off-road vehicles help in meeting changing customer preferences through providing a cost-effective transportation, coupled with optimum output efficiency, lightweight components as well as meeting fuel efficient mobility requirements. Moreover, stringent governmental regulations regarding reduction of vehicular emissions have been also driving the need for manufacturers to invest in electric powered vehicles. In September 2020, Polaris Inc. had revealed about its plans of teaming up with Zero Motorcycles in order to jointly develop electric vehicles, including ATVs and snowmobiles. This move was taken as a part of its ten-year agreement towards aiming for developing electric versions of every vehicle types by 2025. Such factors are further set to boost the market growth for electric powered off-road vehicles in the coming years.

Growing investment towards mining projects drives the market forward:

Growing investment towards mining projects act as a major driver boosting the market growth for off the road. Mining sector involves high-end operations like extraction of raw materials or minerals from underground or much lower ground levels, which drive the need for robust and powerful off-road machines. Extracting massive bulk amounts of iron ores, coal and related minerals eventually create the need for mining companies to invest in heavy duty machinery capable of withstanding high temperature or pressure conditions followed by vibrations. This in turn, have been helping in gaining wide popularity of off-road vehicles particularly in mining operations. In addition, rising demand for metals or minerals overtime have been also impacting the growth of mining sector projects, boosting its market growth. In March 2021, an Indian coal mining company, Coal India Limited had revealed about its approval of 32 new coal mining projects for the ongoing fiscal year, at an estimated cost of $636.13. These projects will include both expansion of existing projects and green field in order to add an incremental peak capacity of193 million tonnes per annum (MTPA) with the earlier sanctioned one. Such factors will further influence the growth of off the road market in the long run.

Off the Road Market Challenge

High cost:

High cost regarding manufacturing, maintenance as well as fuel requirements act as one of the major factors impeding the growth of off the road market. Since off road vehicles are specifically designed for serving harsh environmental conditions be it mining, construction and so on, the need for incorporating robust, high performance and better control features becomes highly essential. Owing to this, manufacturers need to invest on comparatively expensive components, which eventually raises the purchasing costs for the consumers. Advancements such as designing compact off road vehicles with improved traction, braking capability, less fuel wastage and so on further raises its overall costs. In addition, these off the road vehicles are repeatedly used in same kind of high temperature environments having uneven fields, steep surfaces and others, causing high chances of wear and tear. Maintenance or repair costs for such vehicles to avoid industrial work disruptions becomes essential, which in turn increases further expenses for the end users.

Off the Road Market Landscape

Product launches, partnerships, and R&D activities are key strategies adopted by players in the Off the Road market. Off the Road top 10 companies include Polaris Inc., Arctic Cat Inc., Kubota Corporation, Yamaha Motor Co. Ltd, Suzuki Motor Corporation, Bombardier Recreational Products Inc., Honda Motor Company Ltd., Ford Motor Company, American Land Master and Kawasaki Motors Corp. among others.

Acquisitions/Technology Launches/Partnerships

- In March 2021, Polaris had revealed its plans of launching a full-size electric side-by-side utility vehicle, 2022 Ranger EV incorporated with an electric powertrain from Zero Motorcycles.

- In September 2020, Yamaha Motor Corporation, U.S.A announced about the launch of 2021 side by side and ATV line up for off-road vehicles. This development was done to expand as well as drive its enhancements for recreationally focused Wolverine family, including RMAX 1000 models.