views

Motorcycle Insurance Market Overview:

According to the research studies, the worldwide motorcycle insurance market is expected to increase at a CAGR of 5%, with a value of USD 900 billion over the forecasting year of 2026.

The increase in the frequency of accidents, the implementation of strict government regulations requiring vehicle insurance, and the increase in automotive sales worldwide are driving the global auto insurance market's expansion.

The non-life insurance industry is concentrated on motor insurance. The gross premium written for global non-life insurance is growing, with the growth in gross premium written from motor vehicle insurance being the primary driver. Because insurers collect the most premiums in motor vehicle insurance, growth in this sector is frequently important in explaining overall developments in the non-life sector. This line of business has been highlighted as a key driver of non-life sector development in several nations. Due to transportation and travel limitations caused by the COVID-19 epidemic, sales of motorbike insurance coverage were paused. However, governments' relaxation of lockdown restrictions increased motorcycle sales and, as a result, their policies. The recovery of two-wheeler sales in rural and semi-urban regions can increase market demand. Government assistance for economic recovery has also affected customer opinion during the epidemic.

Request Free Sample of Report @ https://www.marketresearchfuture.com/sample_request/10016

Motorcycle Insurance Market Segmentation:

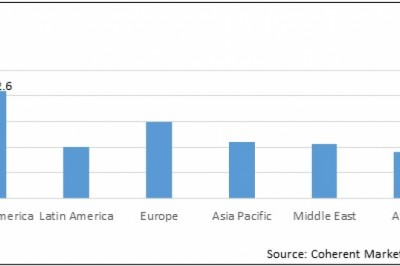

According to the latest report, the motorcycle insurance market has been segmented into user, policy type & regional analysis. According to the user section, the global market has been segmented into two forms personal motor insurance & commercial motor insurance. With the policy type, the motorcycle insurance market has been divided into three forms: third party motor insurance, third party, fire & theft motor insurance, & comprehensive motor insurance. With the basis of regional sectors, the market has been classified into five different regions, including Asia-pacific, Europe, North America, South America and Middle East & Africa.

Motorcycle Insurance Market Regional Analysis:

Usage-based insurance (UBI), sometimes known as compensation, pay-as-you-drive, or pay-as-you-go, is a kind of auto insurance in which the insurer may track how far, where, and how a vehicle is driven. UBI is often driven by telematics technology pre-installed in a vehicle's network or accessible via a plug-in device/mobile application. Telematics devices give insurers a wide range of data, such as braking and acceleration, to monitor drivers' behaviour and vehicle usage. The insurers determine the insurance premium for that specific policy based on the data collected.

Speak to Analyst @ https://www.marketresearchfuture.com/ask_for_schedule_call/10016

In industrialized countries such as the United Kingdom, the United States, Japan, Germany, and Australia, most individuals prefer to purchase vehicle insurance online rather than over the phone or in person. With the highest number of internet users and the advancement of web technologies, online sales of vehicle insurance are becoming increasingly common in developed economies. According to Report, UK customers are most likely to prefer the online channel for vehicle insurance. In the United Kingdom, 81 per cent of respondents chose the online channel to purchase car insurance, followed by Australia, where 60 per cent preferred the online channel, and Japan, where 53 per cent preferred the online channel.

Motorcycle Insurance Industrial News:

The research examines the top participants in the global motorcycle insurance market. With many competitors participating in the industry analyzed, the market is extremely segmented in market share. Companies have shifted their attention to delivering customized solutions to attract more consumers and expand their product line. Large insurance companies are looking to collaborate with rising innovative startups to get access to new market opportunities.