views

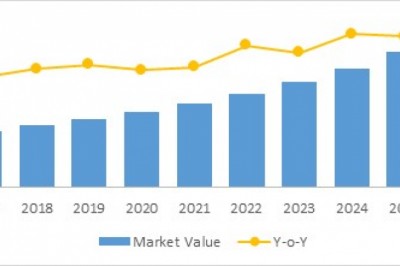

The global mining waste management market share is anticipated to gain traction from the rising number of stringent rules and regulations put forward by the governments of various countries on mining waste disposal, as well as mining operations. This information is given by Fortune Business Insights™ in a new study, titled, “Mining Waste Management Market Size, Share & Industry Analysis, By Source (Surface Mining and Underground Mining), By Waste Type (Solid Waste {Waste Rock, Tailings, Others} and Liquid Waste), By Commodity (Mineral Fuels, Iron, Ferro Alloys, Industrial Minerals and Others) and Regional Forecast, 2020-2027.” The study further mentions that the mining waste management market size was USD 164.16 billion tons in 2019 and is projected to reach USD 203.91 billion tons by 2027, thereby exhibiting a CAGR of 2.9% during the forecast period.

Drivers & Restraints-

Rising Usage of Various Co-disposal Techniques to Augment Growth

Several enterprises nowadays are adopting the co-disposal technique to manage mine waste. In this technique, fine tailings and waste rocks are blended and disposed together. It helps in refining the chemical and physical stability of the mining waste. There are several techniques of co-disposal that are designed by keeping in mind the degree of placement and mixing methods. It has many benefits, unlike the separate or traditional disposal methods. For this, the construction of tailing dams is not required. Hence, it reduces maintenance cost and saves space. Such techniques also aid in simplifying waste water management and water consumption. They also have a lower impact on the environment. These factors are expected to drive the mining waste management market growth in the coming years.

However, the COVID-19 pandemic is expected to decline the market growth in 2020 owing to the shortage of laborers and lower demand for minerals. Besides, some of the mine wastes are hazardous in nature. For disposing them, more safety equipment and highly skipped manpower are needed. This further surges the operating cost. It would also contribute to the slow growth of the market.

Segment-

Mineral Fuels Segment to Lead Stoked by Rapid Industrialization

In terms of commodity, the market is fragmented into industrial minerals, iron, Ferro alloys, mineral fuels, and others. Amongst these, the mineral fuels segment held 84.1% mining waste management market share in 2019. Such fuels include natural gas, uranium, lignite, coal, and other petroleum products. The demand for these fuels is increasing at a fast pace on account of rapid industrialization worldwide. To meet the ever-increasing need of energy, new sites are being explored and mineral fuels are mined effectively. It is, in turn, generating large amounts of waste and hence, there is a high demand for mining waste management systems. These factors are set to contribute to the growth of this segment.

Gain More Insights into Ready-Mix Concrete Industry Research Report: https://www.fortunebusinessinsights.com/industry-reports/mining-waste-management-market-101369

Fortune Business Insights™ provides a list of all the organizations providing mining waste management systems in the global market. They are as follows:

- Enviro-Serve Inc. (South Africa)

- Hatch Ltd. (Canada)

- Veolia Environment S.A. (France)

- Tetronics International (UK)

- Golder Associates Inc. (Canada)

- John Wood Group PLC (UK)

- Ramboll Group (Denmark)

- Tetra Tech, Inc. (USA)

- Ausenco (Australia)

- Seche Environment Company (France)

- Cleanway Environmental Services (Australia)

- Aevitas (Canada)

Regional Analysis-

Asia Pacific to Dominate Fueled by Major Contribution of China

In terms of region, North America procured USD 22.99 billion tons revenue in 2019. This growth is attributable to the major contribution of the U.S. The country is considered to experience high demand for mining waste management systems. Asia Pacific is anticipated to remain in the dominant position throughout the forthcoming years owing to the presence of a large number of mines in China. Europe will stand in the second position backed by the contribution of Russia. The country houses several coal mines.