views

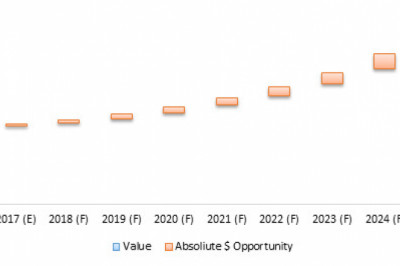

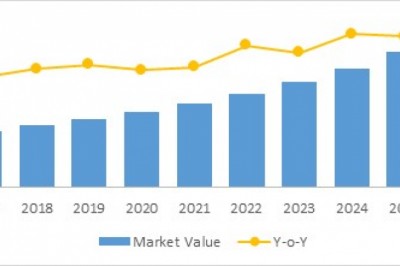

The India P2P lending Market size is forecast to reach $10.5 billion by 2026, after growing at a CAGR of 21.6% during the forecast period 2021-2026. The Peer to Peer Lending Market growth is attributed to increasing transparency in P2P lending with technologies such as block chain and smart contracts being incorporated into lending platforms. The Indian Government’s enthusiastic promotion of cashless technologies has also managed to restructure the financial sector, disrupting the long-held monopoly of traditional institutions like banks Platform-based lending will invariably gain huge momentum over the forecast period. P2P lending is a unique model as it is predominantly an online business in which individual and institutional investors provide funding to people seeking loans. P2P lending is gaining market growth from the risk-averse investor’s standpoint due to the fact that this business has progressed governing this type of social lending.

India P2P Lending Market Segment Analysis - By Operation Pattern

Online P2P lending is anticipated to hold majority of share in the P2P lending market with 97% share in 2020. The digital operations for P2P lending platforms ensure that the overhead costs required for maintaining and staffing a physical establishment are circumvented. This benefit can be passed onto the borrower in the form of lower interest rates and processing charges. Additionally, the online lending platforms ensure relatively faster loan processing than the traditional loan platforms due to minimal paperwork involved. The growth in the fin-tech credit activity around the world gives an implication of the growth lending on e-platforms. According to the Cambridge Centre for Alternative Finance, the Fintech Credit globally has increased to $364 billion in 2019 compared to $11 billion in 2013.

Request for Sample Report @ https://www.industryarc.com/pdfdownload.php?id=19467

Report Price: $ 4500 (Single User License)

India P2P Lending Market Segment Analysis - By Application

The real estate application is expected to witness the fastest growth at a CAGR of 25.7% during the forecast period 2021-2026. The real estate industry is looking at Peer to Peer lending as the best alternative to traditional financial institutions. Real estate projects often require large amounts of investment which makes it difficult for real estate developers to acquire loans from financial institutions. This is a major reason driving developers to opt for P2P social lending platforms. Additionally, restricting credit regulations in banks and other financial institutions is anticipated to benefit the growth of the market, as the demand from the SMEs and consumer credit front increases.

India P2P Lending Market Drivers

Demand from SMEs and consumer credits

P2P lending is seeing increased demand from small and medium businesses and consumer credits due to strict credit policies followed by banks. This is driving customers to turn to P2P social lending platforms that have relatively faster credit approvals. According to statistics from the Peer to Peer Finance Association (P2PFA), the net lending flow to small and medium enterprises on P2P platforms has seen significant growth compared to net lending by major high street banks. In Q4 2019, in India, net lending to SMEs was recorded at over $105m, while the high street banks lent around $80m.

Block chain based P2P Lending

Block chain technology eliminates intermediaries from Peer to Peer lending process. Hence, adoption of block chain in P2P lending will make the entire process transparent and reliable for both lenders and borrowers. The increased transparency is expected to help the declining market in China, which is severely dented by fraudulent activities, and weakened investor and borrower sentiments. Hong Kong-based Alchemy Coin is a block chain-based P2P lending market place that facilitates instant and direct lending between borrowers and lenders by leveraging block chain and smart contracts.

Download Sample Report @ https://www.industryarc.com/pdfdownload.php?id=19467

India P2P Lending Market Challenges

Competition from the big tech firms

P2P lending, along with the other forms of lending models is facing severe threat of disruption with the arrival of big technology firms in the lending sector. Players such as Amazon with large retail customer base have entered into the lending market place by partnering with various existent lenders. Similar to Amazon, Google and Facebook have also ventured into financial lending. Huge financial muscle coupled with technical expertise and firsthand experience of handling large customer bases give these multinational tech firms a great advantage in financial services market. In September 2018, Google has partnered with four Indian banks for availing digital loans. Such trends are anticipated to threaten the the P2P leading market, due to digitalization of traditional lending platforms.

India P2P Lending Market Landscape

Partnerships and acquisitions along with product developments and up gradation are the key strategies adopted by players in the P2P Lending Market. The major players in the P2P Lending Market include Faircent, RupeeCircle, i2iFunding, Lendbox, Paisa Dukan, OMLP2P, i-Lend, LenDenClub Cash Kumar and Kiva Micro funds among others.

Partnerships/Mergers/Acquisitions

In May 2020, Faircent.com to facilitate loans in COVID-19 low impact Green Zones to capitalize on the underserved market.

In January 2019, the U.S. based investment firm Matrix Partners invested over $1.7m into Liquiloans, a P2P lending platform based in India. The company plans to use the fundraising for establishing themselves as a brand and build credibility.

Key Takeaways

The India P2P Lending market is analyzed as fragmented as the relatively new market, RBI regulations and lack of significant investment as compared to global market limits the growth of players.

Online Peer to Peer lending holds majority of market share in the global P2P lending market, owing to advantages such as faster loan approvals and disbursals. Additionally, the operational costs involved in physical establishments is one of the reasons for P2P companies to operate in offline pattern. Regulations surrounding offline lending in India limit the market.

Related Reports :

A. P2P Lending Market

https://www.industryarc.com/Report/19177/P2P-Lending-Market

B. Digital Lending Platform Market

https://www.industryarc.com/Research/Digital-Lending-Platform-Market-Research-505497

For more Information and Communications Technology Market reports, please click here

About IndustryARC: IndustryARC primarily focuses on Cutting Edge Technologies and Newer Applications market research. Our Custom Research Services are designed to provide insights on the constant flux in the global supply-demand gap of markets. Our strong team of analysts enables us to meet the client research needs at a rapid speed, with a variety of options for your business. Any other custom requirements can be discussed with our team, drop an e-mail to sales@industryarc.com to discuss more about our consulting services.