views

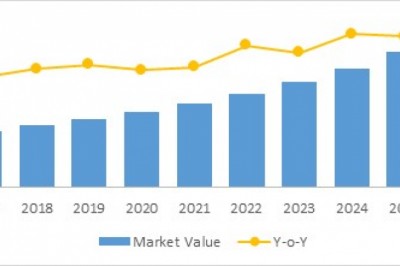

Life insurance in India has been a choice, not a necessity for a long time. The perception that life insurance is difficult to understand and being unawareness of what it does for a person has been a key hindrance for Indians to benefit from life insurance policies. However, the outbreak of COVID-19 has reduced these deterrents to a great extent. People have now begun to understand the need for life insurance as they have realized that unforeseen events can disrupt lives. As per the IRDAI report, during the year 2018, India’s share in the worldwide insurance market was only 2.61%. But these days, there is a shift as consumers combat the challenges that coronavirus has brought forth.

If you want to learn how to buy the best life insurance policies in India in 2022

, this post is worth a read. The first thing you can generally do is compare prices. Yes, the price could be as important as having a life insurance plan. However, giving too much importance to the price is only reasonable when you do not compromise with the financial security of your family.

Uncover these five important features to choose the best life insurance plan in 2022. This will make sure your family will not suffer in future.

Choosing the Best Life Insurance Policy

Selecting a policy that is suitable for your requirement is very important. The policy you choose should change depending on your life stage. Some insurance policies help you save for the future. There are some plans for children, secure parents or your own retirement.

Find a Reliable Insurance Company

The most convenient way to buy a life insurance policy is through an insurance company or aggregator. Professionals working with aggregators are well-versed with new financial tools. They can help you enhance your policy buying process. Find a popular insurance provider to buy your policy. It is good to contact more than one agent or company to get quotes on different policies.

Due to the outbreak of the coronavirus pandemic, insurance companies are developing nuanced digital services for customers. So learning about different policies online is easy for you. You will understand the pros and cons of the policy in detail and take ownership of the terms and conditions. IRDAI suggests selecting the policy coverage based on the number of dependents, the kind of lifestyle you want your family to spend, the amount required for your children’s education, your investment needs.

Compare Different Policies

If you want to purchase term insurance with the help of an agent, then make sure the agent is an IRDAI license holder. Consult an advisor who can assist you in understanding complete details of what you are buying – such as inclusions, exclusions, riders. Compare different insurance policies online with the help of aggregators available online.

An insurance aggregator is a group of independent firms that band together to combine premiums. It gives its members the scale and benefits that are generally only available to the largest agencies

Check Claim Settlement Ratio

Once you have decided to buy a particular plan, check the claim settlement ratio (CSR) of the insurance company. A CSR is the percentage of the insurance claims that have been fulfilled by the insurer compared to the number of claims they received. If your insurance provider has a high CSR, it means you can make a successful claim. Also, make sure the company settles claims on time before finalizing your policy.

Look for Riders

Check your plan to confirm if the insurer is offering riders to increase the scope of your insurance plan. With this, you will enjoy a higher level of protection. Also, look for extra benefits, such as:

- Waiver of premium

- Accidental death benefit

- Income benefit

- Permanent or partial disability rider

Check Documentation

Before buying life insurance, assess all documentation, such as the prospectus or policy brochure. Know what is covered and what is not under the plan. Understand the terms and conditions of a claim settlement.

Solvency Ratio

This is a type of ratio that tells you whether the insurance company you are deciding to choose is able to financially settle your claim in case of needs. According to IRDAI, every insurance company must maintain a solvency ratio of at least 1.5.

In the event of a natural disaster, life insurance will receive multiple claims in a short period and the company needs to settle them quickly. In such cases, the solvency ratio comes into the picture. The financial security of your family depends on how stable your insurer is when it comes to financial stability.

Critical Illness Cover

Critical illnesses include Cancer, Kidney failure, Bypass Surgery, Heart Attack, Heart Valve Surgery, Major Organ Transplantation and more. Treatment of these diseases can cost a lot of money. Insurance with critical illness coverage benefits cover the high cost of treatment and make sure your family has enough money to sustain their normal day-to-day life

Premium Cost

Consider the premium costs of the life insurance policy you want to buy. However, while deciding the premium amount, make certain you do not compromise on any of the points mentioned above just because of cost. In case cost is a prime area of concern for you, opt for a money payment option. Set that the premiums are auto-debited. This way, you will not have to pay the premiums every month manually.

Last but not least, do understand the complex insurance words. Go through policy details. Understand whether it is a single premium or regular premium policy. Know the premium payment frequency and how you can pay the premium. In addition, let your beneficiaries know about the policy benefits in case they need to make claim. Communicate the policy details and what claims can be made in case of requirements.

Your beneficiaries should know about your life insurance policy in case they need to make a claim. Communicate with them the details of your policy and what claims can be made.