views

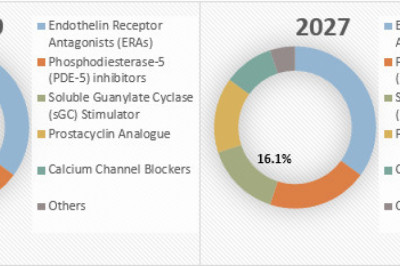

The High Performance Composites Market size is estimated to reach US$46.8 billion by 2027, after growing at a CAGR of 5.8% during the forecast period 2022-2027. The high performance composites (HPC) are prepared using metal matrix composites with high performance fibers including carbon fiber, glass fiber, etc and thermoset and thermoplastics resin. The high performance composites have flourishing demand in the aerospace industry due to rapid utilization in corrosion protection coatings, composite laminate, aircraft components and advanced features such as lightweight body, shape stability and damage resistance, thereby acting as a driving factor in the high performance composites market. In addition, the growing demand for high performance composites in concrete, cultured marble and others for the construction sector is also propelling the growth in high performance composite industry. The covid-19 pandemic created a major disruption in the high performance composites market due to production halt, closure of construction sites, logistics restrictions, demand and supply chain disruption and other lockdown restrictions. However, significant recovery in major end-use sectors such as aerospace, automotive, electronics and others are boosting the demand for high performance composites. Thus, the high performance composites industry is anticipated to grow rapidly and contribute to the high performance composites market size during the forecast period.

High Performance Composites Market Report Coverage

The “High Performance Composites Market Report – Forecast (2022-2027)” by IndustryARC, covers an in-depth analysis of the following segments in the High Performance Composites Industry.

Key Takeaways

- North America dominates the High Performance Composites Market owing to growth factors such as the growing aerospace sector, rising air traffic, rapid automotive production and urbanization, thereby boosting growth in this region.

- The flourishing aerospace industry across the world is propelling the demand for high performance composites for various applications in composite laminate, rotor blades, wings, seats and others, thereby contributing to the growth in the high performance composites market size.

- The demand for fibers, a major component in metal matrix composite is high owing to superior features such as lightweight features, tensile strength and durability, which boosts its applicability across major industries in the high performance composites industry.

- However, the high costs of high performance composites hamper the growth and act as a challenging factor in the high performance composites industry.

Figure: North America High Performance Composites Market Revenue, 2021-2027 (US$ Billion)

For More Details on This Report - Request for Sample

High Performance Composites Market Segment Analysis – by Material Type

The fiber segment held a significant High Performance Composites Market share in 2021 and is forecasted to grow at a CAGR of 5.9% during the forecast period 2022-2027. Fiber has a dominant share in the high performance composites industry owing to its superior features such as lightweight, durability, strength and thermal conductivity. The fibers are a crucial component in metal matrix composites. The fibers such as carbon fiber, glass fiber and others have high growth prospects over the resins due to advantages such as fabrication flexibility, resistance and strength. Moreover, the S-glass fiber composite is growing rapidly and has significant applications in major end-use industries including aerospace, automotive, construction and electronics. With superior properties and demand across major industries, the fiber material type segment is anticipated to grow significantly during the forecast period.

High Performance Composites Market Segment Analysis – by End-Use Industry

The aerospace segment held a significant High Performance Composites Market share in 2021 and is forecasted to grow at a CAGR of 6.3% during the forecast period 2022-2027. The high performance composites have major demand in the aerospace industry for a wide range of applications in aircraft components including blades, gears, bulkheads, composite laminate and others owing to superior properties such as corrosion resistance, durability and weight reduction and others. The aerospace industry is exponentially flourishing owing to growth factors such as rising air traffic, increasing production for aircraft and urbanization. For instance, according to the India Brand Equity Foundation (IBEF), the aerospace & defense sector in India is estimated to reach US$70 billion by the year 2030. According to Boeing, the airline sector is estimated to demand more than 44,000 new commercial airplanes, worth US$6.8 trillion by the year 2038. With the rapid increase in aircraft deliverables and production, the applications of high performance composites in aircraft are anticipated to rise, which, in turn, is projected to boost the growth scope for the aerospace industry in the high performance composites market during the forecast period.

High Performance Composites Market Segment Analysis – by Geography

North America held the largest High Performance Composites Market share in 2021 up to 41%. The robust and lucrative growth for high performance composites (HPC) in this region is influenced by the established base for major end-use industries, including aerospace, automotive and others, along with rising income and rapid urbanization. The aerospace industry is significantly growing in North America owing to growth factors such as robust aircraft manufacturing, rising air travel and demand for military aircraft with lightweight features. For instance, according to the Boeing Commercial Market Outlook 2021-2040, North America will demand 9,160 new airplane deliveries by the end of 2040. Moreover, the airline fleet growth is expected to be 1.7% between 2019 and 2040 in North America. According to the International Air Transport Association (IATA), the revenue for commercial airlines in North America is estimated to grow by 1.9% in 2022 over the previous years. With the increasing aerospace production and growing air traffic, the demand for high performance composites in aircraft for superior strength, lightweight body, shape stability and corrosion protection coatings is growing, which, in turn, is anticipated to boost the growth scope for high performance composites in North America during the forecast period.

High Performance Composites Market Drivers

Bolstering Growth of Automotive Industry:

The high-performance composite has flourishing applications in the automotive sector for the vehicle body, battery housing, cooling water pumps and others. The automotive sector is significantly growing owing to growth factors such as demand for fuel-efficient vehicles, vehicle electrification, rising production trends and urbanization. For instance, according to the International Organization of Motor Vehicles Manufacturers (OICA), the production of passenger cars increased from 55834456 units in 2020 to 57054295 units in 2021. According to the European Automobile Manufacturer Association, South America car production grew by 11% while US car production grew by 3.1% in 2021. According to the India Brand Equity Foundation (IBEF), the automotive industry in India is expected to reach US$ 251.4-282.8 billion by the year 2026. With the increasing automotive vehicle production and consumption, the applicability of high-performance composites in vehicle components, exhaust systems and others is growing, which, in turn, is boosting its demand and driving the high performance composites industry.

Flourishing Growth of Building & Construction Sector:

The high performance composites are majorly used in the building & construction sector for a wide range of applications in concrete, cultured marble and others. This is due to their superior properties such as high tensile strength, weight reduction and durability. The construction sector is rapidly growing owing to growth factors such as rising infrastructural development, rapid growing residential housing plans and urbanization. For instance, according to the National Investment Promotion & Facilitation Agency, the construction industry in India is expected to reach US$ 1.4 trillion by 2025. According to Oxford Economics, the global construction output in 2020 accounted for US$ 10.7 trillion and is projected to grow by 42% to reach USD 15.2 trillion between 2020 and 2030. With the increase in building and construction activities, the applicability of high performance composites is rising in concrete, cement structures and others, owing to their lightweight and low costs, which, in turn, is boosting its demand and driving the high performance composites industry.

High Performance Composites Market Challenges

High Costs and Non-biodegradability:

The costs associated with the high performance composite are high due to the rise in manufacturing cost, R&D expenses and advanced production affects the growth prospects in the industry. The costs of standardization and maintenance technology restrict the applicability and demand in the market. Moreover, the fiber metal matrix composite is non-biodegradable and poses a major waste accumulation and environmental threat due to no decomposition. The problem of non-biodegradability of fiber composites such as ceramic, carbon, glass and others thereby leads to a slowdown due to various regulations and policies. Thus, owing to such growth-restraining factors, the high performance composites industry is anticipated to face growth challenges.

High Performance Composites Industry Outlook

Technology launches, acquisitions and R&D activities are key strategies adopted by players in the High Performance Composites Market. The 10 companies in the High Performance Composites Market are:

- Toray Industries Inc.

- Solvay S.A.

- TPI Composites

- BASF SE

- Teijin Limited

- Owens Corning Corporation

- Albany International Corporation

- DuPont

- Hexcel Corporation

- Huntsman International LLC

Recent Developments

- In December 2021, MBCC Group acquired the Nautec Group, a manufacturer of ultra-high performance concrete and cement composites for repair, marine and wind turbines, thereby providing effective solutions and fulfilling customer satisfaction in the market.

- In November 2021, Hexcel Corporation partnered with Fairmat to build the recycled carbon fiber prepreg composite capability from Hexcel European operations for the reuse in composite panels.

- In September 2020, Applied Composites Holdings, LLC acquired Alliance Spacesystems, LLC, a leader in high performance composite structures, thereby the product line for applications in automotive and aerospace and achieving major growth.

Relevant Reports

Report Code: CMR 0224

Report Code: CMR 0647

Report Code: CMR 27240

For more Chemicals and Materials Market reports, please click here