views

Global Real Time Payment Market was valued US$5.86 Bn in 2019 and is estimated to reach US$XX Bn by 2026 at a CAGR of XX %.

The report includes the analysis of impact of COVID-19 lock-down on the revenue of market leaders, followers, and disrupters. Since lock down was implemented differently in different regions and countries, impact of same is also different by regions and segments. The report has covered the current short term and long term impact on the market, same will help decision makers to prepare the outline for short term and long term strategies for companies by region.

To know about the Research Methodology:-Request Free Sample Report

Technology has created an immediate business environment. In context, the payment industry has decreased and instant payment plans are now being implemented all over the world. For customers' demand to transfer funds from one account to another, definitely, convenient and at a lower price, the immediate payment is an encouragement to the banking industry and the new methods of business with great benefits to the community.

With the rise of the Internet, real time payment systems have been widely used, which are quick, global and responsive. Real time core processing of transactions requires substantial upgrades from a batch-processing model. At the same time, restrain is the banks need to make sure that pressure to provide real-time banking services does not mean compromising on security and confidentiality.

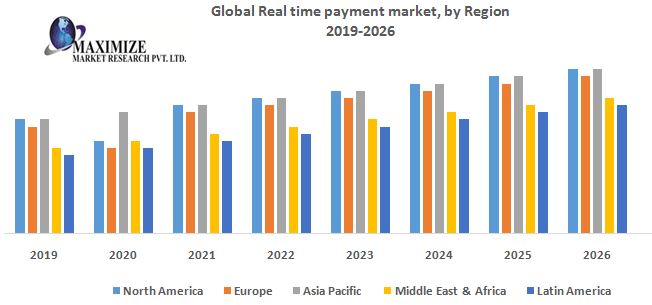

Real time payment market is segmented by Type, by Component, by Enterprise & by Region. Based on type, market is divided into 24*7*365, Bank operation hours. Component is classify into Solution & Service. Enterprise size is spilt into SMEs (Small & Medium enterprise size) & large enterprise size. Region wise the market is divided into North America, Europe, Asia Pacific, Middle East & Africa and Latin America.

On the basis of Type, 24*7*365 real time payment system is widely used. 24*7*365 is also called instant payments or real time payments or immediate payments are defined by the Euro Retail Payments Board (ERPB) as electronic retail payment solutions that are available 24*7*365. Result in the immediate or close-to-immediate interbank clearing of the transaction and crediting of the payee’s account with confirmation to the payer (within seconds of payment initiation). Additionally to meeting the above requirements and expectations, immediate liabilities have generated interest from regulatory, competing authorities and payment service providers. Regulators believe that immediate payments can access banking services, support economic growth, provide options to the Visa / MasterCard Network and reduce cash and check usage

Based on components, services segment is expected to grow at a higher CAGR of XX % during the forecast period. The utilization of real time payments solutions is increasing; this has resulted in the growing demand for real time payments services. Services segment is divided into professional services and managed services. Managed services segment is widely used. Whereas the professional services segment is expected to be a XX % of contributor to the market size. Growing demand for real time payments solutions has resulted in the increasing demand for professional and managed services.

In terms of region, Asia pacific region is dominating the real time payment market. Growth rate can be attributed to various factors, including the adoption of advanced technologies, economic developments, increasing rate of digitalization, and high investments by real time payments solution and service providers. The driving forces for the growth of the market in this region include the huge population in Asia pacific region that contributes to the volume of transactions, and the domestic and international enterprises that are investing in this region.

The objective of the report is to present comprehensive analysis of Global Real Time Payment Market including all the stakeholders of the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of industry with dedicated study of key players that includes market leaders, followers and new entrants by region. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors by region on the market have been presented in the report.

External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give clear futuristic view of the industry to the decision makers. The report also helps in understanding Global Real Time Payment Market dynamics, structure by analyzing the market segments, and project the Global Real Time Payment Market size. Clear representation of competitive analysis of key players by Global Real Time Payment Market Type, price, financial position, product portfolio, growth strategies, and regional presence in the Global Real Time Payment Market make the report investor’s guide.

For More Information Visit :https://www.maximizemarketresearch.com/market-report/global-real-time-payment-market/18481/

Scope of the Report for Global Real time payment Market: Inquire before buying

Global Real time payment market, by Type

• 24*7*365

• Bank operating time

Global Real time payment market, by Component

• Solution

• Service

Global Real time payment market, by Enterprise size

• SEMs

• Large Enterprises

Global Real time payment market, by Region

• North America

• Europe

• Asia Pacific

• Middle East & Africa

• Latin America

Key Players Analysed in Global Real time payment market

• ACI Worldwide

• FIS, Fiserv

• Mastercard

• Worldline

• PayPal

• Visa, Apple

• Ant Financial

• INTELLIGENT PAYMENTS

• Tmenos

• Wirecard

• Global Payments

• Capgemini

• IntegraPay

• SIA

• Obopay

• Ripple

• Pelican

• Finastra

• Nets

• FSS

• Montran

• REPAY

• iCon Solutions.

This Report Is Submitted By : Maximize Market Research Company

Customization of the report:

Maximize Market Research provides free personalized of reports as per your demand. This report can be personalized to meet your requirements. Get in touch with us and our sales team will guarantee provide you to get a report that suits your necessities.

About Maximize Market Research:

Maximize Market Research provides B2B and B2C research on 20,000 high growth emerging opportunities & technologies as well as threats to the companies across the Healthcare, Pharmaceuticals, Electronics & Communications, Internet of Things, Food and Beverages, Aerospace and Defense and other manufacturing sectors.