views

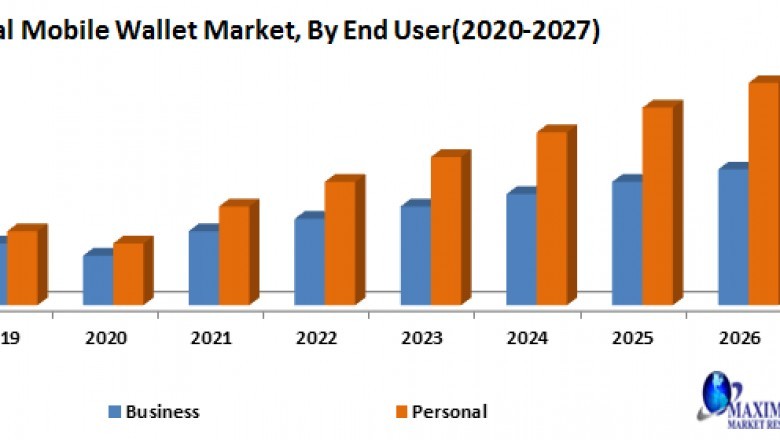

Global Mobile Wallet Market was valued US$ XX Bn in 2019 and is expected to reach US$ XX Bn by 2027, at a CAGR of 27.50 % during a forecast period.

Global Mobile Wallet Market

To know about the Research Methodology :- Request Free Sample Report

The report study has analyzed revenue impact of the COVID-19 pandemic on the sales revenue of the market leader, market followers and market disrupters in the report and same is reflected in our analysis.

The smart phones are becoming the dominant internet access tool across the globe, replacing desktop and laptop computers. The digital wallet is the engine of mobile commerce and also offers an evolutionary path to reduce friction in the transaction and optimize customer satisfaction.

Global Mobile Wallet Market, Dynamics:

An integration of widespread internet access, increased bandwidth & devices, which can capitalize to deliver a new customer experience are some of the prominent factors behind the explosion in wallet development and customer usage. Mobile and digital wallets offers financial institutions with opportunities to increase the customer relationships, enhance customer retention, and protect their customers from fraud.

Despite the lot of benefits offers by mobile wallet, financial institutions are facing problem from alternative payment providers, which are using their payment solutions to upend the current customer and member base. An implementation of policy on strengthening internet security from protection against online fraud and cyber fraud is one of the challenges in the global mobile wallet market.

How the customers can engage more through mobile wallet marketing:

Mainstream mobile wallets offer coupons and loyalty cards. Many service providers have to take the initiative and work with wallet players and mobile specialists like Veoo to create innovative ways to engage customers. It will enable marketers to test information technologies and innovations. They are focusing on the use mobile wallets to increase cross-border travel and shopping experiences. Retailers, airports, hotels, restaurants, duty-free stores, and resorts already have in partnerships to use mobile wallet features like location-based offerings, and real-time tax rebates to increase their engagement. The tactics and agile strategies are expected to empower the UK and US players like Apple and PayPal to morph their mobile wallets into robust customer engagement platforms.

Global Mobile Wallet Market, Regional Analysis:

The global digital wallet world is segmented by geographic lines based on the comparative sophistication of the payment ecosystem in different markets. The developed markets such as North America and Europe are moving to NFC and in-app capabilities, which can be supported by the availability of 4G mobile bandwidths and sophisticated retail point of scale service. In the developing countries like China and India, the mobile wallet is generally used online to shop on marketplaces like Alipay, Tenpay, and Paytm.

In the case of Africa, a less than a quarter of its population have a bank account, but more than 80% population have its own a mobile. The business mobile payments are becoming most attractive markets across the globe. In the current market scenario in the Kenya, despite the more than 22% of the population has a bank account, the 12 million people (29% of all population) send money through M-Pesa (swahili for money) that is expected to boost the adoption of the mobile wallet.

Global Mobile Wallet Market, Competitive Analysis:

Banks, mobile network operators (MNOs), merchants, and third-party providers are all competing in the financial fast-evolving space. Mobile wallets are expected to gain traction during the forecast period by efforts of the players across the ecosystem. NFC penetration in merchant POS terminals and the leading mobile device manufacturers’ integration of NFC functionality are expected to drive the market growth. An introduction of NFC-enabled mobile wallets is creating the opportunity for ubiquitous payment capabilities across merchants, closed-loop payment platforms. However, the chinese digital companies like Alipay and WeChat have started to form rich customer engagement platforms from their mobile wallets. These platforms present reach and opportunities for marketers to make use of mobile moments to serve their customers. Alipay and WeChat have violently added sophisticated engagement features to mobile wallets.

The objective of the report is to present a comprehensive analysis of the Global Mobile Wallet Market including all the stakeholders of the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that includes market leaders, followers and new entrants by region. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors by region on the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers.

The report also helps in understanding Global Mobile Wallet Market dynamics, structure by analyzing the market segments and projects the Global Mobile Wallet Market size. Clear representation of competitive analysis of key players by Application, price, financial position, Product portfolio, growth strategies, and regional presence in the Global Mobile Wallet Market make the report investor’s guide.

For More Information Visit :https://www.maximizemarketresearch.com/market-report/global-mobile-wallet-market/61198/

Scope of the Global Mobile Wallet Market: Inquire before buying

Global Mobile Wallet Market, By Type

• Proximity

• Remote

Global Mobile Wallet Market, By Technology

• Near Field Communication

• QR Code

• Text based/Short message service

• Digital

Global Mobile Wallet Market, By End User

• Personal

• Business

Global Mobile Wallet Market, By Industry Vertical

• Hospitality & Transportation

• Media & Entertainment

• Retail

• Healthcare

• Energy & utilities

• Telecommunication

• Others

Global Mobile Wallet Market, By Region

• North America

• Europe

• Asia Pacific

• Middle East & Africa

• South America

Key players operating in Global Mobile Wallet Market

• Mastercard Incorporated

• PayPal Holdings, Inc.

• Samsung Electronics Co., Ltd

• VISA Inc.

• Amazon Web Services Inc.

• American Express Banking Corp.

• Apple Inc.

• Alipay.com

• AT&T Inc.

• Google Inc.

This Report Is Submitted By : Maximize Market Research Company

Customization of the report:

Maximize Market Research provides free personalized of reports as per your demand. This report can be personalized to meet your requirements. Get in touch with us and our sales team will guarantee provide you to get a report that suits your necessities.

About Maximize Market Research:

Maximize Market Research provides B2B and B2C research on 20,000 high growth emerging opportunities & technologies as well as threats to the companies across the Healthcare, Pharmaceuticals, Electronics & Communications, Internet of Things, Food and Beverages, Aerospace and Defense and other manufacturing sectors.