views

Global Finance Cloud Market was valued at USD xx Bn in 2019 and is expected to reach at USD xx Bn by 2027 at a CAGR of xx% over forecast period 2020-2027.

Global Finance Cloud Market

To know about the Research Methodology :- Request Free Sample Report

The report covers an in depth analysis of COVID 19 pandemic impact on Global Finance Cloud Market by region and on the key players revenue affected till April 2020 and expected short term and long term impact on the market.

Global Finance Cloud Market Dynamics:

A new era of cloud-based technology brings an unprecedented period of disruption and innovation. However, cloud technology is still immature and has many associated risks. Despite this, forward-looking CFOs recognize the shifting dynamics and are increasingly looking to cloud solutions to address a variety of business needs. Various factors such as business agility and focus, rising environmental concerns, increased need for customer management, and deployment of applications via cloud are driving the global finance cloud market over forecast period.

However, factors such as Protection of intellectual property rights (IPR), concern over regulatory compliances, threat of cybercrimes, disaster recovery, intensive rivalry among the players, third-party services are restraining the market growth over forecast period.

Global Finance Cloud Market segmented by Solution, by Service, by Application and by Region. By solution, the security solution held 27.87% of market share in 2019 and is expected to keep its dominance over forecast period due to critical data confidentiality, compliance and legal issues, cloud based security solutions are gaining huge demand in financial sector. Security solution is followed by governance and financial forecasting. In governance solution cloud services capture and visualize financial account information, goals, trusts, business groups, and interactions within and across clients, households, and relationship networks.

By services, managed services is expected to dominate the global market with xx% of market share over forecast period. Many SMEs and Large enterprises are adopting managed services because it is up-to-date on technology, have access to skills and address issues related to cost, quality of service and risk. As the IT infrastructure components of many SMES and large corporations are migrating to the cloud, with MSPs (managed services providers) increasingly facing the challenge of cloud computing a number of MSPs are providing in-house cloud services or acting as brokers with cloud services providers.

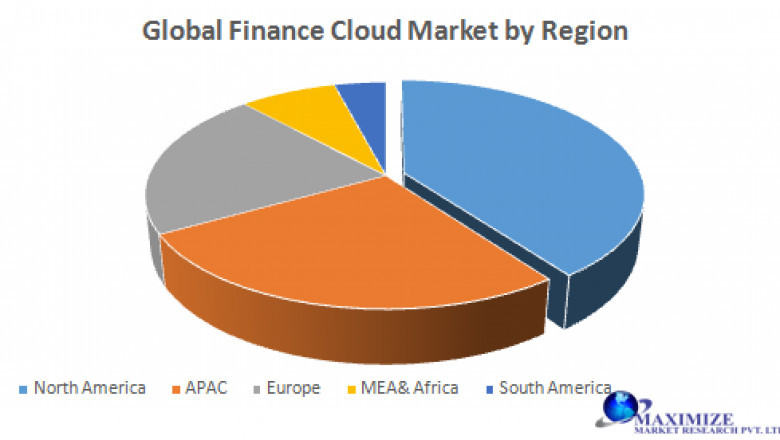

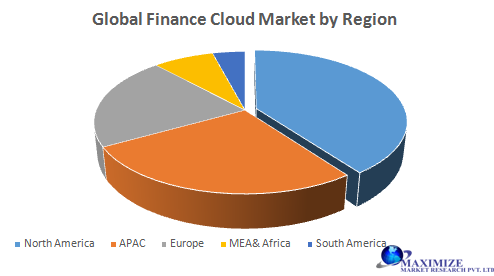

By geography, market is segmented into North America, APAC, Europe, MEA& Africa and South Africa. Among all of these North America held 37.67% of market share in 2019 and is expected to keep its dominance over forecast period owing to presence of major players such as Cisco systems (U.S.), Juniper Networks (U.S.), IBM Corp. (U.S.) and VMware (U.S.) among others. Financial cloud offers various benefits such as it reduces CapEx spending, reduces IT management complexity and improvesdata security due to these benefits the adoption of cloud services in increasing in BFSI services in this region. North America is followed by APAC and Europe.

APAC is expected to hold xx% of market share over forecast period. Financial Institutions across China, India, South Korea, Japan, New Zealand and Australia are embracing digital transformations which is expected to drive the market growth in this region. In India, through fintech initiatives, like Jan Dhan Yojana, Aadhaar, and the Unified Payments Interface (UPI), the Government of India is working toward digitizing payment systems and increasing financial inclusion.The New Zealand Government maintains a 'Cloud First' policy through which it seeks to be open to the benefit from the emergent technologies and act as a leader in cloud adoption.

Report covers in depth analysis of key development, value chain analysis, supply chain analysis, marketing strategies and company profiles of market leaders, potential players and new entrants. Some of the key player’s operating in this market are Cisco systems (U.S.), Juniper Networks (U.S.), IBM Corp. (U.S.), NEC Corp. (Japan), VMware (U.S.), Aryaka Networks Inc. (U.S.), Alcatel Lucent (U.S.), and Brocade Communications Systems Inc. (U.S.), AT&T (U.S.), Ciena Corporation (U.S), and Salesforce among others. These key players are adopting various organic and inorganic growth strategies such as merger& acquisitions, collaborations, expansion, joint ventures, strategic alliances, new product launches, patent and diversification to increase their regional presence and business opeartions.

Salesforce is major market players in global finance cloud market. Salesforce Financial Services Cloud provides intelligent insights to help bankers and advisors prioritize their best prospects and take the next best action to acquire new customers. While deepening relationships with existing ones. So advisors and bankers are able to deliver the personalized service that customers expect.

The objective of the report is to present a comprehensive analysis of the Global Finance Cloud Marketincluding all the stakeholders of the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that includes market leaders, followers and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analysed, which will give a clear futuristic view of the industry to the decision-makers.

The report also helps in understanding Global Finance Cloud Market dynamics, structure by analyzing the market segments and project Global Finance Cloud Market. Clear representation of competitive analysis of key players by price, financial position, Product portfolio, growth strategies, and regional presence in the Global Finance Cloud Market make the report investor’s guide.

For More Information Visit :https://www.maximizemarketresearch.com/market-report/global-finance-cloud-market/63314/

Scope of Global Finance Cloud Market: Inquire before buying

Global Finance Cloud Market by Solution

• Financial Forecasting

• Financial Reporting and Analysis

• Security

• Governance, Risk and Compliances

• Others

Global Finance Cloud Market by Service

• Professional Services

• Managed Services

Global Finance Cloud Market by Application

• Revenue Management

• Wealth Management System

• Account Management

• Customer Management

• Others

Global Finance Cloud Market by Deployment Type

• Public Cloud

• Private Cloud

• Hybrid Cloud

Global Finance Cloud Market by Organization Size

• Small and Medium Enterprise (SME)

• Large enterprise

Global Finance Cloud Market by Sub Domain

• Banking and Financial Service

• Insurance

Global Finance Cloud Market by Region

• North America

• Europe

• Middle East and Africa (MEA)

• Asia-Pacific (APAC)

• South America

Global Finance Cloud Market Major Players

• Cisco systems (U.S.)

• Juniper Networks (U.S.)

• IBM Corp. (U.S.)

• NEC Corp. (Japan)

• VMware (U.S.)

• Aryaka Networks Inc. (U.S.)

• Alcatel Lucent (U.S.)

• Brocade Communications Systems Inc. (U.S.)

• AT&T (U.S.)

• Ciena Corporation (U.S).

• Salesforce

• Oracle

• Microsoft

• Amazon

• Unit 4

• Sage Intacct Inc.

This Report Is Submitted By : Maximize Market Research Company

Customization of the report:

Maximize Market Research provides free personalized of reports as per your demand. This report can be personalized to meet your requirements. Get in touch with us and our sales team will guarantee provide you to get a report that suits your necessities.

About Maximize Market Research:

Maximize Market Research provides B2B and B2C research on 20,000 high growth emerging opportunities & technologies as well as threats to the companies across the Healthcare, Pharmaceuticals, Electronics & Communications, Internet of Things, Food and Beverages, Aerospace and Defense and other manufacturing sectors.