views

Financial App Market by Type size, Growth and Analysis - Forecast to 2027 | MRFR

Synopsis of Global Financial App Market

Market Scenario:

A financial service application is a software program that handles, coordinates, and manages the finances of an individual as well as business enterprises. Technology has made a tremendous impact on financial services sector. Increase in smartphones and digital online transactions are the contributing factors for the growth of the financial sector. In the light of these factors, more and more people are being able to avail financial services; from opening a simple bank account to availing a loan. Furthermore, cloud services are also being adopted by financial sector. The integration of cloud services and deployment models in business enterprises, along with functional departments covering financial services are being transformed into cloud. For instance, banking sector is adopting cloud services for core banking solution, lease and lending services, and revenue management & billing cloud services.

With the increasing demand for cloud services in financial sector, the solution providers such as Oracle corporation offers financial services such industry specific SaaS which include Insurance Data Exchange, Insurance Revenue Management & Billing Cloud, and Health Insurance Value Based Payment Cloud Service and others.

Internet of things (IoT) is an emerging trend in banking and financial service sectors. With the increase in adoption rate of connected devices, such as smartphones, banks offer complete and transparent view of individual finances at real time. Banks are able to presume customer requirements with the help of analytical tools, such as BI, to provide necessary assistance to customers in making financial decisions.

Increase in online transactions is expected to increase the risk of cyber-threat, which is expected to hinder the growth of the market through the forecast period. Furthermore, lack of knowledge in operating financial applications through mobile devices could be a major challenging factor for financial application market over the forecast period.

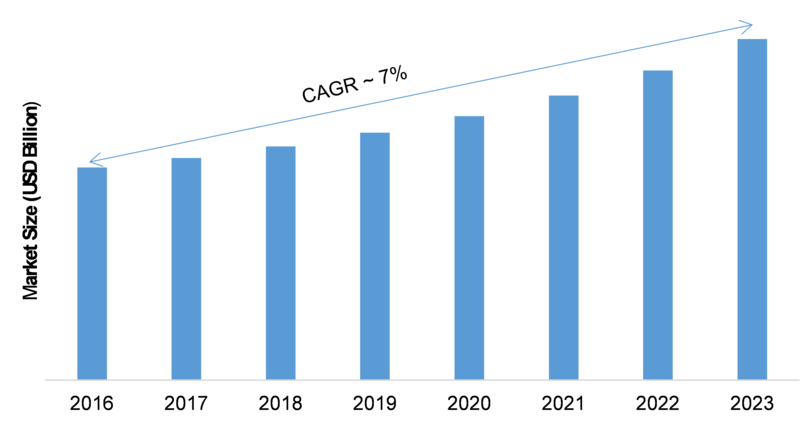

Global Financial App Market, 2017-2023 (USD Billion)

Source: MRFR Analysis

The global Financial App market is expected to reach approximately USD 114.28 billion by 2023 growing at a 7% CAGR through the forecast period of 2017-2023

Key Players

Some of the key players of Financial App market include Accenture Plc (Ireland), FIS Corporation (U.S.), Fiserv Inc (U.S.), IBM Corporation (U.S.), Infosys Ltd (India), Misys (U.K), Oracle Corporation (U.S.), SAP SE (Germany), Tata Consultancy Services Limited (India),and Temenos Group AG (Switzerland)

Segmentation

The Financial App market is segmented into software, services, deployment, organization size, and end-user.

By software, the Financial App market is sub-segmented into audit, risk & compliance management, BI & analytics applications, and customer experience. Based on service, the market is categorized into training & support, consulting service, integration & implementation, operation & maintenance, and others. On the basis of deployment, the market is segmented into on-premises and on-cloud.

Based on organization size, the market is bifurcated into large enterprise and small & medium enterprises. On the basis of end-user, the market is differentiated into retail, government, BFSI, and others.

Regional Analysis

Geographically, the Financial App is segmented into four different regions, namely North America, Asia Pacific, Europe, and Rest of the World.

North America is expected to have a significant growth in the Financial App market, with The U.S. and Canada as the leading countries. This is due to rise in implementation of technologies such as Business Intelligence to facilitate professional services. The United Kingdom, France, and Germany are expected to be the leading countries in the Europe region, owing to increasing awareness regarding mobile applications, which is expected to continue over the next few years. Asia Pacific is also anticipated to be the fastest growing region in the Financial App market through the forecast period, with India, Japan, and China as the leading countries due to increasing number of smartphone users

Target Audience

Frequently Asked Questions (FAQ) :

Increasing digitization in the BFSI industry is expected to boost the expansion of the financial app market in the near future.

As per the analysis, the financial app market is poised to mark 7% CAGR between 20177 and 2023.

The financial app market is poised to earn USD 114.28 Bn by 2023.

The segments of the financial app profiled are audit, BI & analytics applications, customer experience, and risk & compliance management.

Few of the key players assessed are Accenture Plc (Ireland), Fiserv Inc (U.S.), FIS Corporation (U.S.), IBM Corporation (U.S.), Misys (U.K), Infosys Ltd (India), Oracle Corporation (U.S.), Tata Consultancy Services Limited (India), SAP SE (Germany), and Temenos Group AG (Switzerland).

TABLE OF CONTENTS