views

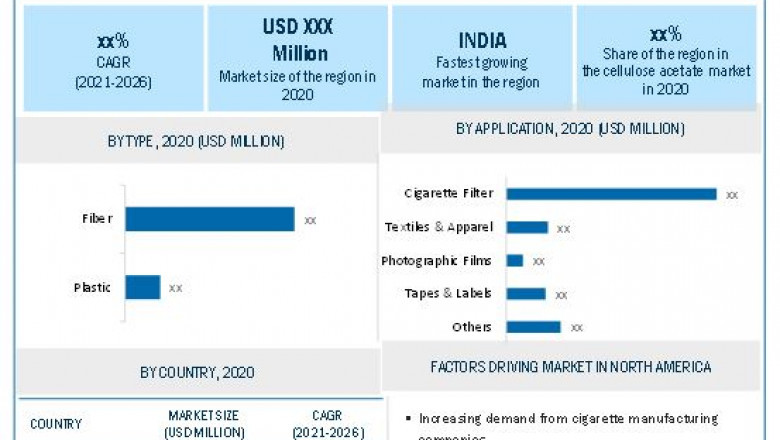

The global cellulose acetate market size is estimated to grow from USD 5.0 billion in 2021 to USD 6.3 billion by 2026 at a compound annual growth rate (CAGR) of 4.7% during the forecast period. The demand for cellulose acetate is increasing from cigarette manufacturing, as cigarette consumption is increasing globally. The excellent filtration properties of cellulose acetate has prevailed as the filter material of choice. Additionally, it also possesses superior biodegradability, which is an advantage if the filters end up in the environment.

Cellulose acetate are mainly used in end-use industries, such as cigarette manufacturing, textiles & apparel, medical, waste-water treatment, etc. The cigarette manufacturing industry is the largest consumer of cellulose acetate. This is because of the major application in cigarette filters. Rising consumption of cigarette in low to middle income countries such as China and India, introduction of longer cigarette filters, and preference for low tar cigarettes is propelling the demand for cellulose acetate. In addition to this, demand for lesser emission of nicotine in the smoke is also accelerating the demand for cellulose acetate in emerging economies. However, the outbreak of COVID-19 has created ripples in the aerospace industry, leading to reduced demand for cellulose acetate. Due to the lockdown scenario in Europe and North America, the demand for cellulose acetate from end-use industries have declined sharply in the first quarter of 2020.

The key players in the market include Eastman chemical Company (US), Solvay, Celanese Corporation (US), Daicel Corporation (Japan), China National Tobacco Corporation (China), Mitsubishi Chemical Holdings (Japan), Sichuan Push Acetati Co. Ltd. (China), Rayonier Advanced Materials Inc. (US), Acordis Cellulosic Fibers Co Ltd (Belgium), Sappi Limited (South Africa).