views

The Automotive Temperature Sensor Market size was valued at $3.6 billion in 2021, estimated to grow at a CAGR of 5.6% during 2022-2027. The shift toward digitalization in automotive electronics has led to the rise of IoT in the sector which has further fueled the growth of Automotive Temperature Sensors. Furthermore, the digital revolution in the sensing industry has enhanced the manufacturers to design and develop new Temperature Sensors that utilize a digital interface with low interface for the automotive sector. In addition, the growing use of Automotive Temperature Sensors in the electric vehicle marketplace is further driving the growth of the Automotive Temperature Sensors market during the forecast period. The rising usage of thermocouples, thermistors and resistance temperature detectors (RTDs) is set to drive market growth. The major growth drivers that impact the Automotive Temperature Sensors market are new technological advancements as well as growing automotive demand.

Report Coverage

The report: “Automotive Temperature Sensor Industry Outlook (2022-2027)”, by IndustryARC, covers an in-depth analysis of the following segments of the Automotive Temperature Sensor Industry.

By Type: Contact, Non-Contact.

By Function: Analog, Digital.

By Product Type: Resistance Temperature Detector (RTD), ICs, Thermistor, Thermostat, Thermocouple Thermometer, Infrared Sensors and Others.

By Fuel Type: Petrol, Diesel, Hybrid, Electric and Others

By Application: HVAC, Engine, Battery, Electric Motor, Exhaust, Fuel System and Others

By Vehicle Type: Passenger Vehicles, LCV, HCV

By Geography: North America (U.S, Canada, Mexico), South America(Brazil, Argentina and others), Europe(Germany, UK, France, Italy, Spain, Russia and Others), APAC(China, Japan India, SK, Aus and Others), and RoW (Middle east and Africa).

Key Takeaways

- In 2021, the Automotive Temperature Sensors market was dominated by Asia Pacific owing to the growth of the automotive manufacturing sector in the countries such as China and India.

- The demand for ADAS Solutions in vehicles is highly enhancing the growth of the Automotive Temperature Sensors market. Moreover, the growing demand for connected vehicles are highly propelling the market’s growth.

- With the increasing demand for internet of things (IoT) powered devices including automotive control systems and connected vehicles are leading to increased focus on temperature sensor adoption thereby expanding the market’s growth.

Automotive Temperature Sensor Market Segment Analysis – By Vehicle Type

Passenger vehicles in the Automotive Temperature Sensor Market held a major share of 67.5% in the vehicle type segment in the year 2021. It is poised to grow significantly driven by the growing demand for passenger vehicles all around the globe. This increasing trend of passenger cars production is anticipated to continue in the coming years, thereby providing significant opportunities to the automotive temperature sensor market. HCVs are also projected to witness significant growth. HCVs are mainly used for the transportation of heavy goods such as construction materials, raw ores and others. Globally, increasing construction projects coupled with growing investments in construction industry is anticipated to enhance the demand for the HCVs, which in turn affects the automotive engine cooling system market growth

Automotive Temperature Sensor Industry Segment Analysis – By Type

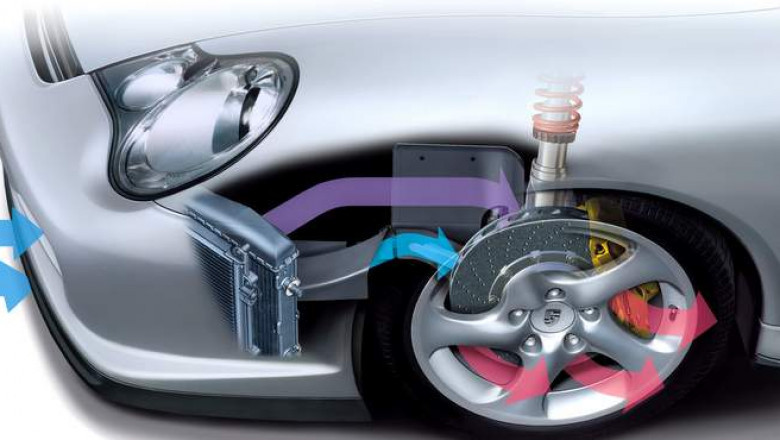

Digital Automotive Temperature Sensors account for a large share of the Automotive Temperature Sensor market size at 69.2% in 2021. Sophisticated safety systems and pervasive electronic systems have affected almost every sector of the automobile operations from engines to seat controls. In doing so, Automotive Temperature Sensors have become an unavoidable component of every automotive vehicle. The rising purchasing power of the millennial population is further resulting in a growing demand for various upgraded vehicles equipped with those sensors, thereby creating a demand influx in the Automotive Temperature Sensor market. Mounted on battery, exhaust pipe, engine, and air duct, the automotive Temperature Sensors such as humidity sensor, infrared sensor, thermocouple, thermistor, Resistance temperature Detector (RTD) and others are used to gauge the temperature measurement of a vehicle. The increasing fuel-efficient technologies combined with growing demand in engine control management is further paving opportunities for the automotive Temperature Sensor market in the upcoming years. With the developing concern for global warming, the stringent governmental laws to decrease CO2 emissions are building, which are equally driving the automotive Temperature Sensor industry. Amidst the global CO2 emission, transportation sector contributes 14%. Therefore, with the evolution and expansion of the automotive Temperature Sensor marketplace, this rising concern can be controlled. Sensirion has got a breakthrough innovation named SCD40, which is a first miniaturized CO2 and RH/T sensor that can be fitted in just one cubic centimeter space and can accelerate environmental sensing expertise by incorporating a best-in-class humidity and Automotive Temperature Sensor. This innovation will create an impact on the environment boosting the automotive Temperature Sensor market across the globe.

Automotive Temperature Sensor Industry Segment Analysis – By Geography

In 2021, Asia Pacific dominated the Automotive Temperature Sensor market size with a share of more than 40.1%, followed by North America and Europe. The countries such as China and India have major automotive manufacturing industries and has fueled the demand for Automotive Temperature Sensors market in this region. The dominance of APAC region in the global Automotive Temperature Sensor Market is attributed to the increasing disposable incomes in the region and the growing population which is, in turn, is increasing the demand for vehicles in the region, following a market recovery post Covid-19. China is the biggest automotive market in the world. In 2021, China recorded sales of 20.1 Million units and accounted for 36% of the passenger vehicle sales worldwide. With a large consumer base, world-class infrastructure and an open investment policy, the US automotive market continue to be a premier market for the automotive industry and this is set to propel the Automotive Temperature sensor industry Outlook.

Automotive Temperature Sensor Market Drivers

Electrification of Vehicles has also created opportunities for the automotive Temperature Sensors

Demand for electric and hybrid vehicles is soaring across the globe, thereby creating an opportunity for the growth of automotive temperature sensors market during the forecast period. Increasing research and development activities in the field of temperature sensors for automobiles and other vehicles coupled with government initiatives has also created opportunities for the rise of automotive engine cooling system market across the world. By electrification of vehicles, efficiency of the engine can be increased and it also limits the CO2 emissions and usage of fossil fuels. Additionally, the government of various counties has taken initiatives for leveraging production and encouraging people to buy electric vehicles. Also, various government subsidiaries' focus on the purchase of electric vehicles, is anticipated to provide prospects for the electric vehicles market, which in turn drives the electric vehicles engine cooling system market growth. The declining battery costs and the increase in battery capacity has led to increase the demand for electric vehicle. This is anticipated to have a major impact on the electric vehicle temperature sensor market growth. Furthermore, technological advancements in the charging stations is anticipated to increase the demand for the electric vehicles, thereby impacting the electric vehicles engine cooling system market growth. Nearly 6.5 million electric vehicles (EVs) were sold worldwide in 2021, up 109% from 2020 and a 195% increase from 2019.

Increasing Demand for IoT

The rising demand for Internet of things (IoT) devices has raised the need for Automotive Temperature Sensors. Moreover, the increasing application of mobile battery-powered IoT applications has driven the need for Automotive Temperature Sensors, as it has very low power consumption, and can be used at any point of time. In addition, the demand for air conditioner equipped with IoT are significantly enhancing the need for advanced Automotive Temperature Sensors for optimizing the room temperature and compressor settings. Thus, the increasing demand for the IoT platforms is majorly driving the demand for the digital sensors market. According to Statista, the install base for IoT devices globally is forecast to amount to 30.9 billion units by 2025, a significant increase from the 13.8 billion units in 2021 which will significantly drive market growth for Automotive Temperature Sensors.

Automotive Temperature Sensor Market Challenges

Design Challenges

The Automotive Temperature Sensors are becoming widely popular, but it is mainly hindered by the process of designing. The designing of the Automotive Temperature Sensors are complex and also requires features such as stability, accuracy and sensitivity. In order to maintain these features Automotive Temperature Sensors are widely dependent on monitoring solution. Thus, this monitoring solution requires highly skilled workforce in order to overcome the designing challenges of the Automotive Temperature Sensors.

Automotive Temperature Sensor Industry Outlook

Technology launches, acquisitions and R&D activities are key strategies adopted by players in the Automotive Temperature Sensor market. In 2021, the market of Automotive Temperature Sensor has been consolidated by the top ten players –

- TI

- Maxim

- Analog

- Microchip

- NXP

- ON Semiconductor

- Measurement Specialties (TE Connectivity)

- Melexis

- IDT

- STMicroelectronics

Recent Developments

- In March 2022, CTS Corporation completed the acquisition of TEWA Temperature Sensors SP. Zo.o. and its subsidiaries for an enterprise value of $24.5 million. TEWA is a reputable designer and manufacturer of high-quality temperature sensors.

- In December 2020, CTS Corporation announced that it has acquired Sensor Scientific, Inc. (SSI), a privately held temperature sensing company.

- In March 2020, TE Connectivity Ltd. has completed its public takeover of sensor technology company First Sensor AG. TE now holds 71.87% shares of First Sensor

Related Reports

Digital Temperature Sensor Market - Forecast(2021 - 2026)

Report Code: AIR 0332

RTD Temperature Sensors Market - Forecast(2021 - 2026)

Report Code: ESR 0613

For more Automotive Market reports, please click here