views

Asia Pacific Digital Banking Platform Market

Asia Pacific Digital Banking Platform Market was valued at USD 745.4 million in 2018 and is expected to reach at USD 2365.21 million by 2026 at a CAGR of 15.53% over forecast period 2019-2026.

To know about the Research Methodology :- Request Free Sample Report

A digital banking platform (DBP) enables a bank to begin the transformational process of becoming a truly digital bank that is ecosystem-centric. A DBP also enables banks to achieve business optimization.

The report study has analyzed revenue impact of covid-19 pandemic on the sales revenue of market leaders, market followers and disrupters in the report and same is reflected in our analysis.

Asia Pacific Digital Banking platform market is mainly driven by increasing number of digital banking users. Across Asia, more than 700 million consumers use digital banking regularly, with a significant portion in developing countries like China and India.

Various applications of Digital Banking Platform such as focus on building a set of digital capabilities that are core to enhancing customer engagement, revenue growth through advanced analytics, end-to-end process digitization, User-centered design to create an outstanding are driving the market over forecast period. The government of various countries are taking initiatives to promote the digital banking. For instance, the Indian government launched Cashless India, Digital India. The Hong Kong Monetary Authority granted eight digital banking licenses in the region in 2019 under its smart banking initiatives. Thus, such government initiatives are expected to drive the growth of digital banking platform market in the region.

However, factors such as cyber security concerns & lack of technological infrastructure and less awareness about digital banking in some countries are restraining the market growth over forecast period.

Trends such as the increasing proliferation of smart devices, easy availability of internet, upcoming wave of 5G, advancement of IoT, and artificial intelligence are expected to lucrative opportunities for market.

Asia Pacific Digital Banking Platform Market Segmentation Analysis:

Asia Pacific Digital Banking Platform Market is segmented by Type, by Deployment Type and by region. By banking types, market is segmented into corporate banking and retail banking. Among these retail banking type segment holds highest 60-65% market share in 2018 and expected to keep its dominance over forecast period. The Retail segment is leading the market owing to the need to meet retail customers elevated expectations of personalization and align these expectations in line with the growing multiplication of channels.

Asia Pacific Digital Banking Platform Market country wise Analysis

By country, market is segmented into China, India, Japan, South Korea, ASEAN and Rest of Asia-Pacific. Among all of these China is holds highest 35-40% market share in 2018 and expected to keep its dominance over forecast period. Factors such as high rate of adoption of new technologies, growing digitization across BFSI sector and rising demand for mobile banking solutions are contributing in the growth of market.

Moreover, China is followed by India. India is expected to grow at fastest xx% CAGR over forecast period. The first bank in India to offer internet banking was the ICICI bank since then a number of other banks have followed suit and today most of the banks provide online banking facilities. Centralized Online Real-time Exchange (CORE) banking in India allowed customers to perform financial transactions and access their account from any of the participating bank’s branches.

Asia Pacific Digital Banking Platform Market Competitive Landscape

Major Key players operating in this market are Appway AG, CREALOGIX Holding AG, EdgeVerve Systems Limited, Fiserv, Inc., Oracle Corporation, SAP SE, Sopra Steria, Tata Consultancy Services Limited (TCS), Temenos Headquarters SA, Intellect Design Arena (India), NETinfo (Cyprus), Kony (US), NF Innova (Austria), and SAB (France). These players holds 80% market share of Asia Pacific Digital Banking Platform Market. By using various growth strategies such as new product launches, strategic alliances, expansion, and joint ventures these players are increasing their business operations and regional presence. For instance, EdgeVerve Systems, a subsidiary of Infosys, launched Finacle Digital Engagement Suite, an advanced Omni channel solution suite that helps banks onboard, sell, service, and engage customers with tailored experiences.

The objective of the report is to present a comprehensive analysis of Asia Pacific Digital Banking Platform Market including all the stakeholders of the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all aspects of the industry with a dedicated study of key players that includes market leaders, followers and new entrants by region. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors by region on the market are presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding Asia Pacific Digital Banking Platform Market dynamics, structure by analyzing the market segments and project the Asia Pacific Digital Banking Platform Market size. Clear representation of competitive analysis of key players by Type, price, financial position, product portfolio, growth strategies, and regional presence in the Asia Pacific Digital Banking Platform Market make the report investor’s guide.

Scope of the Asia Pacific Digital Banking Platform Market: Inquire before buying

Asia-Pacific Digital Banking Platform Market by banking modes

• Online banking

• Retail banking

Asia-Pacific Digital Banking Platform Market by Type

• Corporate Banking

• Retail Banking

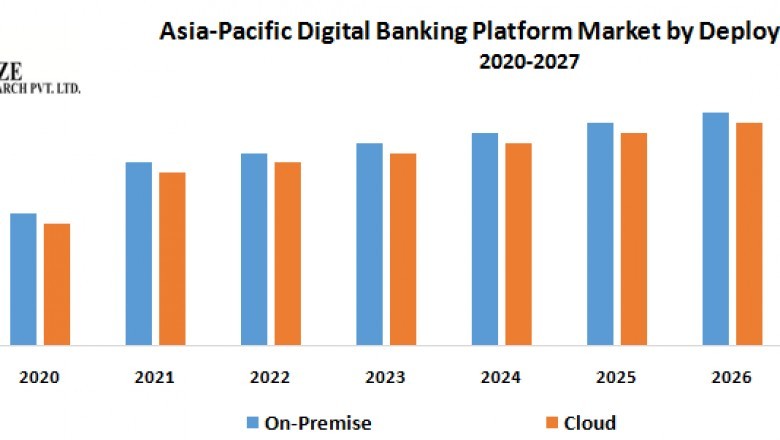

Asia-Pacific Digital Banking Platform Market by Deployment Type

• On-Premise

• Cloud

Asia-Pacific Digital Banking Platform Market by Country

• China

• India

• Japan

• South Korea

• ASEAN

• Rest of Asia-Pacific

Asia-Pacific Digital Banking Platform Market Key Players

• Appway AG

• CREALOGIX Holding AG

• EdgeVerve Systems Limited

• Fiserv, Inc.

• Oracle Corporation

• SAP SE

• Sopra Steria

• Tata Consultancy Services Limited (TCS)

• Temenos Headquarters SA

• Intellect Design Arena (India)

• NETinfo (Cyprus)

• Kony (US)

• NF Innova (Austria)

• SAB (France)

• Worldline SA

• Etronika

• Fidor Solutions AG

• Finastra

• Halcom.com

• ieDigital

For More Information Visit @: https://www.maximizemarketresearch.com/market-report/asia-pacific-digital-banking-platform-market/44572/

This Report Is Submitted By:MaximizeMarket Research Company

Customizationof the report:

MaximizeMarket Research provides free personalized of reports as per your demand. Thisreport can be personalized to meet your requirements. Get in touch with us andour sales team will guarantee provide you to get a report that suits yournecessities.

AboutMaximize Market Research:

MarketResearch provides B2B and B2C research on 20,000 high growth emergingopportunities & technologies as well as threats to the companies across theHealthcare, Pharmaceuticals, Electronics & Communications, Internet ofThings, Food and Beverages, Aerospace and Defense and other Maximize manufacturingsectors.