views

The COVID-19 pandemic has resulted in a tremendous increase in the burden on healthcare organizations across the globe. According to the WHO, as of September 29, 2020, there were 33,249,563 confirmed cases of COVID-19, including 1,000,040 deaths, with the highest number of deaths in the Americas, followed by Europe and Southeast Asia. Furthermore, due to the COVID-19 pandemic, governments across the globe have announced country-wide lockdowns as well as social distancing measures to prevent the collapse of their health systems. Shutdown measures to curb COVID-19, however, resulted in a decrease in the number of orders of biological microscopes during the three months of April–June 2020. This has further negatively impacted the quarterly revenue of leading players operating in this market.

Currently, no effective treatment for COVID-19 is available in the form of vaccines or antiviral drugs, and patients are currently treated symptomatically. According to the WHO, there are 70 vaccine candidates under development, and three candidates are already being tested in human trials. At the forefront of the COVID-19 outbreak, many researchers worldwide are engaged in the viral research of SARS-CoV-2, the virus that causes COVID-19. Live cell imaging systems, including advanced microscopy systems, help researchers investigate cellular behavior during viral research.

Biomedical research requires the analysis of enormous amounts of data to develop vaccines. Therefore, major live cell imaging system providers, such as Leica Microsystems (Germany) and CytoSMART Technologies (Netherlands), have donated live cell imaging systems to assist COVID-19 researchers.

The normalization of the global economy will slowly increase the demand for live cell imaging systems in non-COVID-related research activity labs, leading to market growth from the first quarter of 2021. Furthermore, players operating in the market are altering their strategies, for both long-term and short-term growth, by tapping the research market and developing innovative products to combat the pandemic. On the other hand, even though the impact of COVID-19 on the live cell imaging market is low compared to other medical device markets, timely development and implementation of contingency plans are critical for business operations and, in particular, for key imported raw materials.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=163914483

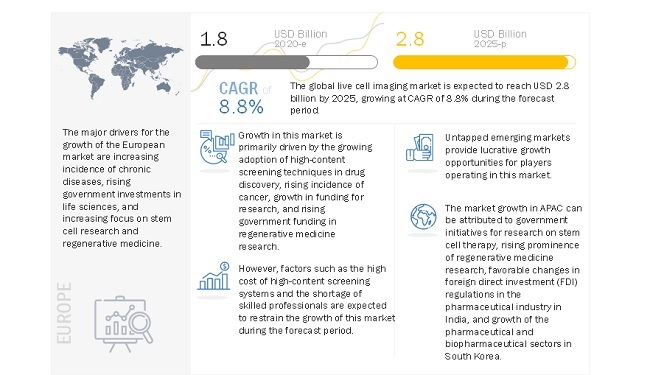

[ 212 Pages Report] The global live cell imaging market size is expected to reach USD 2.8 billion by 2025 from an estimated value of USD 1.8 billion in 2020, growing at a CAGR of 8.8% during the forecast period. growing adoption of high-content screening techniques in drug discovery and rising incidence of cancer primarily drives the market for live cell imaging.

The growth in research funding and rising government funding and investment in regenerative medicine research will also support the market growth in the coming years. However, the high cost of high-content screening systems is limiting the overall adoption of these products.

The traditional method of toxicity and drug safety studies involves the screening of large libraries through high-throughput screening. This method is expensive, has a low success rate, and is resource- and time-consuming. To overcome these challenges, pharmaceutical companies are increasingly adopting high-content screening (HCS) cell-based assays for identifying the effects of toxicity in drug development studies (cell-based imaging enables the monitoring of drug toxicity mechanisms, such as oxidative stress, micronuclei, mitochondrial dysfunction, steatosis, and apoptosis).

The use of HCS makes the drug development process more time- and cost-efficient. Owing to these factors, the adoption of high-content screening for toxicity studies is expected to increase during the forecast period. This, in turn, is expected to drive market growth as live cell imaging is used in HCS to identify meaningful information from complex systems such as in vitro, in vivo, and ex vivo systems.

High-content screening (HCS) instruments are equipped with advanced features and functionalities and are, therefore, priced at a premium. A confocal microscope, for instance, can cost more than USD 250,000, and a wide-field microscope can cost more than USD 100,000. Similarly, the InCell 2000 Analyzer system (from GE Healthcare) used in HCS costs around USD 240,000. Academic research laboratories find it difficult to afford such high-priced instruments as they have restricted budgets.

Geographically, the global live cell imaging market is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific is expected to show the highest growth rate during the forecast period. The high growth rate of this region can mainly be attributed to the factors such as the government initiatives for research on stem cell therapy.