views

COVID-19 Impact on Benzene in Chemicals and Materials Industry

INTRODUCTION

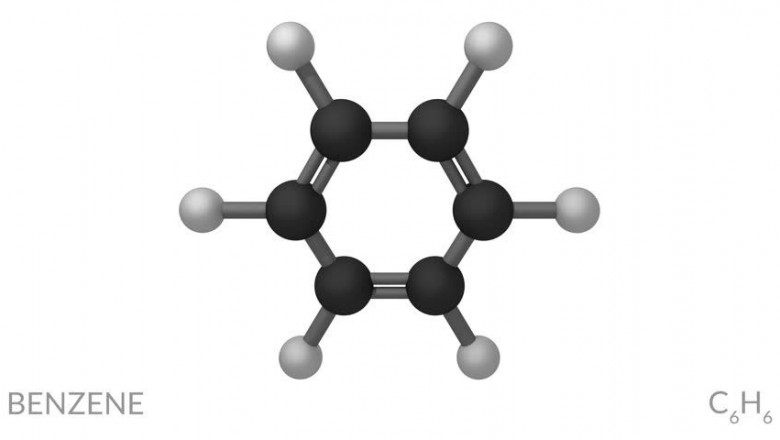

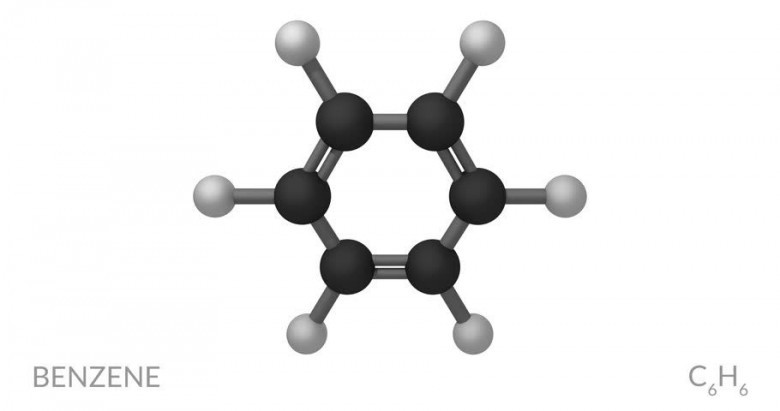

Aromatic compounds are organic chemical compounds that are derived during the distillation of crude oil in refineries. Some of the major aromatic compounds are benzene, toluene, aniline, cumene, styrene, xylene, and others. Benzene is one of the simplest (in terms of composition) and a widely used aromatic compound. It is obtained as a co-product during steam cracking of gas oil. Other than this, benzene is also obtained during catalyst reforming of hydrocarbons. It is also used to make other aromatic compounds such as nitrobenzene, cumene, ethyl benzene, and others.

The entire world is facing the effects of the COVID-19 pandemic in various sectors and industries. As China is the producer and supplier of most of the raw materials or inputs in various industries, the outbreak of the virus in China has disrupted the entire economy. China being the most significant producer and consumer for chemicals, the entire aromatic chemicals industry has been affected. After China, the chemical industry will be affected severely in India and the U.S.

The outbreak of novel coronavirus in China had the most critical impact across the Chinese chemical industry, as the movement of all types of chemicals inside the country and outside the country had suffered. Most of the industries were shut down from the beginning of January 2020, which restricted both demand and supply for benzene. Industrial, traffic, and social activities were largely suspended in China, effectively reducing the intensity of pollution emissions and air pollution levels. As per the data published by the Ministry of Ecology and Environment of the People’s Republic of China PM10, PM2.5, SO2, and NO2 in 337 cities in China decreased by 30.0%, 27.3%, 23.1% and 28.0%, respectively, compared with the values for February of 2020, and the decline was more significant than other winter months.

GLOBAL IMPACT

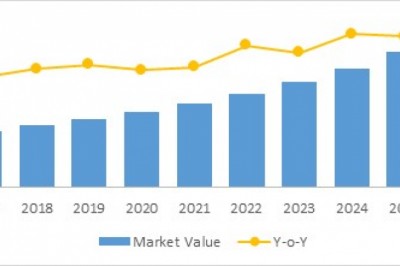

The entire chemical industry including aromatic chemical compounds has witnessed a decline of more than 5% earlier this year. This decline percentage has increased to around 20% as the effect of coronavirus has intensified. Also, the sudden outbreak of second wave has again hit the market and the supply chain, which was into the building zone, got demolished once again. The appearance of new variants of COVID-19 has still positioned a threat on the market. Major reason behind the continuous decline is raw material and labor shortages as well as government-mandated plant shutdowns. Also, the dual impact of the pandemic that resulted in shutdown and the March 2020 oil price collapse has exacerbated the oversupply situation that some U.S. chemical producers already faced. This resulted in dip in demand in both local and global markets.

The benzene market is dependent on various raw material inputs, such as oil, gas, coal, minerals, and bio-based materials. Apart from this, any impact on end-user companies will have huge implication over the industry. Benzene is used across a broad range of industries to manufacture various chemicals used to produce plastics, resins, and nylon and synthetic fibers. Benzene is also used to make some types of lubricants, rubbers, dyes, detergents, drugs, and pesticides. All these industries are facing downturn in almost all parts of globe and thus have resulted in decreased demand for benzene and other aromatic compounds.

IMPACT ON DEMAND

After the outbreak, the demand for benzene has been observed inconsistent across distinct segments. Before the COVID-19 eruption, benzene ranked in the top 20 chemicals for production volume. As it works as a raw material for production of plastics, resins, and nylon and synthetic fibers along with lubricants, rubbers, dyes, detergents, drugs, and pesticides, many industries are dependent on it. Any impact on the demand of these products, directly impacts the demand of benzene. Soon before the challenge of the pandemic is over and market conditions return to pre-outbreak stages, benzene suppliers will need to make well-informed structural adjustments and restructure their firms to handle this uneven demand scenario.

As benzene can also be prepared naturally through volcanoes and fire outburst in forests, many countries have noticed higher benzene concentration. This has definitely increased the production of benzene, but the demand is still struggling to match up the mark. In some countries, as the nation was facing lockdown, many industries were shut, the amount of benzene is air was reduced by 62%.

IMPACT ON CHEMICAL MANUFACTURING COMPANY

For companies that are into the production of benzene or any other aromatic compounds, the pandemic has had a mixed effect. For certain product lines, low oil prices lowered raw material costs, although the closure of Chinese plants also allowed factories from Europe, the U.S. and India to fill the gap and raise order intakes. Disruptions in the supply chain, however, have contributed to sourcing difficulties for many suppliers. Significant logistics difficulties are also faced by industries relying on Chinese raw materials.

Major effect on demand and supply of benzene was felt by the suppliers in Q2 of 2021 rather than in Q4 of 2020. Reduced earnings have already been announced by various aromatic compound manufacturers for Q1 2020. Though many emerging economies have lifted the lockouts, it is not expected that the demand will rise significantly, so these businesses will mostly undergo a U-shaped recovery. Once factories reopen and supply chains become more fluid, benzene producers are most likely to meet their current order obligations before the end of 2020. How early lockdowns are removed in different parts of the world and how rapidly the world will recover from the pandemic will depend on the time taken and scale of recovery.

TRENDS THAT EMERGED POST COVID-19 IN BENZENE MARKET

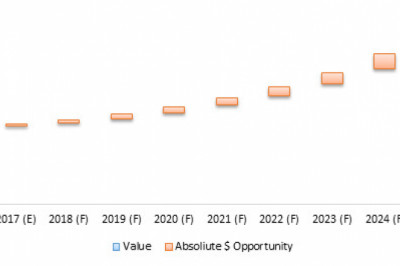

The speed of business-to-business (B2B) trade adoption in chemicals has been slower than in other B2B sectors until recently. Chemical transactions on US B2B e-commerce websites are increasing at a compound annual growth rate of 3.7 percent (CAGR; 2017-2020), compared with a CAGR of 13.6 percent during the same period for total US B2B e-commerce sales. In a recent study, two-thirds of 76 managers of the chemical industry shared their reliance on other market goals or capability constraints as the key reasons why digital commerce has not been embraced more rapidly by the chemical industry to date.

RESTRICTION ON LOGISTIC SUPPORT

The restriction on logistics has been the main challenge for all sectors of the industry. The countries were divided into divided into thousands of islands by the isolation policy when the spread of coronavirus was on its peak. There was huge restriction on movement of people and goods. In a bid to contain the virus, people and cargoes were separated between provinces, cities, towns or even villages. The railways were also stopped in several countries and where it continued to operate, the loading & unloading have been constrained by a shortage of labor resulting at one point in the transport capability dropping by some 50%.

Transportation has been seriously impacted. As for cross-border travel by vehicles, if the route had not already been closed, the drivers had to be quarantined for two weeks. Vehicle traffic was often constrained by the provinces coming from states or areas where the crisis was worst. Transportation via water sources was the only alternative left, but even in that situation, many ports declined to work and offer their services. For instance, ports in Jiangsu, refused barges from Hubei to dock.

Logistics continue to be a problem for the sector even after the change in the overall conditions. While there are no government road blockages, both for transport purposes and at the plants themselves, there is still a lack of labor. It is expected that it will take some weeks still before normal activity across the whole industry is resumed. In the meantime, supply of Chinese benzene has tightened prompting prices to firm both in the domestic and export markets.

CONCLUSION

The chemical industry and aromatic chemical compounds market is in the recovery phase. Initially, the industry had to face severe outcomes as China was the first country where this disease was spread and China itself is the major producer of chemicals. Because of this the entire world market was disturbed. Now when the China has almost recovered from this disease, the rest of the world is still struggling and thus, the industry is not up with full capacity.

Things will take time, but the benzene market will buck up soon as they are the pillars of global economy. The Ministry is constantly making efforts so that the industry can once again be back on track and the availability of all raw materials and products will become normal.