views

The influence of chemical companies on strategic development

Impact on strategic development

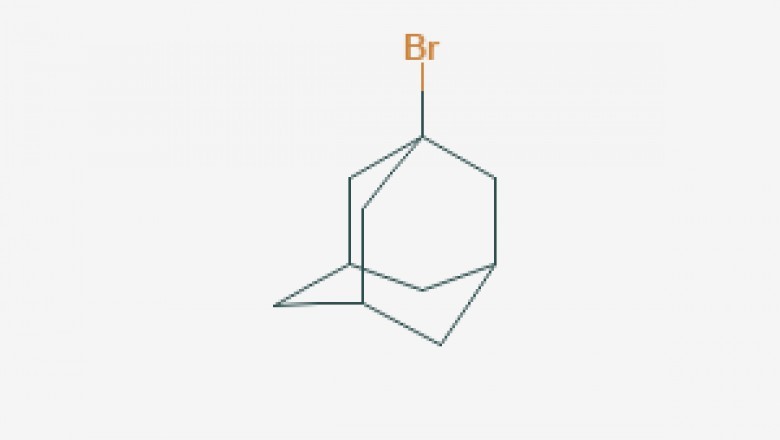

All these developments will make the strategic development of chemical companies more complicated (especially because they may be interdependent). While technology may help to address climate change, evolving trade dynamics may complicate the fight against the impact of climate change, as regulation may vary significantly across jurisdictions.

Although every chemical company has to address the challenges in a way that suits its product mix and environment, there are several things that deserve industry wide consideration:

Growth assumptions may need to be revisited in view of the likely upcoming sustainability legislation and its impact on customer demand. In general, regulatory and geopolitical considerations may be more relevant than factors experienced by the management team in the past.

The value of flexibility and selectivity will increase in the next few years, and competitive advantage will be redefined. This concept is not easy for an industry accustomed to building increasingly large factories with decades of life. Examples of this flexibility include partnerships, collaboration, fee based arrangements or more broadly designed research projects, as well as designing smaller, more flexible production units that have been adopted by other industries, such as pharmaceutical companies.

Asia, especially China, will become the center of the chemical industry. Assuming steady growth - a brave assumption - India will follow the path of China, though only for a few decades.

As modern digital technology becomes more and more important, its initial focus will be on improving productivity, but it will also have the potential to support the development of new business models. Later, we may see significant changes in customer value pooling and far-reaching business process automation. If quantum computing becomes more pervasive, it could revive part of chemical research and development.

All of this will happen in an environment where shareholders will get better information and thus demand higher financial, environmental, social and governance performance. In fact, we believe ESG will perform as well as cost and other productivity indicators in the past.

What about cowid-19?

The novel coronavirus pneumonia is far from over, and no one can foresee any extreme development. In addition to concurrent events, covid-19 is another crisis - the industry has gone through it again and again.

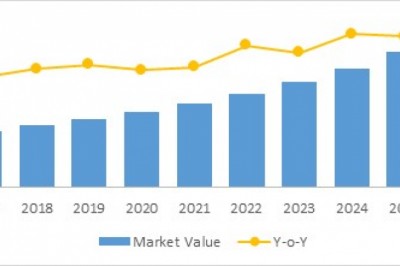

The income of the chemical industry is linked to the development of GDP. The revenue of chemical companies will drop slightly more than GDP, and the enterprises downstream of their respective value chains will empty their warehouses. In return, growth after the trough of the crisis will be much higher than GDP growth, because the same downstream enterprises also need to replenish inventory.

According to this logic, the performance of chemical stocks is in the middle to a certain extent, and there is reason to think that they will continue to develop along this track. Depending on the product mix, some products are more vulnerable (e.g. durable goods manufacturers), while some products may be profitable (e.g. packaging materials manufacturers).

While ensuring the safety of employees, the management team maintains the supply chain day and night, purchases necessary raw materials, and handles a large number of new regulations and practical difficulties. However, while the cowid-19 crisis does accelerate some developments (e.g., digitization, flexible work arrangements, and geopolitical tensions), it is not possible that it has changed the overall strategic context of the chemical industry's operations, or any of the above basic trends.