views

What is the Best Real estate investing strategy?

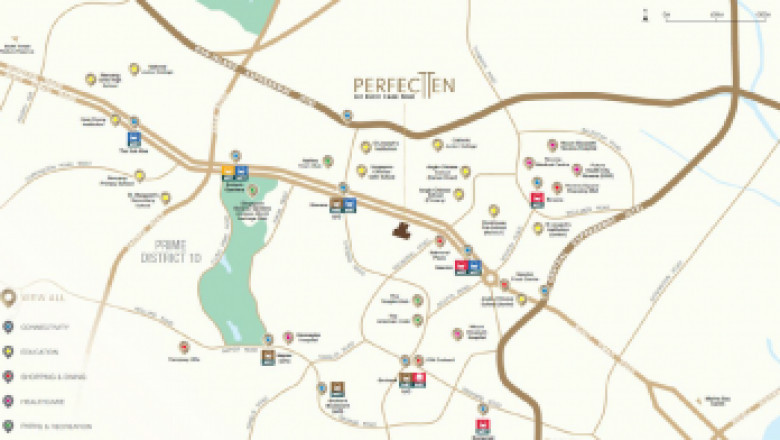

For a competitive edge in the property market, the first thing we must do is find out what kind of property is suitable for us to purchase and choose the location with the potential for growth. Get more information about Perfect ten

What is the most effective real Property Investing Strategy?

There isn't a universal answer to this query, as the best real estate investing approach will differ based upon your goals, resources, and willingness to risk. There are however some general rules that can help you decide on the most suitable strategy for you.

If you're just getting started with real estate investment, it is advisable to start small and gradually increase your investment portfolio as time passes. This strategy will let you to become familiar with the subject without putting your money at too many risks.

If you're experienced and are seeking higher gains, you may think about flipping homes or investing in larger multi-family residences. These strategies can be than a risk, but they offer the possibility of higher returns.

Most importantly, the best real estate investing strategy is the one that is in line with your goals and is compatible with your risk tolerance. By taking a careful look at these factors and determining the best strategy for you, you will increase your chances of being successful in the highly competitive field of real estate investment.

Different types of investment Strategies

There are many real estate investment strategies there , and it's difficult to figure out which is the best for you. Here are the four most sought-after investment strategies:

1. Fix and Flip

The method involves purchasing a property, fixing it up before selling it to make a profit. This is a good way to make money, but it will take a significant amount of working and patience.

2. Renting

This method involves buying the property and renting it to tenants. This will provide a steady source of income, but it can also be a burden that comes with being an landlord.

3. House Hacking

This option involves living in a property while renting out additional areas or rooms. This can help offset the cost of owning the property and allow you to save for a down payment on another property.

4. Wholesaling

This method involves locating property that is undervalued and then selling them to investors for profits. This is a simple method of making money, but it is a process that requires understanding of the market and access to capital.

Pros and cons to each Strategie

There are many different real estate investing strategies which you can use for making a profit. Some of the most sought-after strategies include fix and flips, buy and hold leasing, wholesaling, and landlording. Each strategy comes with each of them own pros and cons that should be considered before choosing which option is the most appropriate for your needs.

Fixed and Flip investing involves purchasing an investment property, making repairs or renovations, before selling it for a higher price. It can be extremely profitable if done correctly but it also has a higher degree of risk. You could lose money if your property doesn't sell, or if repairs end up costing more than what you initially anticipated.

The process of buying and holding involves purchasing a house and holding on to it for an extended time, usually for several years. This strategy can offer a steady source of income than flipping, however it demands more patience and more capital upfront. There is also the chance that the property might decline in value in the course of time.

Wholesaling entails finding heavily discounted property and then selling it to a third party investor to earn an immediate profit. This is a strategy that can be highly lucrative, but it needs some knowledge of the market for real estate as well as how to find the best deals.

Landlording is the process of purchasing a rental house and collecting rent from tenants. This strategy provides you with a steady income, but it also comes with a lot of responsibilities including maintenance, repairs, and evictions.

Who Should Benefit From The Alternative Strategies?

There is no one-size-fits-all answer regarding whether or not one should utilize alternative real estate strategies for investing. Different people will have their own expectations and goals, and what works for one might not work for another. But, there are general guidelines that can help you decide which strategy is suitable for you.

If you're new to real investment in real estate, you might prefer more conventional strategies such as fix and flip or purchase and hold. These strategies are more likely to produce predictable results, which will give you the peace of mind you need to grow your business.

If you're an expert investor who is seeking higher returns, other strategies could be an ideal fit for you. There are many alternative strategies, such as short-term rentals or Airbnb investing, can yield greater returns than traditional investments. However, they come with more risk which is why it's vital to be aware of the risks before investing in.

in the end, the most successful real estate investing strategy is the one that is tailored to your demands and goals. If you're not sure where to start, consult with an expert advisor who can assist you in finding the ideal strategy for your situation.

Conclusion

If you're trying to find the most effective real estate investment strategy, there's not a universal answer. The optimal strategy will depend on your goals and personal circumstances. However, some strategies that are popular include fix and flip buying and holding, and wholesaling. Whichever method you choose make sure you do your research and speak with an expert to aid you in making the best decision for your needs.