views

Cryptocurrency have been popular for some time now and then there are several paperwork and content on basics of Cryptocurrency. Not simply possess the Cryptocurrency prospered but have opened up like a new and trusted potential for brokers. The crypto market remains to be young but mature ample to fill from the satisfactory quantity of data for analysis and predict the developments. Though it is known as probably the most unstable market as well as a massive risk as an investment, it offers now grow to be expected into a specific point and also the Bitcoin commodities really are a proof of this. Many concepts of your stock market have recently been used on the crypto market with some tweaks and alterations. This provides us an additional proof that lots of people are implementing Cryptocurrency market daily, and currently a lot more than 500 million traders can be found within it. Though the overall market cover of crypto market is $286.14 Billion that is certainly roughly 1/65th from the stock market during writing, the market potential is very substantial considering the achievement despite its age and the inclusion of already founded financial marketplaces. The true reason for this is certainly nothing else but the reality that folks have started trusting inside the technology and the products backing a crypto. This also means that the crypto technology have confirmed itself and thus much the businesses have agreed to place their possessions in the form of crypto coins or tokens. The thought of Cryptocurrency started to be successful with the achievements Bitcoin. Bitcoin, which once was previously really the only Cryptocurrency, now contributes only 37.6% to the complete Cryptocurrency market. The reason why being, development newest Cryptocurrencies and the prosperity of assignments backing them. This does not show that Bitcoin was unsuccessful, in reality market capitalization of Bitcoin has increased, instead what this indicates is the fact that crypto market have expanded overall. Acquire more information about https://www.metaworldcrypto.xyz/pricing

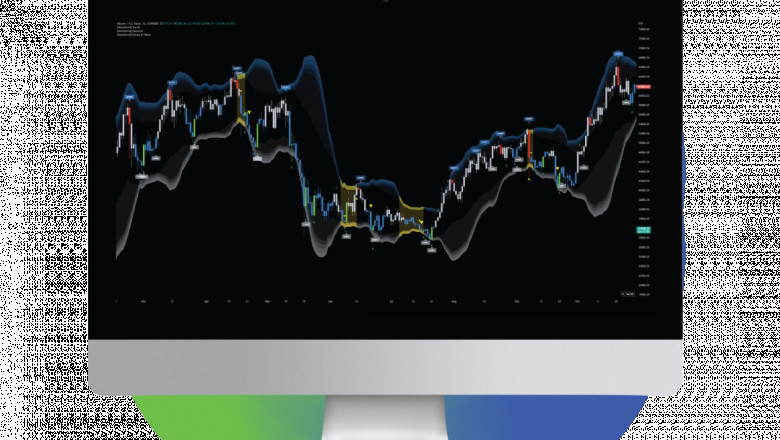

These information are sufficient to confirm the success of Cryptocurrencies along with their market. And also in reality expense in Crypto market is regarded as safe now, towards the degree that some commit concerning their retirement program. For that reason everything we need after that are definitely the tools for analysis of crypto market. There are many such tools that allow you to evaluate this market inside a way similar to stock market supplying comparable metrics. Such as coin market cap, coin stalker, cryptoz and investing. Even believed these metrics are quite obvious, the do provide essential information about the crypto under consideration. As an example, a high market limit signifies a solid venture, a high 24hour amount shows high demand and going around provide signifies the whole amount of coins of that crypto in flow. Another significant metric is volatility of any crypto. Unpredictability is when a lot the buying price of a crypto fluctuates. Crypto market is considered as highly erratic, cashing out at a minute might deliver in a number of revenue or get you to take your hair. As a result whatever we seek out is really a crypto that may be stable ample to present us time to make a calculated determination. Currencies including Bitcoin, Ethereum and Ethereum-vintage (not specifically) are believed as secure. With simply being dependable, they need to be sufficiently strong enough, so that they usually do not come to be invalid or simply stop current from the market. These traits make a crypto reputable, and the most trustworthy Cryptocurrencies are utilized as a form of liquidity.

As far is crypto market is concerned, volatility comes hand in hand, but so do its most essential property i.e. Decentralization. Crypto market is decentralized, what this means is that this cost slip in one crypto is not going to necessarily indicates down craze for any other crypto. Thus giving us the opportunity in the form of just what are called reciprocal cash. It's a Concept of running a profile of the crypto currencies which you put money into. The Idea would be to distribute your investments to numerous Cryptocurrencies in order to minimize the danger concerned if any crypto starts off on a bear run

Much like this idea is the thought of Indices in crypto market. Indices give a common point of reference point to the market as a whole. The Concept is to select the top currencies within the market and distribute an investment among them. These selected crypto currencies alter when the list are active in nature and just look at the top rated foreign currencies. By way of example if a currency 'X' declines down to 11th situation in crypto market, the index thinking about top rated 10 foreign currencies would now won't consider currency 'X', quite commence thinking of currency 'Y' that have undertaken it's spot. Some service providers including cci30 and crypto20 have tokenized these Crypto indices. Even if this might appear like a good Idea to some, other folks oppose because of the fact that you have some pre-requisites to invest in these tokens for instance a bare minimum quantity of expense is essential. And some for example cryptoz provide you with the methodology as well as a the list worth, in addition to the currency ingredients in order that a venture capitalist costs nothing to invest the amount he/she would like to and judge not to purchase a crypto otherwise contained in an directory. As a result, indices offer you a option to additional sleek the unpredictability and reduce the chance concerned.

Verdict

The crypto market might seem dangerous initially seem and lots of might be cynical of its validity, However the maturation that this market has acquired throughout the simple period of its living is incredible as well as the proof ample due to its genuineness. The greatest worry that investors have is unpredictability, where there had been a solution in type of indices.