views

chemical manufacturer ranked “value-added services” higher than buyers did

The Accenture Global Buyer Values Study― according to surveys of two,205 materials companies, industrial buyers, retailers, and consumers ― discovered that chemical suppliers’ fears about losing people to the competition are well-founded since many buyers have options. Approximately 1 / 2 of buyers (55%) stated they might change to alternate materials, including materials from providers outdoors caffeine industry, for instance using metals rather of plastic.

Based on the study, the chance of customer defection might be compounded by variations between what buyers and consumers want and just what chemical manufacturer thinks they need. For example:

When requested to position the most crucial product characteristics associated with sustainability, consumers and buyers reported safer materials and sturdy products. But chemical manufacturer thought these stakeholders would state that alternative energy and recyclable products were most significant.

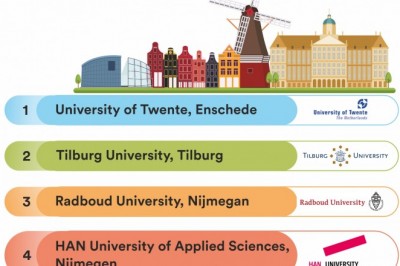

chemical manufacturer rated “value-added services” greater than buyers did, which implies they're prioritizing services that buyers don’t fully value. Many of the difficulties for a chemical manufacturer, given that they see value-added services like a road to differentiation.

Buyers and consumers rated logistics and delivery longevity of greater importance than chemical manufacturers expected they'd.

“We also found a notable distinction between how chemical manufacturer and buyers evaluate relationship building,” stated Bernd Elser, an MD at Accenture who leads its Chemical industry practice globally. “Buyers placed a greater value on digital interfaces and encounters making it simpler and much more intuitive to have interaction. This means that chemical manufacturers come with a chance to enhance customer relationships through the usage of technology.”

The findings demonstrate that almost all chemical manufacturers (99%) are utilizing a minimum of one new technology, for example, analytics or robotics, to become more customer-centric. However, doing this requires good data, and roughly three-fourths of the chemical manufacturers (74%) stated they face data-related challenges - either an excessive amount of, not enough, unusable, or poor-quality data. This yet other on customer-centricity were corroborated throughout a virtual panel only at that year’s American Chemistry Council Annual Meeting.

“As a part of our customer-experience efforts, we use data to assist us to establish correlation after which ultimately causation between your services you want to purchase ― and evolve ― and also the financial connection between our customers,” stated Dan Futter, Dow’s chief commercial officer, who spoke around the panel. “We have put in many focus on that at Dow jones, attempting to understand individuals' correlations. Hopefully to create far better data into discussions around prioritizing investments in customer encounters over classical investment areas.”

Sucheta Govil, Covestro’s chief commercial officer and the other panelist, noted that being a product-centric company is not enough which driving a person-centric culture is essential.

“This allows you to better map decision journeys, build more powerful relationships and use people to identify joint outcomes that you wish to solve,” Govil stated. “Circularity is really a situation in the reason for the caffeine industry, much like emissions. The need for customer-centricity is obvious. However, it’s as much as us to structure, document making the advantages easily digestible and available.”