views

Polkadot and Cardano are ground-up-Proof-of-Stake (PoS) blockchain projects that seek to introduce the mass adoption of Proof-of-Stake before the Ethereum blockchain can completely shift from its operation from a Proof-of-Work(PoW) protocol to a PoS protocol.

WHAT IS CARDANO (ADA)?

Cardano is a decentralized third-generation proof-of-stake blockchain platform. While it shares characteristics and applications with other blockchain platforms like Ethereum, Cardano distinguishes itself from others through a commitment to peer-reviewed scientific research as building blocks for updates to its platform and Cardano’s cryptocurrency is called “ada”.

Cardano’s main applications are in identity management and traceability. The former application can be used to streamline and simplify processes that require the collection of data from multiple sources. The latter application can be used to track and audit a product’s manufacturing processes from provenance to finished goods and potentially, eliminate the market for counterfeit goods.

WHAT IS POLKADOT (DOT)?

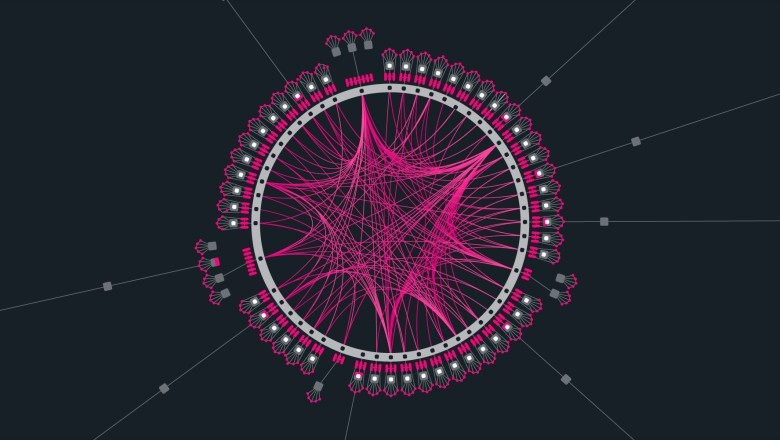

Polkadot is a multi-chain network that aims to connect different specialized blockchains into a single unified network. Blockchains that connect with Polkadot work in parallel as so-called parachains. This enables them to access the Polkadot network’s proof-of-stake validation of transactions and security. Polkadot’s cryptocurrency is DOT. This token allows holders to vote on potential code changes, which then automatically upgrade across the network if a consensus is reached.

The primary applications of Polkadot are letting blockchains pool their security, which means that the blockchain’ security is aggregated and applied to all. By connecting to Polkadot, blockchain developers can secure their blockchain from day one.

CARDANO (ADA) VS POLKADOT (DOT) :

The listed below are the primary differences between Cardano and Polkadot.

Different PoS protocols:

Ouroboros is the proof-of-stake consensus algorithm forming the backbone of the Cardano blockchain. Cardano’s native virtual currency ADA is referred to as “stake”, and instead of miners, there are ADA “stakeholders” in the Cardano ledger.

Cardano’s PoS system uses a randomized process to elect a stakeholder to produce a block based on the weight of the stake recorded in the ledger. Not all stakeholders have the expertise to produce a block if elected, so stakeholders can pool their resources by delegating their stake to stake pools. The managers of these stake pools, known as stake pool operators, manage block production during slots where the Ouroboros algorithm elects stake delegated to them. These rewards are then automatically shared with the stakeholder.

In a DPoS system, stakeholders vote on who is responsible for producing blocks. This is different from Cardano PoS, where a stake is delegated to stake pools rather than used as a voting mechanism. The voting power of each person is weighted to the number of cryptocurrencies a person owns.

These block producers are responsible for grouping transactions into a block and broadcast them to the network. These block producers receive rewards for progressing the network. DPoS is designed so that block producers who fail to perform their duties can be voted out as delegates in elections. A DPoS system relies on a fixed amount of delegates to be voted on, meaning there is a set amount of parties allowed to progress the network. Cardano’s POS can have a much larger number of stake pools running, and thus Cardano furthers decentralization.

Polkadot developed its PoS out of Ouroboros protocol with some changes. With Polkadot’s Nominated Proof of Stake, nominators select up to 16 validators they trust, and the network will automatically distribute the stake among the validators in an even manner. Polkadot uses tools ranging from election theory to game theory to discrete optimization to develop an efficient validator selection process that offers fair representation and security, thus avoiding uneven power and influence among validators.

Polkadot uses a Nominated Proof of Stake system where nominators back validators with their own stake as a show of faith in their good behaviour. Nominated Proof of Stake differs from the more generic concept Delegated Proof of Stake, in that nominators are subject to loss of stake if they nominate a bad validator.

Overall, Polkadot’s model places a large responsibility on holders to delegate the right validators or risk losing their money. At the same time, Cardano offers a more relaxed validation process where tokens can be delegated without locking them up or risk of loss.

Different Target Areas:

Polkadot has a global focus aiming to be the premier blockchain, while Cardano currently targets Japan, Africa, and developing countries trying to solve real-world problems.

Network:

Polkadot’s network has a much smaller number of validators currently because it slashes malicious validators and stakeholders, meaning that anyone who placed a stake or delegated the bad validator would lose part of their stake. Therefore fewer people are willing to stake on validators. It makes expansion and decentralization more difficult for polkadot as Dot token holders require more trust due to the high-risk Cardano has more stake pools since there is no risk in delegating to a stake pool.

Development:

Since Polkadot requires more commitment from its users, naturally, many of those who choose to invest their time and money in it are actively involved in building dApps on top of the protocol. There is less involvement in Cardano from token holders and stake-pool validators because many just want to hold some Ada coins and wait for them to grow.

Tokenomics:

Polkadot places are high-pressure to delegate tokens to not lose out to inflation, unlike Ada coin. It is for the more active investor.

Governance and Ecosystem:

Direct voting on Proposals is supported on Polkadot, but an elected Council of Governance can veto malicious proposals. There is also a technical committee that can quickly submit technical proposals to solve network problems. The Council is elected, and the developers form a committee on the Polkadot platform. Thus it offers good backstops for recovering lost or stolen money. Cardano’s governance is in development. Project Catalyst, which has a Decentralised Autonomous Organization (DAO) format, is in experimentation and will be refined over time.

Polkadot has a complete ecosystem with Edgeware, Ocean protocol, Acala network and is backed by Web3 foundation. It has an excellent test net in Kusama. Cardano has project Marlowe Playground and a newly released Glow programming language for testing DApps.

CONCLUSION:

Both networks have great potential in integrating blockchains through their efficient and low transaction cost PoS algorithms. Polkadot may be ahead right now in the development curve, but Cardano looks to overtake it by introducing the ability to pay transaction fees in any token being transferred.

WHY CHOOSE THE BLOCKCHAIN APP FACTORY TO DEVELOP YOUR TOKENS?

Both Polkadot and Cardano have their own pros and cons depending on the factors. At Blockchain App Factory specializes in creating and developing tokens such as DOT and ADA. In order to develop an authentic and efficient token, reach out to Blockchain App Factory. Their experienced developers will assist you through every step of the way from development to deployment, and provide robust service that is quick and cost-effective. They also offer round the clock customer support and make sure you reach your business goals.