views

2018 would be a rough year for chemical suppliers

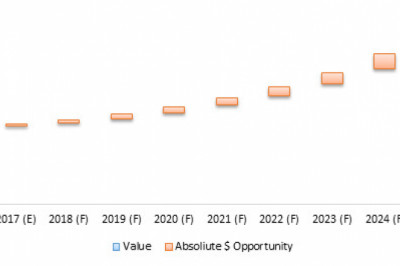

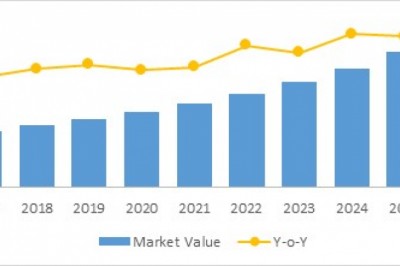

2018 would be a rough year for chemical suppliers. Median one-year total shareholder return (TSR) was lower 20%. Among 42 chemical suppliers, merely a quarter ended the entire year with positive TSR. Stock values really required a success within the 4th quarter, when just one company ended the quarter with positive TSR. Basically we notice that chemical stock values could be highly volatile, additionally, it seems that margins continue being pressurized and growth might be slowing. Is that this an indication of a lower cycle? Not always. However it does help remind us the chemical market is inherently cyclical along with a lower cycle can come sooner or later.

In the compensation committee’s perspective, an apparent results of a downturn available cost is the fact that outstanding equity award values will decrease. That can be a demonstrates alignment with shareholders, boards should also consider worker engagement and retention. Inside a lower cycle, men and women be given the job of operating a business in difficult conditions while salaries are most likely stagnant annual incentives might be tracking below target (or might not shell out) and unvested lengthy-term incentive awards are less significant, particularly at 'abnormal' amounts within the organization. Presuming the management team is the correct one to guide the organization via a downturn, it will likely be vital that you ensure stability, engagement, and retention.

Just how can compensation committees manage incentive programs in case of a lower cycle? While each clients are various and has distinct proper priorities, there are numerous actions that warrant review and consideration.