views

Report Coverage

The report: “Healthcare Integration Market Forecast (2021-2026)”, by Industry ARC, covers an in-depth analysis of the following segments of the Healthcare Integration Market.

By Product Type: Medical Device Integration Software, Media Interaction Solutions, and Interface Engines.

By Service: Implementation Services, Training Services, and Support, and Maintenance Services.

By Application: Hospital Integration, Lab Integration, Medical device Integration, Radiology Integration, Clinics Integration, and Others.

By End User: Hospitals, Laboratories, Diagnostic Imaging Centers, Clinics, Pharmacies, and Others.

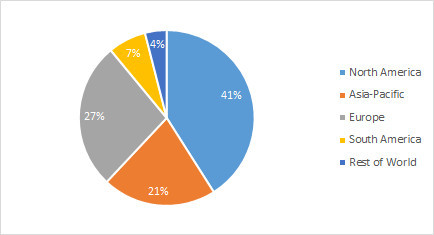

By Geography: North America (U.S., Canada, and Mexico), Europe (Germany, UK, France, Italy, Spain, Russia, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia & New Zealand, and Rest of Asia-Pacific), South America (Brazil, Argentina, and Rest of South America) and Rest of World (the Middle East and Africa).

Key Takeaways

- Geographically, the North American Healthcare Integration market accounted for the largest share in 2020 owing to growth in demand for efficiency, patient safety, and patient satisfaction in the region.

- An increase in the use of telehealth services by healthcare providers during the Covid-19 pandemic is driving the market for Healthcare Integration. However, the lack of skilled professionals to operate and maintain the IT infrastructure is a major challenge for the growth of the market in low and middle-income regions.

- Detailed analysis on the Strength, Weaknesses, and Opportunities of the prominent players operating in the market will be provided in the Healthcare Integration Market Report.

For more details on this report - Request for Sample

Healthcare Integration Market Segment Analysis-By Product Type

Based on Product Type, the Healthcare Integration Market is segmented into Medical Device Integration Software, Media Interaction Solutions, and Interface Engines. The Medical Device Integration Software segment is anticipated to have the largest share of the market in 2020 and is poised to dominate the market during the forecast period 2021-2026. The system collects the patient vital sign data from all the health monitoring devices and integrates them into the electronic medical record system. The seamless data transfer eliminates the need for manual data input and transfer thereby, improving efficiency, accuracy, productivity, and reducing errors. The Interface Engines segment is projected to grow the fastest at a CAGR of 9.6% owing to their ability to provide access to data within multiple electronic health records. Moreover, they also help translate data being received from other healthcare facilities to match the format used by the hospital in order to be stored in their central repository.

Healthcare Integration Market Segment Analysis-By End User

The Healthcare Integration Market based on End Users can be further segmented into Hospitals, Laboratories, Diagnostic Imaging Centers, Clinics, Pharmacies, and Others. The Hospitals segment accounted for the largest Healthcare Integration market share in 2020 owing to the increasing need to improve patient safety, reduce healthcare expenditure, improve efficiency, and reduce errors. Moreover, the increasing inflow of patients to hospitals for consultation, treatment, and therapy owing to the rise in communicable and non-communicable diseases is growing the need to integrate health systems to efficiently manage the massive amounts of data collected by the various departments of the hospital. The Laboratories segment is anticipated to witness the fastest growth during the forecast period at a CAGR of 10.1% owing to their increasing prevalence in developing regions as the majority of the small-scale hospitals do not have a dedicated laboratory department.

Healthcare Integration Market Segment Analysis-By Geography

The Healthcare Integration Market based on Geography can be segmented into North America, Europe, Asia-Pacific, South America, and the Rest of the World. The North American segment is projected to dominate the Healthcare Integration market during the forecast period 2021-2026 with a market share of 41% owing to the presence of highly developed healthcare infrastructure, high importance of patient satisfaction, growing patient population, and massive healthcare expenditure in the region. Moreover, the presence of key industry players such as Infor, InterSystems Corporation, Cerner Corporation, Allscripts Healthcare Solutions, NextGen Healthcare, General Electric Healthcare, Oracle Corporation, and IBM in the region ensures lower costs, higher innovation, and more options for the end-user. The Asia Pacific region is predicted to register the fastest growth owing to the increase in public and private healthcare funding in major emerging economies like China and India.

Healthcare Integration Market Drivers

Increase in Use of Tele Medicine is Projected to Drive Market Growth.

The increase in the adoption of Tele Medicine is predicted to drive the demand for Healthcare Integration products for enabling effective data management and transfer. Telehealth involves the distribution of medical information to patients remotely through electronic devices. This allows the patient to gain access to clinician contact, medical care, real-time health monitoring, and remote admissions. In the US, around 76% of the hospitals used telemedicine to connect with patients in 2020. 39.5% of medical professionals practicing in Radiology, 27.8% in Psychiatry, and 24.1%, Cardiology used telemedicine to connect with patients. This helps hospitals provide quality care to patients without increasing their risk of infection during the COVID-19 Pandemic.

The rise in Adoption of Electronic Health Records is Anticipated to Boost Demand.

The increase in the adoption of electronic health records and other digital systems in the healthcare sector is boosting the demand for healthcare integration as it is essential for ensuring the proper management of the substantial volumes of data being generated in healthcare facilities. In 2009, only 12.2% of US non-federal acute care hospitals had an electronic health records system, according to the American Hospital Association (AHA). However, in 2015, this number increased to 83.8% and around 96% of them had electronic health record systems certified by the Centers for Medicare and Medicaid Services (CMS). The penetration of this system in the US is estimated to have risen to more than 89% in 2020.

Healthcare Integration Market Challenges

The High Risk of Data Breach is Anticipated to Hamper Market Growth.

The growing concern regarding the leak of confidential patient information from hospital networks, clinics, and diagnostic centers owing to cyber-attacks is a major challenge that can hamper the market growth. For instance, on average, more than 3.34 million healthcare records were breached every month in the US between July 2020 and June 2021 by ransomware and other cyberattacks. The leaked information includes patient names, addresses, diagnosis information, contact details, and insurance information. The American health service provider UHS lost around $67 million in 2020 owing to network shutdowns caused by ransomware attacks. This is reducing the confidence of healthcare providers in implementing more IT technologies in their facilities for integration as data leaks can cause massive financial and legal issues for the organization.

Covid-19 Pandemic and Subsequent Restrictions is Projected to Limit Growth Opportunities

The rapid spread of the Covid-19 virus and the increased cases of hospitalizations have led to hospitals diverting funds and manpower from the IT department. The low priority given to IT owing to financial and manpower constraints may lead to postponement or cancellation of planned orders for healthcare integration products and services. This is projected to restrict the growth of the market. The AHA estimates that around $202.6 billion of revenue was lost for US hospitals and healthcare systems owing to the pandemic while developing regions require around $52 billion every 4 weeks to contain the disease. The average cost of treating a single Covid-19 patient with ventilator support in the US can exceed $88,000.

Healthcare Integration Market Industry Outlook:

Product launches, mergers and acquisitions, joint ventures, and geographical expansions are key strategies adopted by players in the Healthcare Integration Market. The top 10 companies in of the industry include:

- Allscripts Healthcare Solutions Inc

- Cerner Corporation

- Epic System Corporations

- Siemens Healthcare

- GE Healthcare

- Core-point Health

- Sandiano Group

- Cognizant

- Athena Health

- IBM Corporation

Partnerships/Product Launches:

I

Relevant Links:

Healthcare Cloud Computing Market – Forecasts (2021 - 2026)

Report Code: HCR 0510

Healthcare IT Market – Forecast (2021 - 2026)

Report Code: HCR 40559

For more Lifesciences and Healthcare related reports, please click here