views

The global Body Armor Market size is expected to reach USD 3.53 billion by 2028, registering a CAGR of 5.4% from 2021 to 2028, according to a new report by Grand View Research, Inc. The market is anticipated to be driven by the rising demand for defense protection equipment owing to the rise in asymmetric warfare in various countries, such as South Korea, Iraq, and India. The growing number of conflicts around the globe and violence, in general, has led to the significant demand for ballistic protection for the law, military enforcement agencies, and armored vehicles. This has further attributed to the rising demand for lightweight body armor protection.

The ever-increasing focus of defense agencies on soldier survivability is driving the demand for body armor. The shortage of ballistic protection suits and the rise in asymmetric warfare activities among various countries worldwide are further accelerating industry growth. Besides, vast developments in the field of nanotechnology are helping develop materials and fibers that can make armor lightweight and more flexible, consecutively driving industry growth. The emergence of armor based on advanced technologies, such as dragon skin and liquid body armor, is also contributing to market expansion. Moreover, the rising demand for body armor for civilian use has also created several industry growth opportunities. The increased demand for body armor among civilians can be attributed to the rise in crimes, burglaries, home invasion, and similar activities; bulletproof vests are one of the most common body armors used by civilians. CITIZEN ARMOR, a U.S.-based protection equipment manufacturing company, offers ballistic plates for civilians. The relatively low cost of steel plates has led to their re-emergence in the manufacturing of body armors for civilian use in the American market. Besides, metal plates are advantageous over ceramic plates since they can protect against multiple hits.

Modernization activities have created several opportunities for industry participants, leading to alliances with military agencies in a contractual environment. For instance, in July 2019, KDH Defense Systems, a U.S.-based body armor manufacturer, received two separate delivery orders worth USD 40 million from the U.S. Armed Forces. Emerging economies, such as India and China, are increasingly focusing on replacing legacy military equipment and increasing their defense budget. For instance, in May 2020, China hiked its defense budget to USD 179 billion compared to USD 177.6 billion in 2019. However, it has been the lowest hike in recent years due to the significant economic disruption caused by the novel coronavirus outbreak.

Related Press Release@ Body Armor Market Report

Body Armor Market Report Highlights

- The high penetration of body armor in the defense sector can be attributed to the emergence of modern military equipment and legacy systems

- In the civilian application segment, the demand for body armor is high, especially among people residing in crime-prone areas, jewelry store owners, embassy personnel overseas, and executive protection personnel

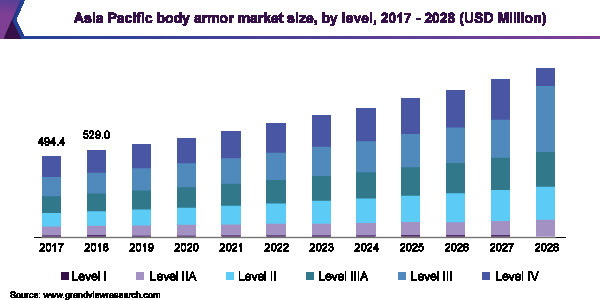

- The level IV body armor plate segment is expected to expand at a noticeable CAGR over the forecast period. This growth is attributable to the fact that the introduction of the final version of NIJ (National Institute of Justice) Standard 0101.07 is anticipated to improve the test methods and the performance requirements for the ballistic resistance levels

- The law enforcement protection application is expected to register a noticeable CAGR over the forecast period since NIJ has been pivotal in developing modern body armors for police officers