views

COVID -19 Impact on the Hemostats Market

With the WHO officially declaring the outbreak of COVID-19 a pandemic, a mix of established pharmaceutical and biopharmaceutical companies and small startups has stepped forward to develop treatments and vaccines that target the infection caused by the novel coronavirus. The COVID-19 outbreak has significantly impacted the availability of hospital resources worldwide. This has been primarily managed by dramatically reducing inpatient and outpatient services for other diseases and implementing infection prevention and control measures. the number of surgical procedures declined precipitously, with countries worldwide being affected by the pandemic

Global Hemostats Market Dynamics

Driver: Growing Volume Of Surgical Procedures Performed

Adhesion formation is a major post-surgical complication, which results in healthcare complications and generally requires repeat surgeries for the treatment of affected patients. Post-surgical adhesion formation leads to different complications in different surgeries, such as severe abdominal pain in the case of abdominal surgeries, infertility in women after gynecological surgeries, and physical impairment of patients after neurological surgeries. Considering the severe effects of post-surgery adhesion formation in patients, the importance of products such as adhesion barriers is increasing in the market.

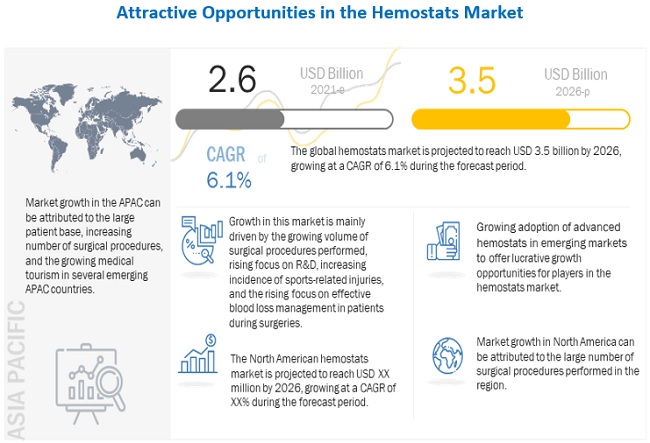

Over the years, there has been a significant rise in the number of surgical procedures performed across the globe. According to WHO estimations (2019), approximately 235 million major surgical procedures are undertaken worldwide every year. This is attributed to the growing prevalence of obesity and other lifestyle diseases, the rising geriatric population, the increasing prevalence of orthopedic conditions, and the increasing incidence of spinal and sports-related injuries.

According to the Heart and Circulatory Disease Statistics 2019 from the British Heart Foundation (UK), there has been a significant increase in the number of cardiac surgical procedures such as angioplasty and aortic valve replacement in the UK over the last decade, and this trend is expected to continue in the coming years.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=9571619

Opportunity: Growth In The Number Of Hospitals & Surgical Centers

The number of hospitals and surgical centers is increasing in both developed and emerging countries. The demand for surgical equipment (including medical devices such as hemostats) is high in these newly established surgical centers and hospitals, owing to the increasing patient population base. For instance, in October 2020, the Prime Minister of the UK announced plans of investing USD 4.3 billion for 40 hospitals and certain schemes for future funding for 48 hospitals by 2030. In addition, in March 2021, Steward Health Care announced plans to construct a new hospital in Washington County.

Over the last decade, developing countries such as India and China have witnessed significant improvements in their respective healthcare infrastructure. According to an article published in January 2020, China announced to invest USD 4.6 billion for the construction of hospitals in Wuhan. According to the Commonwealth Fund in 2018, China has approximately 12,000 public hospitals and 21,000 private hospitals. Similarly, in June 2019, the Indian Ministry of Health and Family Welfare announced the opening of 22 new AIIMS across the country. The significant growth in the number of hospitals and surgical centers is expected to support the growth of the hemostats market, as these are key end users of the hemostats market.

Challenge: Dearth Of Skilled Personnel For The Effective Use Of Hemostats Products

Skilled professionals are required to handle hemostats as the improper closure of arteries after surgical procedures may lead to continuous bleeding or cause ischemia. Some devices even require several steps in sequence while using them. Based on the current scenario, the American College of Cardiology estimates a shortage of 21% of cardiac surgeons by 2025 in the US (Source: American Heart Association).

Currently, the lack of skilled surgeons, both in developed and developing economies, is one of the major factors limiting the adoption of these products. For instance, the Association of American Medical Colleges (AAMC) projects a shortage of about 122,000 physicians by 2032 in the US. Of these, a shortage of 12,000 medical specialists and 23,400 surgeons and 39,100 other specialists such as neurologists and radiologists is expected to occur by 2032.

The technology landscape and application areas of hemostats products are changing rapidly, owing to technological advancements in this field. This necessitates physicians and other healthcare providers to acquire the necessary skills to apply advanced hemostats products such as hemostats, bone graft substitutes, surgical sealants, and adhesives effectively. Therefore, surgeons and physicians in hospitals and clinics are reluctant to use advanced surgical products for wound closure.

Some of the major players operating in this market are C.R. Bard (US), Baxter (US), Teleflex Incorporated (US), Ethicon (Subsidiary of Johnson & Johnson) ( US), Medtronic plc (Ireland), B. Braun Melsungen AG (Germany), Pfizer (US), etc. In 2020, Ethicon (Subsidiary of Johnson & Johnson) ( US) held the leading position in the market. The company has a strong geographic presence across the US, Asia, Europe, Middle East and Africa, & the Americas. Moreover, the company’s strong brand recognition and comprehensive product portfolio in the Hemostats market is its key strength.