views

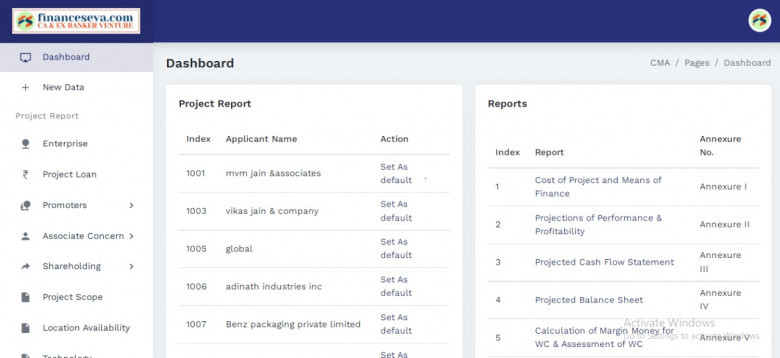

Apply Online Click Here:- CMA Data

This data will be checked by lenders to evaluate company creditworthiness.

If you are looking to borrow a big-ticket size amount for Business Loan expansion then you will be asked to submit CMA Data prior to loan application. Under the rule & regulations set by RBI that each & every bank has to prepare CMA for large funding. No matter whether you are borrowing a term loan, Working Capital Loan or Project Loan- CMA is an essential requirement. Simple format of CMA

Calculate Your EMI Click Here:- EMI Calculator

It contains 2 financial years performance include current & forecast the projection on next five year. Below listed are the table of content:-

•Particulars of current & Proposed Limit

•Profit & Loss Statement

•Cash Flow Statement

•Ratio Analysis

•Analysis on Balance Sheet

•Estimation on Maximum Permissible Bank Finance (MPBF)

•Fund Flow Statement

Who can prepare CMA Data?

Due to the complexity involvement, these types of Data only can be created by professional such like chartered accountant, Financial professional Financeseva.com has a high-end professional team that has the potential to prepare accurate CMA Data at reasonable pricing. They have vast experience especially in the creation of CMA Data as well as project report for bank loans across various industries. A well-drafted & clear CMA helps borrowers to get easy approval on loans.