views

What Loan Against Property

What Loan Against Property

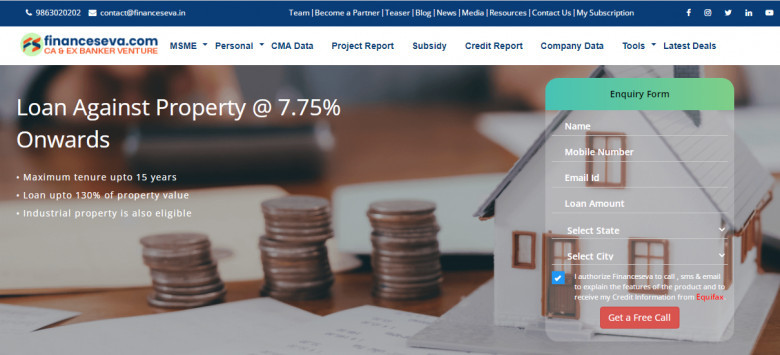

A loan against property is a loan on your assets such as a what loan against land property, constructed or commercial properties for Business Needs, Marriage, medical expenses, and other personal needs. A loan against property is a simple solution to your financial needs. Such loans are provided by banks and financial institutions. Lenders provide loans to anyone who owns any piece of land and uses collateral as security for loans.

You need to meet their basic requirements, and you can get your mortgage loan processed and disbursed immediately. You can get up to 60% of property value with flexible tenure. But you need to make sure you own residential, commercial, or industrial loan against property.

Generally, Loan Against Property Eligibility Criteria depends on a range of factors like age of individual, monthly salary or business income, total work experience & CIBIL Score, etc. These are some common eligibility criteria given below:

- Age Limit of Salaried Individuals - 28 to 60 years of age

- Work experience minimum of 3 Years and should be at public, private companies, or MNC (Salaried Individuals)

- CIBIL (Credit Information Bureau India Limited) Score should be above 750

- Nationality - Resident of Indian

- Minimum Years of doing Business - 3-5 Years (Self-Employed Individuals)