996

views

views

An unsecured loan is a credit tool offered by banks, financial institutions, and NBFCs. Such types of loans are sanctioned without any security or collateral.

Unsecured Loan In India

Apply Online Click Here:- Unsecured Loan In India

Such types of loans are sanctioned without any security or MSME Collateral. These loans require high credit scores and demand a high rate of interest as compared to secured loans. In case of any default, lenders do not have any security or collateral to recover the debt.

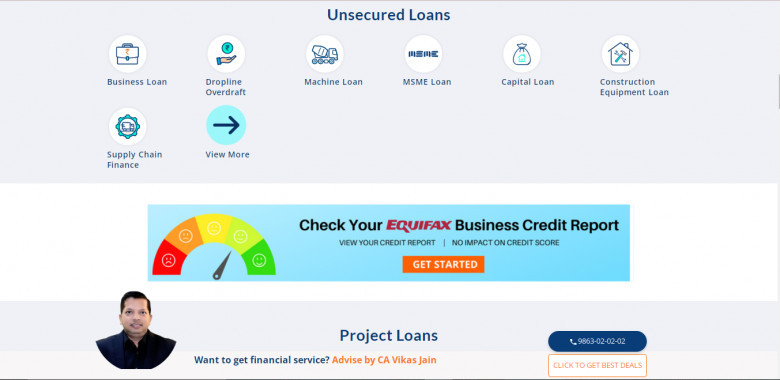

Unsecured Loans include:

- Machinery loan

- Business loan

- Professional loan

- Capital loan

- Startup loan

- Dealer finance

- MSME Loan

- Mudra loan

- Loan against credit card receipt

- Medical equipment finance

- Warehouse receipt finance

- Dropline overdraft limit

- Supply chain finance

- Vendor finance

- Dealer finance

- Factoring finance, etc.

Unsecured loan – Eligibility Criteria

- Minimum age of an applicant should be 21 years and the maximum are 65 years.

- You must have stable employment.

- Employed for a minimum of 2 years for salaried individuals and self-employed individuals have been earning for 5 years.

- A good credit history.

- It regulates the elasticity of interest rate, loan amount and eligibility criteria.

- Make sure you don’t have any pending EMI Calculator from existing loans.

Documents required

- For salaried individuals:

- Passport size photographs

- Loan application form

- Identity proof- voter ID, Driving license, PAN Card

- Residential proof- ration card, electricity bill.

- Salary slip for last 6 months

For self-employed individuals:

- Passport size photographs

- Identity proof- driving license, voter ID, PAN Card

- Residential proof- ration card, electricity bill

- Loan application form

- Proof of business continuity

- Office address proof

- Bank statements for the last 6 months

- Processing fee cheque