views

Over the past few years, oligonucleotide developers have outsourced complex manufacturing procedures to specialty contract manufacturing service providers, in order to address growing demand competitively, economically and profitably

Roots Analysis has announced the addition of “Oligonucleotide Synthesis, Modification and Purification Services Market: Focus on Research, Diagnostic and Therapeutic Applications, 2021-2030” report to its list of offerings.

Since the approval of the first antisense drug in 1998, oligonucleotides have paved their way into the therapeutic segment, owing to their ability to treat a myriad of disease indications and high target specificity. This presents lucrative opportunities for contract service providers that offer manufacturing services for this rapidly evolving class of pharmacological intervention. As a consequence, oligonucleotide manufacturers are increasingly strengthening their capabilities and capacities, in order to cater to the growing demand.

To order this 360+ page report, which features 175+ figures and 225 + tables, please visit https://www.rootsanalysis.com/reports/304/request-sample.html

Key Market Insights

Over 95 companies claim to offer oligonucleotide manufacturing services

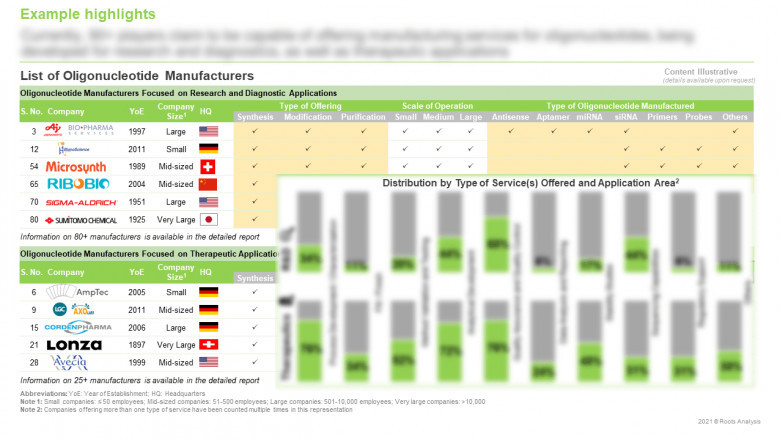

The Oligonucleotide Synthesis market landscape is currently dominated by the presence of small firms (1-50 employees), which represents close to 41% of the total number of industry stakeholders. This is followed by mid-sized players (~30%), and large and more established firms (~29%). Further, close to 14% of the service providers claim to offer manufacturing services for research diagnostic and therapeutic applications.

Partnership activity has increased at a CAGR of over 47% within this domain, since 2014

Majority of the agreements (34%) were inked to offer manufacturing services to oligonucleotide-based product developers, followed by instances of mergers / acquisitions (26%), aimed at the consolidation of existing service portfolios.

Multiple expansion initiatives were undertaken by service providers, between 2015 and 2021

Over 49% of such initiatives were focused on establishment of new facilities, followed by expansion of manufacturing-related capabilities (26%). Further, the US emerged as the most active country (in terms of number of expansion initiatives), followed by China and Germany.

440+ oligonucleotides focused clinical trials have been registered, worldwide

The clinical research activity (in terms of number of trials registered) increased at a CAGR of 41%, during the period 2013-2020. Of the total number of trials, close to 67% have already been completed, while 31% studies are presently active.

North America has emerged as oligonucleotide manufacturing hub, in terms of installed capacity

At present, the annual, installed manufacturing capacity in US and EU is estimated to capture around 80% of the available global capacity. This is primarily driven by players having commercial scale expertise / capabilities.

Demand for oligonucleotides is anticipated to grow at a CAGR of 10.5%, during 2021-2031

Given the fact that several oligonucleotide-based drug products were approved in the last 3-4 years, the commercial demand for oligonucleotides is anticipated to increase in the near future. Interestingly, over 76% of the estimated commercial demand was observed to have generated from antisense oligonucleotides.

Antisense Oligonucleotides and siRNAs are anticipated to capture over 86% of the market share in 2030

At present, the aforementioned types of oligonucleotides capture close to 79% of the total revenues. It is worth mentioning that the contract manufacturing market for oligonucleotides in Asia-Pacific is anticipated to grow at a relatively faster pace (20%).

Key geographical regions (North America, Europe, and Asia-Pacific and rest of the world)

In order to account for the uncertainties associated with the Oligonucleotide Synthesis Market Growth and to add robustness to our model, we have provided three forecast scenarios, portraying the conservative, base and optimistic tracks of the market’s evolution.

To request a sample copy / brochure of this report, please visit this

https://www.rootsanalysis.com/reports/304/request-sample.html

Key Questions Answered

§ Who are the leading players offering oligonucleotide synthesis, modification and purification services for research, diagnostic and therapeutic applications?

§ What are the preferred modification and purification methods used for oligonucleotides?

§ What are the key challenges faced by stakeholders engaged in this domain?

§ What kind of partnership models are commonly adopted by industry stakeholders?

§ What are the recent expansion initiatives undertaken by service providers within this domain?

§ Which therapy developers are likely to partner with oligonucleotide manufacturing service providers?

§ What is the annual, clinical and commercial demand for oligonucleotides?

§ What is the current, installed manufacturing capacity for oligonucleotides?

§ What percentage of oligonucleotide manufacturing operations are outsourced to service providers?

§ What factors should be taken into consideration while deciding whether the manufacturing operations for oligonucleotides should be kept in-house or outsourced?

§ What are the different initiatives undertaken by big pharma players engaged in this domain, in the recent past?

§ What are the opportunities in emerging markets for oligonucleotide manufacturing?

§ How is the current and future market opportunity likely to be distributed across key market segments?

§ What are the anticipated future trends related to oligonucleotide manufacturing?

The financial opportunity within the oligonucleotide synthesis, modification and purification market has been analyzed across the following segments:

§ Application Area

§ Research and Diagnostic Applications

§ Therapeutic Applications

§ Type of Oligonucleotide

§ Antisense Oligonucleotides

§ miRNA

§ shRNA

§ siRNA

§ Others

§ Scale of Operation

§ Clinical

§ Commercial

§ Purpose of Production

§ In-house Operations

§ Outsourced Operations

§ Type of Operation

§ API

§ FDF

§ Size of Manufacturer

§ Small

§ Mid-sized

§ Large

§ Key Therapeutic Areas

§ Autoimmune Disorders

§ Cardiovascular Disorders

§ Genetic Disorders

§ Infectious Diseases

§ Metabolic Disorders

§ Neuromuscular Disorders

§ Oncological Disorders

§ Ophthalmic Disorders

§ Other Therapeutic Areas

§ Key Geographical Regions

§ North America

§ Europe

§ Asia-Pacific and the Rest of the World

The report features inputs from eminent industry stakeholders, according to whom, the oligonucleotide manufacturing services market is primarily driven by the increasing demand for such molecules, for use in diagnostic and therapeutic applications. The report includes detailed transcripts of discussions held with the following experts:

§ Arun Shastry (Co-Founder and Managing Director, Hanugen Therapeutics)

§ Hans-Peter Vornlocher (Managing Director, Axolabs)

§ Joachim Bertram (Chief Scientific Officer and Managing Director, IBA Life Sciences)

§ Tobias Pohlmann (Founder and Managing Director, BianoScience)

The research covers detailed profiles; each profile features a brief company overview, its financial information (if available), along with information on its service portfolio, manufacturing facilities, details on partnerships, recent developments (expansions), and awards received by the firm, as well as an informed future outlook.

§ Agilent Technologies

§ Ajinomoto Bio-Pharma Services

§ BioSpring

§ CordenPharma

§ Integrated DNA Technologies

§ Kaneka Eurogentec

§ LGC Biosearch Technologies

§ Lonza

§ Microsynth

§ Nitto Denko Avecia

§ Sigma Aldrich

§ STA Pharmaceutical

§