views

Veterinary Molecular Diagnostics: Making Treatment of Animals Easier

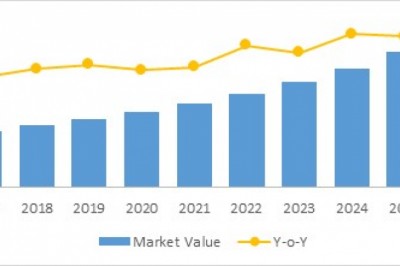

According to a new market research report, “Veterinary Molecular Diagnostics Market by Product (Kits & Reagents, System & Software), Technology (PCR, Microarray, DNA Seq), Animal Type (Companion, Livestock), Application (Infectious Disease, Genetics), and End User - Forecast to 2029”, published by Meticulous Research®, the veterinary molecular diagnostics market is expected to grow at a CAGR of 9.7% from 2022 to reach $1.61 billion by 2029.

Animals sometimes carry germs that can make people sick. As animals also provide us food for consumption, foodborne zoonotic diseases are caused by consuming food or water contaminated by pathogenic microorganisms. According to the WHO, an estimated 600 million, i.e., almost 1 in 10 people in the world, fall ill every year from consuming contaminated food. Children under five years of age are at a particularly high risk of carrying 40% of the burden of foodborne diseases, with 1,25,000 children dying from foodborne diseases every year. Diarrheal diseases are the most common illnesses resulting from the consumption of contaminated food, causing 550 million people to fall ill and 2,30,000 deaths every year.

Further, there are many key conditions responsible for increasing the prevalence of disease and affecting the health of the pet population. Diabetes Mellitus & Heartworm Diseases are the most common diseases diagnosed in canines and felines. According to Vetsource 2018, it is estimated that 1 in every 300 dogs and 1 in 230 cats develop diabetes during their lifetime. Governments across the globe are heavily focusing on increasing awareness about these diseases, thereby resulting in early diagnosis. For instance, in April 2019, the British Horse Society (BHS) and the University of Nottingham (U.K.) launched the Colic Awareness Week to increase the awareness of recognizing the earlier signs of colic.

Impact of COVID-19 Pandemic on the Veterinary Molecular Diagnostics Market

All the industries worldwide were affected due to the COVID-19 pandemic outbreak. Similarly, the veterinary molecular diagnostics industry was affected due to travel restrictions and lockdowns. During the lockdowns, the meat processing plants were temporarily shut down as many of them were recognized as hotspots for COVID-19 infections. This resulted in reduced production of meat products.

Download Sample Report @ https://www.meticulousresearch.com/download-sample-report/cp_id=5284?utm_source=Article&utm_medium=Social&utm_campaign=Product&utm_content=16-11-2022

Livestock animals were tested using diagnostic products for diseases and disorders to ensure the superior quality of foods. The reduced meat production led to reduced testing in livestock animals. In addition to that, as the outbreak was declared a pandemic by the WHO and the spread of the infection was uncontrolled, all the healthcare resources were directed toward human testing. All the laboratory equipment, testing kits, other instruments, and human resources were directed toward testing humans for the virus. This resulted in reduced testing in animals as human beings were prioritized due to the severe situations of infections.

The veterinary molecular diagnostics market is segmented on the basis of product, application, technology, animal type, and end user. The study also evaluates industry competitors and analyzes the regional and country markets.

Based on product, in 2022, the kits & reagents segment is estimated to account for the largest share of the veterinary molecular diagnostics market. The large share of this segment is mainly attributed to the fact that they are frequently used and the availability of a diverse range of reagents and consumables for various diseases.

Based on technology, the PCR segment is estimated to account for the largest share of this market in 2022. PCR tests are used in the early stages of an infection, where the level of infection is often below the detection limit (or in the latent phase) of conventional methods. It gives an immediate response to the current infection i.e. PCR offers information about the animal’s current infection status and therefore offers significant value to veterinarians and farmers. The use of techniques, such as PCR and real-time PCR, has led to the development of assays that decrease the problems associated with cross-contamination among samples and facilitates. Thus, these factors are expected to drive the market for this segment.

Based on animal type, the companion animals segment is estimated to account for the largest share of the veterinary molecular diagnostics market in 2022. Companion animals can act as a carrier of diseases that infect humans (i.e. zoonotic disease). Therefore, the care and concern by pet owners regarding the health and wellbeing of companion animals are increasing. In recent years, infection of various diseases in companion animals has increased, leading companion diagnostic providers to develop new devices and tests. Also, increasing awareness among pet owners to regularly diagnose glucose levels increases the demand for glucose monitors. Further, companies are developing newer diagnostic products, which are helping expand the segment.

Speak to Analyst @ https://www.meticulousresearch.com/speak-to-analyst/cp_id=5284?utm_source=Article&utm_medium=Social&utm_campaign=Product&utm_content=16-11-2022

Based on application, the infectious diseases segment is estimated to account for the largest share of the veterinary molecular diagnostics market in 2022. The benefits of MDx tests, such as agility, fast and flexibility, and providing results in low resource settings compared to core laboratories, make MDx suitable for infectious disease testing.

Based on geography, North America is estimated to dominate the veterinary molecular diagnostics market in 2022, followed by Europe and Asia-Pacific. The increasing awareness of animal disease diagnosis, rising number of veterinarians, and increased spending on the healthcare of farm & pet animals in the region supported the largest share of North America in the veterinary molecular diagnostics market. However, Asia-Pacific is expected to witness rapid growth during the forecast period. The factors driving the growth of the Asia-Pacific veterinary molecular diagnostics market are the large population of livestock animals, rising incidence of various zoonotic diseases, and focus on adopting newer molecular technologies in animal healthcare.

The report also includes an extensive assessment of the product portfolio, geographic analysis, and key strategic developments in the industry's leading market participants over the past four years (2019–2022). The veterinary molecular diagnostics market witnessed several new product launches, enhancements, approvals, partnerships & agreements, expansions, and acquisitions. For instance, in December 2020, Neogen Corporation (U.S.) launched Igenity Canine Wellness, a preventative care DNA screening tool for veterinarians with respect to canines. This product predicts the percentage of the heritable component for relatively common, actionable diseases by using genetic information.

Some of the key players operating in this market are IDEXX Laboratories, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), bioMérieux S.A. (France), Neogen Corporation (U.S.), Heska Corporation (U.S.), Biomedica Medizinprodukte GmbH & Co KG (Austria), VCA, Inc. (U.S.), Novacyt Group (U.K.), QIAGEN N.V. (Germany), and BioChek B.V (Netherlands).

Get Request Sample @ https://www.meticulousresearch.com/request-sample-report/cp_id=5284?utm_source=Article&utm_medium=Social&utm_campaign=Product&utm_content=16-11-2022

Scope of the Report:

Veterinary Molecular Diagnostics Market, by Product

- Kits and Reagents

- Instruments

- Software

Veterinary Molecular Diagnostics Market, by Application

- Infectious Diseases

- Metabolic Diseases

- Genetics

- Other Applications

Veterinary Molecular Diagnostics Market, by Technology

- PCR

- Microarray

- DNA Sequencing

Veterinary Molecular Diagnostics Market, by Animal Type

- Companion Animals

- Livestock Animals

Veterinary Molecular Diagnostics Market, by End User

- Veterinary Hospitals

- Clinical Laboratories

- Research Institutes

Veterinary Molecular Diagnostics Market, by Geography

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe (RoE)

- Asia-Pacific (APAC)

- Japan

- China

- India

- Rest of APAC (RoAPAC)

- Latin America

- Middle East & Africa