views

Unlike other biosimilar markets, competition among follow-on products of HUMIRA® is very high and several eager companies are attempting to carve out a share of the multibillion-dollar opportunity associated with this blockbuster product

Roots Analysis has announced the addition of the “HUMIRA® (Adalimumab) Biosimilars – Pipeline Review and Partnerships” report to its list of offerings.

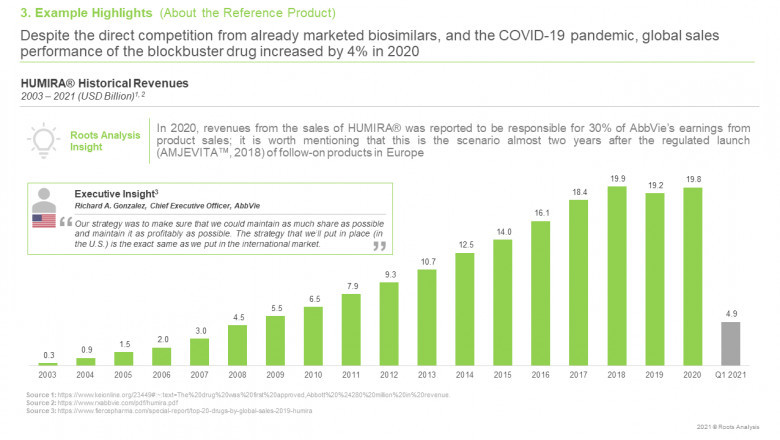

Being one of the first biologics against anti-inflammatory diseases, HUMIRA® is considered an aberration in terms of patent protection, with AbbVie strategically covering novel uses of the product and thereby, enjoys uncharacteristically prolonged marketing exclusivity. In fact, a year after multiple adalimumab biosimilars were launched in Europe, the originator released a statement that its diverse product placement strategy was able to maintain profitability, despite the availability of enemy products.

To order this report, which features 50+ insightful figures, depicting key analytical takeaways, please visit this link

Key Report Highlights

Despite direct competition from marketed biosimilars, global sales of the blockbuster drug, HUMIRA® increased by 4% in 2020

In the same year, revenues from the sales of the originator product were reported to be responsible for 30% of AbbVie’s earnings from product sales; it is worth mentioning that this is the scenario almost two years after the regulated launch of follow-on products in Europe.

There are close to 50 companies, across the world, claiming to be engaged in the development of HUMIRA® biosimilars

Although multiple companies have obtained regulatory approvals for their respective biosimilars to HUMIRA®, the launch of these products in regulated markets has been delayed until 2023 and is subject to the procurement of the appropriate licenses from AbbVie.

Multiple adalimumab biosimilar candidates are presently under development across more than 70 trials, worldwide

For several such investigational leads, new drug applications (NDAs) / marketing authorization applications (MAAs) have already been submitted to regulators across the world.

Partnership activity, related to biosimilars of adalimumab, has grown at a gradual pace since 2012

Most of the deals reported in the public domain are licensing and commercialization agreements; this trend can be attributed to the fact that biosimilar developers generally tend to partner with local business entities in order to launch their proprietary offerings across different geographies.

To request a sample copy / brochure of this report, please visit this link

Key Questions Answered

§ Who are the key players engaged in the development of biosimilars of adalimumab?

§ In which global marketplaces are HUMIRA® biosimilars currently available?

§ What is the current scenario within the clinical development landscape of adalimumab biosimilars?

§ How many biosimilar development programs have and what were the reasons?

§ Who are the key players involved in the commercialization of adalimumab biosimilars across the world?

§ What kind of partnerships have been inked between stakeholders in this domain?

The research includes detailed profiles of companies having approved / launched biosimilars across different global regions; each profile features an overview of the company, information related to its current portfolio of adalimumab biosimilars, financial information (if available) and key product related specifications.

§ Amgen

§ Bio-Thera Solutions

§ Boehringer Inglheim

§ Cadila

§ Celltrion

§ CinnaGen

§ Cipla

§ Emcure

§ Fresenius Kabi

§ Fujifilm Kyowa Kirin Biologics

§ Hetero Biopharma

§ Hetero Healthcare

§ Innovent Biologics

§ LG Chem (formerly LG Life Sciences)

§ Pfizer

§ Reliance Life Sciences

§ Samsung Bioepis

§ Sandoz

§ Shanghai Henlius Biotech

§ Torrent Pharmaceuticals

§ Zydus Cadila

§ Zydus Research Centre

For additional details, please visit

https://www.rootsanalysis.com/reports/humira-biosimilars-pipeline-review-and-partnerships.html or email sales@rootsanalysis.com

You may also be interested in the following titles:

1. Avastin® (Bevacizumab) Biosimilars – Pipeline Review and Partnerships

2. Herceptin® (Trastuzumab) Biosimilars – Pipeline Review and Partnerships

Contact:

Gaurav Chaudhary

+1 (415) 800 3415

+44 (122) 391 1091