views

With the emergence of blockbuster drugs, such as Gazyva® (for

Chronic Lymphocytic Leukemia) and POTELEGIO® (for Sézary syndrome), Fc

engineered antibodies have garnered significant interest in the medical

community, for various clinical conditions

London

Roots Analysis has announced the

addition of “Fc Protein and Glyco-engineered Antibodies Market,

2021-2030”

report

to its list of offerings.

Over time, a substantial body of evidence has validated the

therapeutic applications of Fc engineering platforms; Fc modified antibodies

have shown to augment the various immune effector functions, such as

antibody-dependent cellular cytotoxicity (ADCC), complement-dependent

cytotoxicity (CDC), antibody-dependent cellular phagocytosis (ADCP) activity

and / or the half-life of the molecule

To order this 250+ page report,

which features 100+ figures and 110+ tables, please visit https://www.rootsanalysis.com/reports/fc-protein-engineered-and-glycoengineered-antibodies-market.html

Key Market Insights

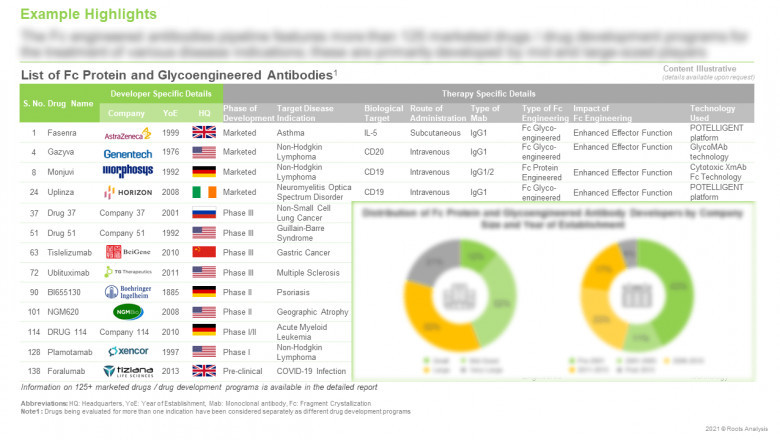

The Fc engineered antibodies pipeline features more

than 125 marketed drugs / drug development programs

Around 15% Fc protein and glyco-engineered antibodies are marketed,

while close to 75% are being evaluated in different phases of clinical trials

and 10% in preclinical studies. Examples of marketed Fc engineered antibodies include

Gazvya®, Imfinzi®, MONJUVI® and Skyrizi®.

Around

30 companies claim to be engaged in the development of Fc protein and glyco-engineered

antibodies

Around 55% of the aforementioned players are large companies

(with more than 5000 employees). It is worth highlighting that, majority of the

developers engaged in this domain (54%) are based in North America, followed by

Europe (26%) and Asia-Pacific (20%).

Over

1,800 clinical trials are currently evaluating the therapeutic effects of Fc

protein and glyco-engineered antibodies, worldwide

It is worth mentioning that most of the trials were / are being

conducted in North America (35%) region;

however, more than 91% of the patients enrolled in trials

conducted in North America were enrolled in different sites in the United

States. Further, 43% of the trials are being sponsored by non-industry players.

Close to 140 grants have been awarded to support research on Fc

protein and glyco-engineered antibodies, since 2019

An

estimated USD 63 million in grants have been awarded to various companies /

organizations working in this domain, during time period between 2019 and 2021.

Almost 50% of the total grant amount was funded by the National Institute of

Allergy and Infectious Diseases.

Close

to 6,500 patents have been filed / granted for Fc protein and glyco-engineered antibodies,

since 2016

Around 30%

of these intellectual property documents were filed / granted in the Asia-Pacific;

with maximum number of patents filed in Australia. This is followed by North

America (32%) and Europe (23%). Leading industry players (in terms of the size

of intellectual property portfolio) include Roche, Janssen, Novartis,

Genentech, Amgen, MacroGenics and Genmab.

Partnership

activity within this domain has grown at a CAGR of 48%, between 2016 and 2020

More than 50% of the total deals have been inked post 2019. Licensing

(36%) emerged as the most popular type of partnership model adopted by

stakeholders in this domain, followed by clinical trial agreements (16%) and acquisitions

/ mergers (14%).

The market is anticipated to grow at a CAGR of over 30%, during

the period 2021-2030

Growth in this domain is anticipated to be driven by the drugs

that are being developed for the treatment of oncological disorders. North

America (primarily the US) and Europe are expected to capture major share of

the Fc protein and glyco-engineered antibodies market by 2030, in terms of the

sales-based revenues.

To request a sample copy / brochure of

this report, please visit this https://www.rootsanalysis.com/reports/fc-protein-engineered-and-glycoengineered-antibodies-market/request-sample.html

Key Questions Answered

§ Who are the leading industry and non-industry players engaged in the development

of Fc protein and glyco-engineered antibodies?

§ Which are the key disease indications being targeted by Fc engineered

antibodies?

§ Which partnership models are commonly adopted by stakeholders engaged in

this domain?

§ Which geographies are the most active in conducting clinical trials on

Fc protein and glyco-engineered antibodies?

§ Which are the leading administering institutes supporting the research

related to Fc protein and glyco-engineered antibodies?

§ How has the intellectual property landscape in this market evolved over

the years?

§ Which key factors are likely to influence the evolution of this market?

§ How is the current and future market opportunity likely to be

distributed across key market segments?

The financial

opportunity within the Fc protein and glyco-engineered antibodies market has

been analyzed across the following segments:

§

Type of Fc

Engineering

§

Fc Protein

Engineering

§

Fc Glyco-engineering

§

Type of Therapy

§

Monotherapy

§

Combination Therapy

§

Therapeutic Area

§

Oncological Disorders

§

Rare Disorders

§

Dermatological Disorders

§

Autoimmune Disorders

§

Infectious Diseases

§

Gastrointestinal Disorders

§

Neurological Disorders

§

Pulmonary Disorders

§

Route of Administration

§

Intravenous

§

Subcutaneous

§

Others

§

Key Geographical Regions

§

North America

§

Europe

§

Asia-Pacific

§

Rest of the World

The research includes profiles of key players (listed below); each profile features an

overview of the company, its financial information (if available), brief

description of its drug(s), recent developments, and an informed future

outlook.

§

AbbVie

§

Alexion Pharmaceuticals

§

AstraZeneca

§

Genentech

§

MacroGenics

§

Kyowa Kirin

For additional details, please visit

or

email sales@rootsanalysis.com

You may also be interested in the following titles:

1.

TIL-based

Therapies Market,

2021-2030

2.

TCR-based

Therapies Market,

2021-2030

3.

Peptide

Therapeutics Market,

2021-2030

Contact:

Ben

Johnson

+1

(415) 800 3415