views

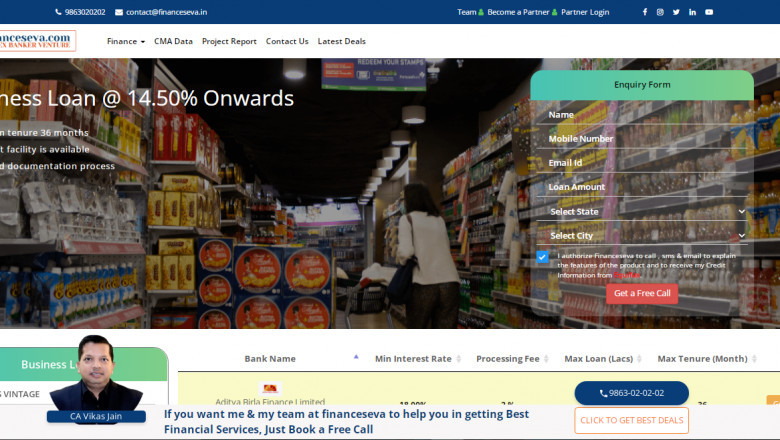

Small Business Loan

Apply Online Click Here:- Small Business Loan

The borrower who wants to enlarge their Business Loan or finance a business plan can go for the business loan. It is provided by the Banks, Financial institutions, or NBFCs. A n applicant can get loan amount up to Rs. 5 crores for the business purpose with repayment tenure of maximum 36 months.

Interest rate for small business loan

Loan amount

Rs. 1 lakh – Rs. 5 crores

Rate of interest

14.50%

Loan tenure

Up to 36 months

Eligibility for small business loan

- The applicant must have the residence of India.

- Age of the borrower should be a minimum of 21 years.

- Balance sheet of the business must show in profit.

- Proof of IT return of last 3 financial years and sales turnover.

The borrower should be self-employed individual and have 3 years of business experience.

Documents required for small business loan

- Identity proof – Passport, Voter ID Card, Aadhar card, etc.

- Address proof - Voter ID Card, Passport, Utility bill, etc.

- Business proof – Trade license, Establishment license, etc

Bank statements of last 6 months.

Commercial Property Loan and house property documents for secured business loan.

Partnership deed, and sole proprietor deed, etc.

Balance sheet that shows profit and loss account of last 2 years and business income tax certificate which has to be certified by Chartered Accountant.