views

Investment banking has generally adopted technology more slowly than other tech-savvy markets. But over the past two years, unequaled competition and unforeseen changes have led more banks to start embracing digital transformation to support wiser decision-making, quicken processes, and scale operations.

Below mentioned are the top trends impacting investment banking services

1. First-party data being used to impact growth

Many investment banking services get started with technology at an early stage. Once a company has a modest team of corporate finance and M&A managing directors looking for business, the company starts to receive thousands of business investment opportunities every year for potential deals. It quickly becomes difficult to keep track of all these connections and businesses, and how well a company manages all of its financial information becomes a competitive advantage for entering and dominating particular markets, sectors, and industries.

Your first-party data gives you the most control.

Your most valuable technological asset is the network of essential relationships that each banker has that spans business groups, product types, and economic sponsor coverage teams. This is so that technology can analyze calendar conferences, email communications, social corporate ties, and more to create a rich tapestry of ties. Technology can also intelligently (and automatically) create new relationships and contacts.

2. Leveraging network resources to find new opportunities

Investment banks get a tonne of exclusive first-party information about relationships, business finances, target industries, deal multiples, anticipated offer ranges, and other topics. Firms use data points to generate insights and direct the best investment opportunity after a thorough examination. There are various ways to measure the size and activity of an investment bank's network, even though operating partners and senior managing directors may disagree on the relative worth of these datasets and how valuable they are for assigning personnel assignments or maximizing deal value.

It also uses technology and automation to help dealmakers and coverage officers set their keep-in-touch reminders, power industry mailing lists, power social strategies, and over time, highlight the value of their relationships.

The emphasis then shifts away from specific transactions and toward the long-term objective of creating relationship value. This paradigm shift influences and grows generations.

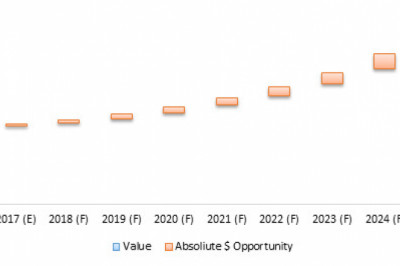

3. Big data is expanding

With data lakes or master data management (MDM) architecture on the roadmap, many of our clients have started their digital transformation initiatives, and for good reason. When an investment bank can operationalize the data it has collected about its most important clients and business connections, the mountain of data that results become a tremendous resource for extracting client insights, developing new market strategies, and launching new products.

When third-party market data sources are coupled with Salesforce, investment banking services can identify new opportunities and save significant amounts of time spent completing data entry—and time spent keeping it updated—in addition to the requirement for first-party and second-party data integrated and ready for use.

4. Accelerating deals with the power of Artificial intelligence and predictive analytics

What you need, to make sense of all of this first-party, second-party, and third-party data (and the potential implications for the rest of your organization) are the right kind of AI and predictive analytics. Since technology has been advancing, investment banking services have started to use the power of artificial intelligence and machine learning to get proactive results.

The appropriate AI and predictive analytics can help take cognizance of all of this first-party, second-party, and third-party data (and the potential ramifications for the rest of your company). Investment banks are starting to use machine learning and artificial intelligence to get proactive notifications when their professional networks alter as a result of the advancements in technology over the past ten years.

Conclusion

Investment banking has a tradition of adopting new technologies last among other sectors of the economy. However, evidence demonstrating the effectiveness of digitally mature dealmakers, along with the need to adapt in the face of historical market disruption and competition, is encouraging more investment banks to embrace digital transformation.

The investment banking services of Pantomath Advisory Services Group provide value to your company. They focus on aligning with your long-term visions and bringing life to that. The company assists its clients in managing large products by identifying the risk associated in advance, thus saving valuable time for its clients.