600

views

views

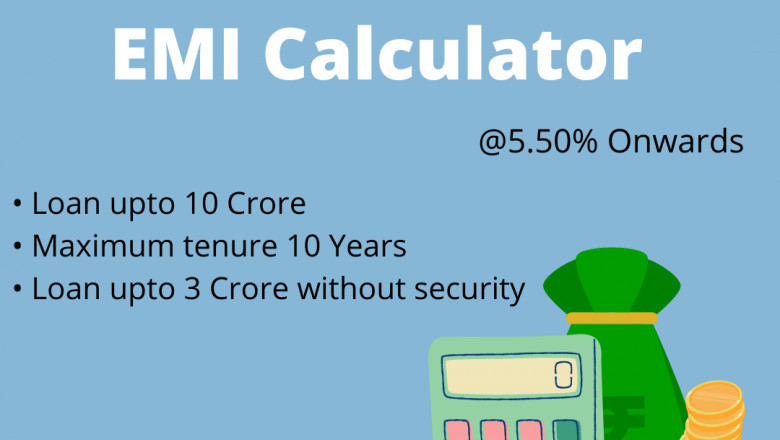

With the help of a machinery loan EMI calculator, one can easily do the evolution of loan EMIs or monthly instalments which becomes much easier. To get a quick result, borrowers are required to enter basic loan variables, such as desired loan amount, loan duration and offered interest rate.

EMI Calculator for Machinery Loan

With the help of a machinery loan EMI calculator, one can easily do the evolution of loan EMIs or monthly instalments which becomes much easier. To get a quick result, borrowers are required to enter basic loan variables, such as desired loan amount, loan duration and offered interest rate.

Advantages of Using Machinery Loan EMI Calculator?

Below listed are the advantages of using a machinery loan EMI calculator:

- Helps in managing finances better

- Loan amount can be decided as per the repayment capability

- Support in managing business cash flow

- Helps in overcoming urgent short-term cash requirements

- Can be accessed from anywhere via mobile, laptop, desktop or tab

Machinery Loan EMI Formula

Machinery loan EMIs are computed with the aid of following formula:

This universal formula is used by almost all financial bodies to provide loan EMIs related information

[P x R x (1+R) ^ N]/[(1+R) ^ (N-1)]

Here,

- P stands for the loan principal

- R stands for the rate of interest on a monthly basis

- N stands the loan repayment tenure in months

- Machinery Loan – Features & Eligibility Criteria

Features:

- Interest Rate: These interest rate varies from bank to bank and shall depend on applicant’s profile and financial stability

- Loan Amount: The desired loan amount depends on the machinery that to be purchased (New or Pre-owned).

- Repayment Tenure: Based on the loan tenure, the longer repayment tenure for higher loan amount are given by the bank.

- Collateral: Depends on the loan amount/lender and type of loan (secured or unsecured)