views

Core Banking Software Market is Booming Across the Globe, Business Strategies, and New Challenges till 2030

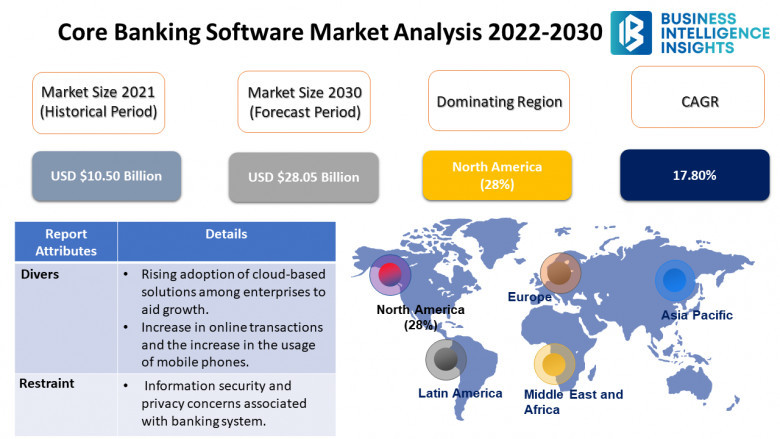

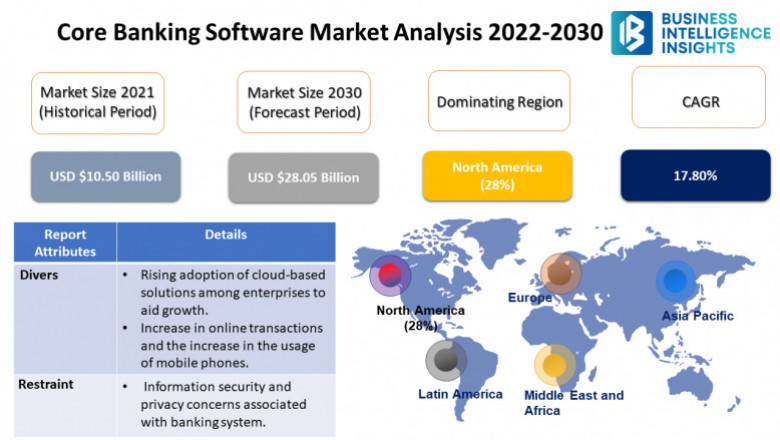

According to Business Intelligence Insights “Core Banking Software Market" is expected to grow from USD 10.50 billion in 2021 to USD 28.05 billion by 2030, at a CAGR of 17.80% during the forecast period 2022-2030.

Regional Analysis:

North America dominated the market with more than 28% of the market share

In 2021, North America dominated the core banking software industry, accounting for about 28% of worldwide sales. The regional market is likely to increase as prominent banks in the region adopt modern core banking software on a broad scale. Furthermore, small and medium businesses in the region are employing these solutions to ensure a smooth flow of funds. Over the projected period, the fast growing sizes of businesses and the expanding areas of application of these solutions are expected to boost the regional market's expansion. In recent years, the region has seen an increase in demand for next-generation cloud-based core banking systems.

However, over the projection period, Asia Pacific is expected to be the fastest-growing regional market. The increasing adoption of mobile and web-based business applications in the banking sector is expected to boost market growth in Asia Pacific. Moreover, several banks in the region are working on implementing core banking systems, which allow them to handle large volumes of transactions and banking services without interruption.

Segmentation Insights:

By Solution

· Deposits

· Loans

· Enterprise Customer Solutions

· Other

Enterprise Customer Solutions category dominated the market with more than 47% of the market share

In 2021, the enterprise customer solutions category dominated the market, accounting for over 47% of worldwide sales. Enterprise customer solutions link seamlessly with CRM and ERP systems, and manage management tools and client data through a bank's central database. Data integration for many reasons such as CRM, cross-selling, and regulatory reporting enables banks and financial institutions realise economies of scale. Furthermore, these technologies assist financial institutions in identifying critical business drivers and making decisions that promote client loyalty and happiness.

By Service

· Professional Service

· Managed Service

Professional Services category dominated the market with more than 70% of the market share

In 2021, the professional services category led the market, accounting for about 76.0 percent of global revenue. Banks all around the world are working on implementing open-system architecture and cutting-edge technology that is platform agnostic. Professional service providers assist banks in seamlessly integrating these technologies into their current and future operational systems. The growing demand for help at every stage of the software deployment process, including pre-implementation of scope and consulting, project management, and integration, can be ascribed to the expansion of the professional service market. Maintaining a full-time IT department for a small or medium-sized firm can be costly, inefficient, and time-consuming. Professional service providers provide small and medium businesses with on-demand assistance and resources at low IT service costs, boosting the segment's growth.

Top Key Players Analysis:

· Capgemini

· Finastra

· FIS

· Fiserv, Inc.

· HCL Technologies Limited

· Infosys Limited

· Jack Henry & Associates, Inc.

· Oracle Corporation

· Temenos Group

· Unisys

Read our strategic analysis: http://www.businessintelligence-insights.com/press-release/49/core-banking-software-market

Core Banking Software Market