863

views

views

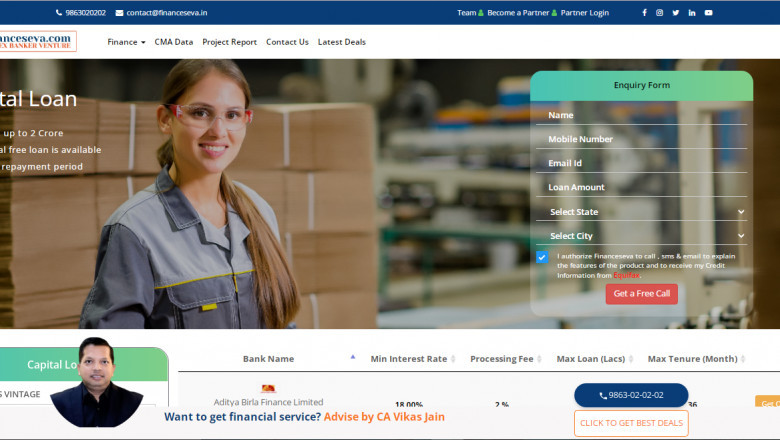

Cover up all day-to-day operational expenses of business through the aid of capital loan offered at affordable rate, We help you in choosing the right platform.

Capital Loan

Apply Online Click Here:- Capital Loan

A Working Capital Loan is a loan that can be used to finance the day-to-day operational expenses of a company I.e., purchase inventory, paying salaries, and other payable expenses. Such loans are used to issue working capital that includes short-term operational requirements of a company. Capital Loans generally include recurring expenses like wages, account payables, etc. It is not intended for the purchase of assets, and long-term investments.

There are various ways of disbursement for working capital loans given below:

- Bills limit

- Cash credit among others

- Letter of Credit (LC)

- Bank Guarantee

- Term loan

- Post shipment finance

- Overdraft Against Salary

- Line of credit

- Packing credit

Eligibility criteria for Capital Loan

For self-employed individuals:

- The age of an individual is between 21 to 65 years of age.

- Minimum work experience of salaried applicants is 3 to 5 years.

- CIBIL Score must be above 750.

- Business Loan of nature should include manufacturing and trading.

Documents required for Capital Loan

- Two passport-sized photographs

- Aadhar card + Passport

- Copy of PAN Card

- Address proof: - permanent address proof, also required if rented

- Bank statement of salary account of last 1 year.

- ITR with computation of income of last 3 years form – 16 (if file)

- Cheque for processing fee in Favour of bank

- Sanction letter and loan schedule (if running)

- Salary slips of last 3 months + Appointment letter

- Complete property documents with MAP and Supply Chain Finance + ATS