views

Effective Corporate Strategies

It's time we dive headfirst into the varied corporate strategies available.

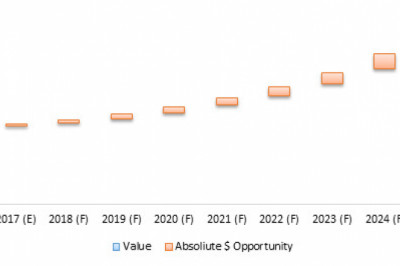

Growth Strategy

An effective method to raise capital and broaden a company's reach is called a growth strategy. Depending on the market and the company's resources, there are many ways to expand a business. Gaining a larger share of the market and expanding your customer base are two of the most common goals of growth strategies. The overarching objective is always business expansion, regardless of your specific aims as advised by investment management firms.

Finding the right growth strategy for your company is essential because no two businesses are alike. You can achieve your goals and realize your vision by breaking it down and identifying the areas that need the most work. Transaction advisory services may offer you some of the below guidelines for efficient growth strategy implementation, including the below points:

1. Focus on the area of growth

2. Focus on consumer metrics and customer satisfaction

3. Hire talent who is aligned with your company's goals.

4. Determine value chain metrics

Stability Strategy

When an organization adopts a stability strategy with the help of a corporate strategy advisory, its primary goal is to keep things as they are in the market. That strategy requires a company to concentrate on what it does best: selling to its current customer base. Methods that fall under this category include sticking with what's working for instance continuing to sell the same products to the same customers and not exploring new avenues such as expanding into new markets.

With the help of investment banking services, many companies take a passive stance toward expanding their capital and improving their standing in the industry. In addition, a business employing this strategy can get by with its current level of infrastructure and personnel expertise, with no need for additional investment. However, this tactic works best in an easy and stable setting.

Retrenchment Strategy

One way to stabilize a company's finances is through a "retrenchment strategy," which entails reducing or eliminating low-profit lines of business. It also means pulling out of a market where profits are too low to stay in business. It usually ends with layoffs and the sale of assets like product lines.

Corporate strategy advisory may advise you of the following Retrenchment strategy for the stability of your organization:

1. Turnaround strategy

2. Divestment Strategy

3. Liquidation Strategy

4. Re-investment Strategy

Any money received as a result of selling an investment, such as dividends, interest, or other earnings, is considered proceeds. The investor would receive a cash distribution if the money was not reinvested. The majority of a social business's profits are reinvested within the company.

Investment management firms can help your business with Dividend Reinvestment, Income Investments, and Risk Mitigation regarding reinvestment strategies.

Conclusion

Investment management firms that specialise in "Corporate Strategy" will examine your company's strategic alignment and provide you with a detailed, workable strategy. The evaluation of a company's corporate strategy should include not only the selection of appropriate business strategies but also their development and implementation. Pantomath Advisory Services Group offers a range of corporate strategy advisory customized for your organization's skyrocketing growth to develop ideal financial health and devise business plans that help you long term. Want to know more? Contact us today!